Business Interruption Insurance Form

Page 5 of 11 your business interruption policy SPECIMEN SPECIMEN purposes or used for lighting or heating the building destruction or damage so caused being herein termed Damage at any time before four oclock in the afternoon of the last day of the Period of Insurance or of any subsequent period in respect of which the Insured shall have paid and the Company shall have accepted the. Is Business Interruption Insurance a Form of Casualty Insurance.

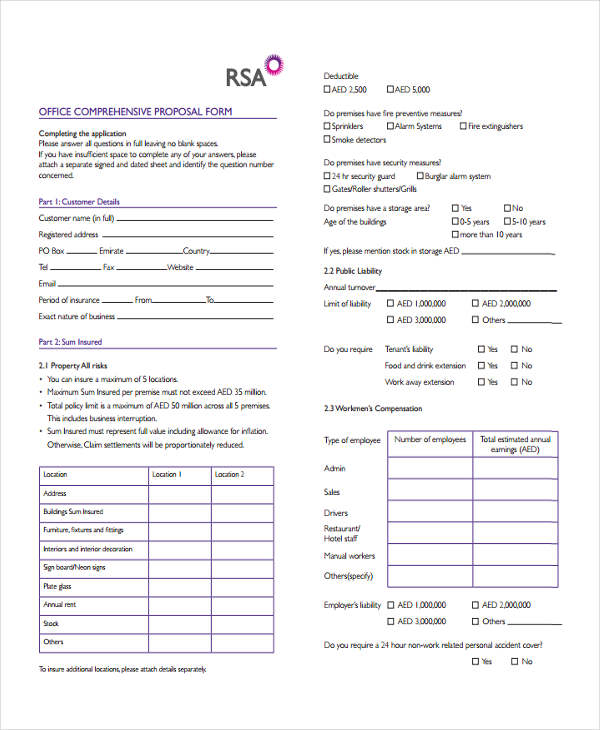

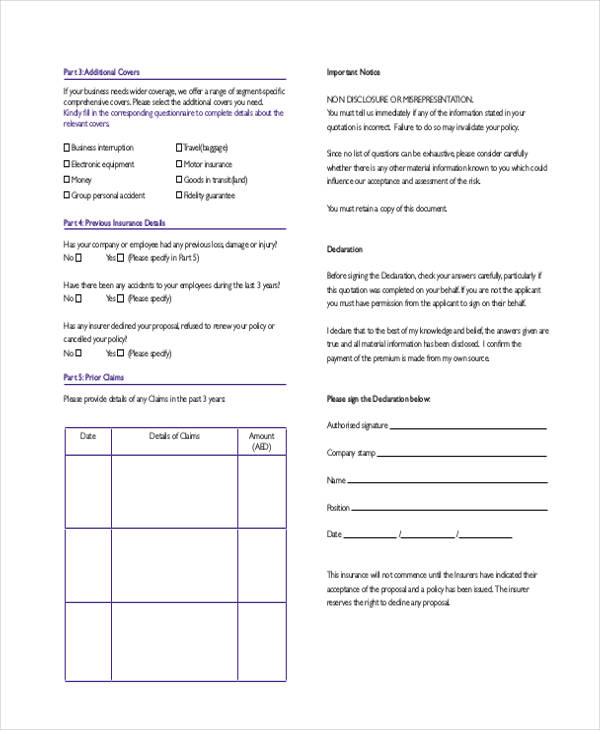

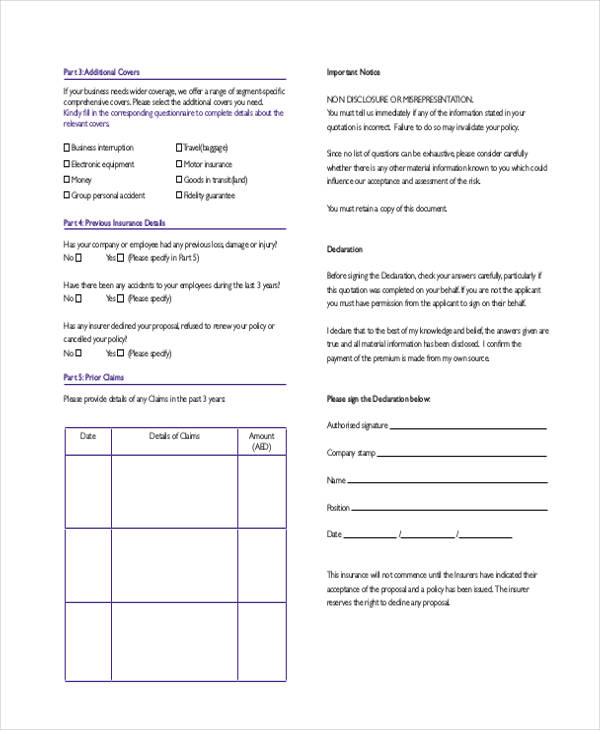

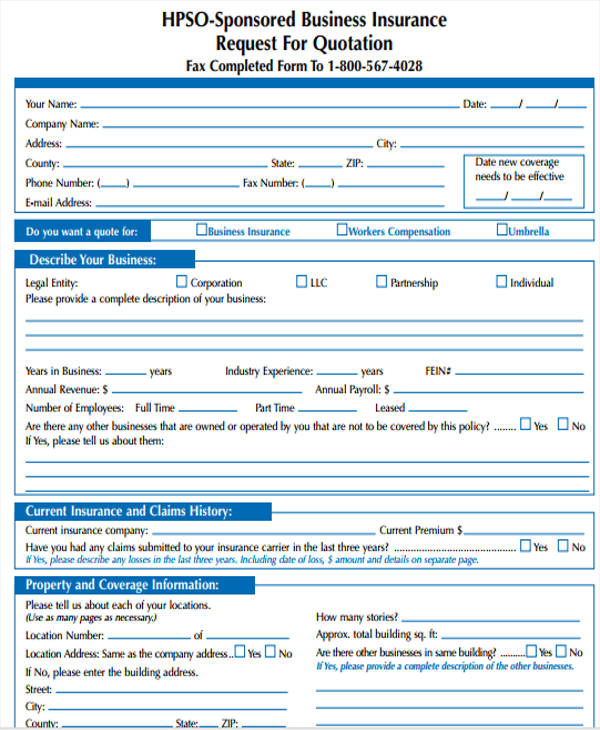

Free 38 Insurance Proposal Forms In Pdf

Free 38 Insurance Proposal Forms In Pdf

Loss of sales multiplied by the Rate of Gross Profit RGP and the increase in cost of working.

Business interruption insurance form. BI business interruption and. Business interruption insurance sometimes called business income insurance can be part of a standard business policy form or purchased as an endorsement or rider to a property insurance policy or package. This bill requires an insurer to provide business interruption coverage due to the COVID-19 global pandemic and all mutated forms.

While many such clauses are in use today a typical business interruption insurance clause might read as follows. Actual loss sustained or ALS is a form of business interruption insurance and is defined as all actual costs and expenses incurred due to a claim as a result of direct physical. A successful business interruption insurance claim will depend first on the words of the particular policy and the scope of coverage.

