How To Get Cash Advance From Security Bank Credit Card

Cash back cards are an easy way to get money back on credit card spending. Otherwise you can take your card to a bank that offers advances through your cards.

Applied Bank Unsecured Classic Visa Card Reviews

Applied Bank Unsecured Classic Visa Card Reviews

Insert your credit card into an ATM Enter your credit card PIN Select the cash withdrawal or cash advance option Select the credit option if necessary you may be asked to choose between.

How to get cash advance from security bank credit card. Most credit card issuers put a limit on how much of your credit line you can withdraw. You may choose to avail of Cash Advance via Security Bank or BancNet ATMs. Getting a cash advance means using your credit card to get cash from an ATM or a bank teller or by moving cash from your credit card to your checking account or by cashing a convenience check.

With your Citi credit card you can turn your credit limit to instant cash at any time and use it for unexpected expenses or any emergencies. If you have a credit card that allows cash advances you can access cash in a few different ways. To request for CA PIN please call our Customer Service Hotline at 02 888-791-88.

They allow you to take out cash using your credit card at your bank or an ATM. Then there are the fees and interest charged. But if your credit card is lost or stolen you can get a replacement card and dispute any unauthorized charges made with your card.

Print send the scanned form to SB Cards via email or to any Security Branch branch. All you have to do is input the cash advance in QuickBooks. Fast cash is tempting and credit card issuers offer many different ways to easily get a cash advance including the ability to directly transfer money from a credit card to your bank account.

If your credit card has a PIN you can get cash advances directly from an ATM. Unlike a cash advance that comes with high fees cash back rewards are free money in your pocket. Tap the Deposit To drop-down to select your bank account and enter the correct date in the appropriate box.

To enroll your credit card to online banking you need to create an account here. Never worry about not having enough cash on hand. Ways in availing Security Bank Cash Advance.

You may also do over-the-counter transaction at selected Security Bank branches for a minimal fee. In the Received From column go to the first line and select your credit card vendor. Cash Advance Fee of PHP 200 or USD 4 per transaction.

Most card issuers that allow you to take an advance give you three ways to do so. Any Security Bank ATMs 10000 withdrawal limit per transaction and up to maximum available Cash Advance limit on your account. Youll have to show the teller your card and a valid government-issued ID.

By withdrawing cash at an ATM withdrawing cash from your card. Via any Security Bank ATM with your Cash Advance PIN. 1 day agoBank of America Cash Rewards is also at the low end of the cash advance fee range for major credit cards and charges only a slightly higher APR than for regular purchases.

Citi Cash Advance is a feature of your Citi credit card that allows you to get the emergency cash you need in any currency wherever you are worldwide. But the card is. Most card issuers that allow you to take an advance give you three ways to do so.

And if applicable an Over-the-Counter OTC Processing fee of PHP 500 per transaction. By withdrawing cash at an ATM withdrawing cash from your card. For example you may have a credit line of 5000 but only be able to withdraw up to 1000 as a cash advance.

Activation can be done. Cash Advance is a credit card facility that lets you withdraw money here or abroad. Cash advances via an ATM Getting a cash advance from an ATM requires your physical card as well as a personal identification number PIN provided by your card issuer.

Go to the Banking menu at the top to choose Make Deposits. You may be able to get a cash advance by visiting a brick-and-mortar bank associated with your credit card issuer though the availability of this service depends on the issuer. But it comes at a price with high interest rates steep fees and the potential to cause dings to your credit score a cash advance is rarely your best.

Besides cash-advance fees and ATM or bank fees cash advances sometimes carry a higher interest rate than a regular credit card.

Merrick Bank Credit Card Reviews

Merrick Bank Credit Card Reviews

What Is A Credit Card Cash Advance Valuepenguin

Cash Advance Fee Limit And Payment Faqs

Cash Advance Fee Limit And Payment Faqs

What Is A Cash Advance On A Credit Card Credit Karma

What Is A Cash Advance On A Credit Card Credit Karma

Want To Make A Big Cash Withdrawal Don T Bank On Being Allowed Current Accounts The Guardian

Want To Make A Big Cash Withdrawal Don T Bank On Being Allowed Current Accounts The Guardian