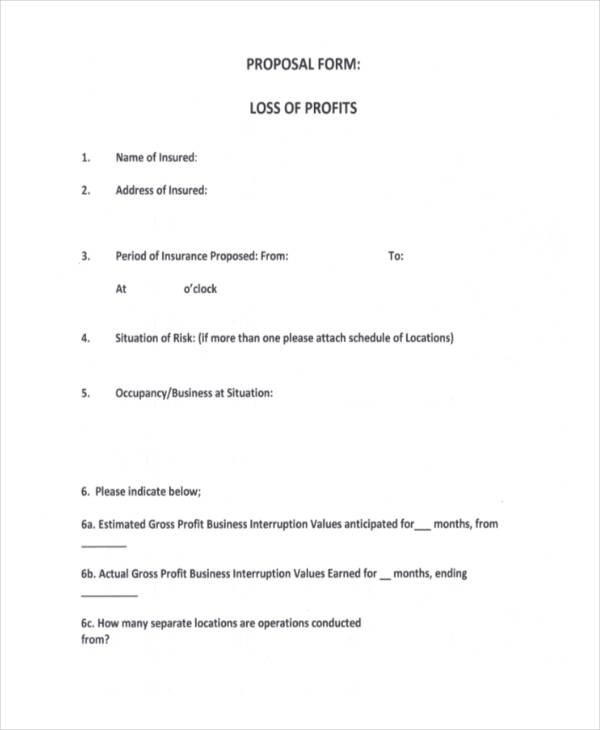

The business interruption formula can be summarized as follows. If more than one please attach schedule of Locations OccupancyBusiness at Situation. LOSS OF PROFITS Name of Insured.

Sometimes a business owner will get lucky. Business interruption insurance helps replace lost profits as a result of a covered event such as a fire or a storm. That means no penalties even while youre unable to generate income.

This ensures on-time payments. Business Interruption Insurance Commercial Flood Insurance Contractors Insurance Cyber Liability Data Breach Directors and Officers Employment Practices Liability Environmental or Pollution Liability Management Liability Sexual Misconduct Liability. Business interruption covers the revenue you would have earned based on your financial records had the disaster not occurred.

CP 00 30 04 02 - Business Income And Extra Expense Coverage Form Created Date. Oclock At Situation of Risk. T the number of time units hours days operations are shut down Q the quantity of goods normally produced or sold per unit of time used in T V the value of each unit of production usually expressed in profit.

But you may use business interruption insurance to cover the cost of these loan payments. Business income coverage BIC form is a type of property insurance policy which covers a companys loss of income due to a slowdown or temporary suspension of. What Business Interruption Insurance Doesnt Cover.

Provides for coverage under business interruption insurance during the COVID-19 disaster emergency. Review your Business Interruption. BI T x Q x V where.