What Is A Cash Advance On A Credit Card Credit Karma

What Is A Cash Advance On A Credit Card Credit Karma

How To Get A Cash Advance On A Credit Card Without A Pin Youtube

How To Get A Cash Advance On A Credit Card Without A Pin Youtube

Can I Use A Credit Card At An Atm How Cash Advances Work

Can I Use A Credit Card At An Atm How Cash Advances Work

8 Alternatives To A Credit Card Cash Advance

Surge Credit Card Reviews Apply Online

Surge Credit Card Reviews Apply Online

How To Get A Cash Advance On A Credit Card Without A Pin Youtube

How To Get A Cash Advance On A Credit Card Without A Pin Youtube

Can I Use A Credit Card At An Atm How Cash Advances Work

Can I Use A Credit Card At An Atm How Cash Advances Work

How Do I Get Cash From My Credit Card Experian

How Do I Get Cash From My Credit Card Experian

What Is A Cash Advance On A Credit Card

Can I Use A Credit Card At An Atm How Cash Advances Work

Can I Use A Credit Card At An Atm How Cash Advances Work

Merchant Cash Advance Business Bank Account Cash Advance Budgeting Money

Merchant Cash Advance Business Bank Account Cash Advance Budgeting Money

8 Best Online Cash Advance Loans For Bad Credit 2021 Badcredit Org

8 Best Online Cash Advance Loans For Bad Credit 2021 Badcredit Org

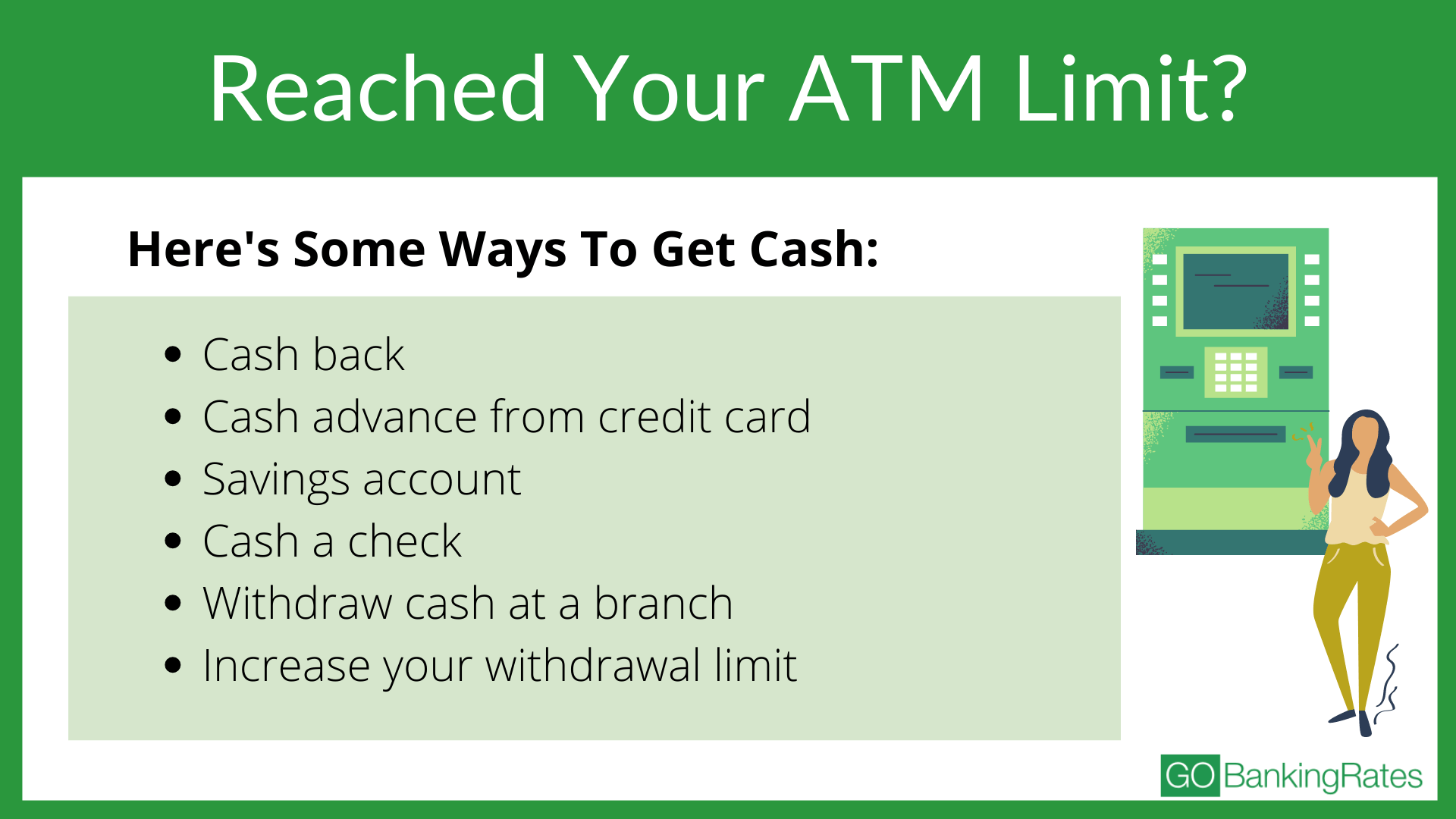

:max_bytes(150000):strip_icc()/dotdash_Final_8_Alternatives_to_a_Credit_Card_Cash_Advance_Oct_2020-01-9a2637fa582a4a2687ce65a99f556410.jpg) 8 Alternatives To A Credit Card Cash Advance

8 Alternatives To A Credit Card Cash Advance

Atm Withdrawal Limit How Much Can You Withdrawal Daily Gobankingrates

Atm Withdrawal Limit How Much Can You Withdrawal Daily Gobankingrates