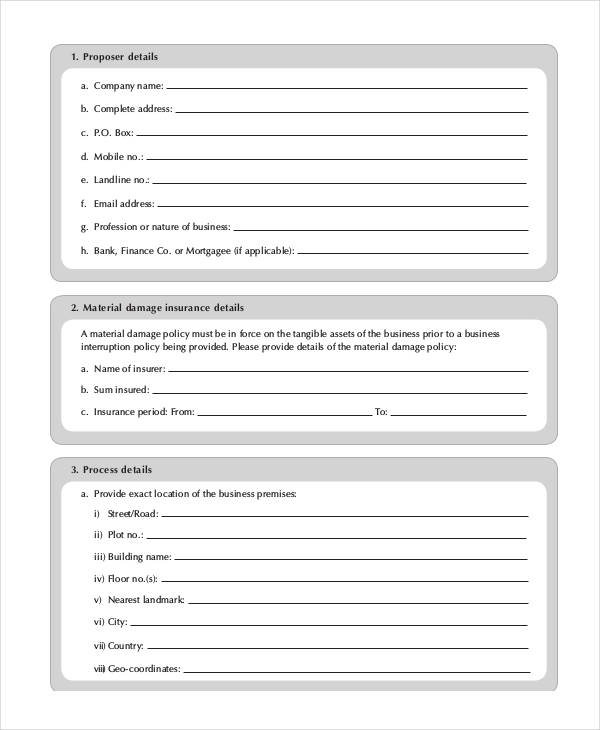

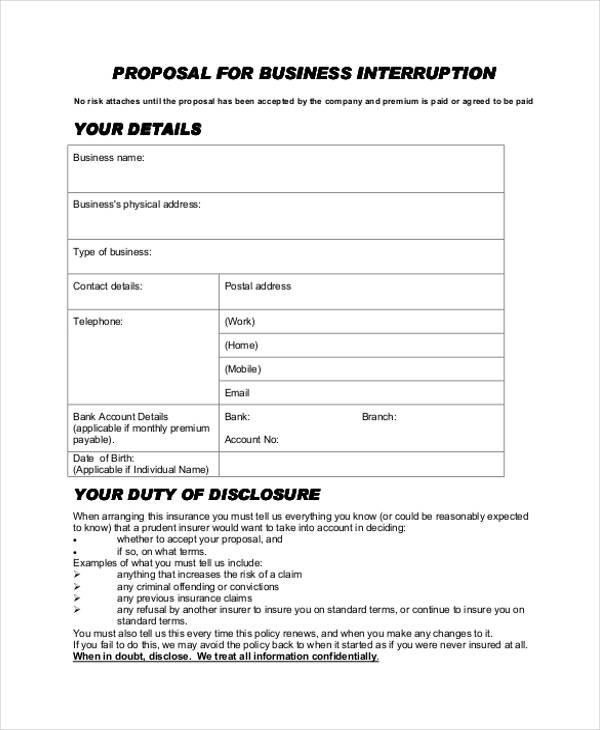

Business Interruption - Proposal Form. Most business interruption forms require direct physical loss or damage to trigger business interruption coverage. Business interruption insurance is a form of insurance coverage that replaces business income lost as a result of a business interruption event.

This is why any business with physical locations and assets should consider having some form of business interruption coverage as a part of their insurance program. Page I of4 4 anent PROPOSAL F0RM. Business interruption insurance Texas is a form of coverage that replaces business income lost following an event that interrupts the operations of the business such as fire or a natural disaster.

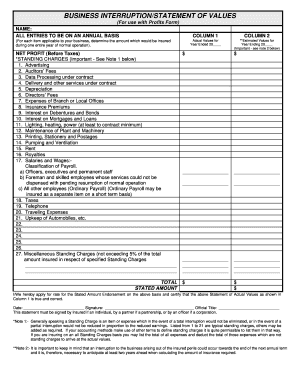

Business interruption insurance covers just two elements regardless of which form of cover is selected by a client. Otherwise you significantly increase the risk of under-insurance Total Business Interruption Value 3 4 Total Business Interruption and Extra Expense Value 2a 2b 2c 2d 2e 2f 2g 2h 2j 2k 4a 4b Total Ordinary Payroll 4a 4b Total fixed charges 2a through 2k. Business interruption insurance is a form of insurance coverage that replaces business income lost as a result of a business interruption event.

These forms of insurance include. Period of Insurance Proposed. In fact a standard business interruption form may only pay a nominal amount as little as 2500 if the cause of loss is from interruption of computer operations.

Business interruption insurance is beneficial in that it covers quite a bit. However depending on which of the two forms is selected will change the make-up of the cover as highlighted in the table below. A business interruption clause or endorsement is designed to protect the insured for losses of business income it sustains as a result of direct physical loss damage or destruction to insured property by a covered peril.

What is business interruption insurance.

Free 42 Insurance Proposal Form Formats In Pdf Ms Word Excel

Free 42 Insurance Proposal Form Formats In Pdf Ms Word Excel

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

Free 42 Insurance Proposal Form Formats In Pdf Ms Word Excel

Free 42 Insurance Proposal Form Formats In Pdf Ms Word Excel

Free 38 Insurance Proposal Forms In Pdf

Free 38 Insurance Proposal Forms In Pdf

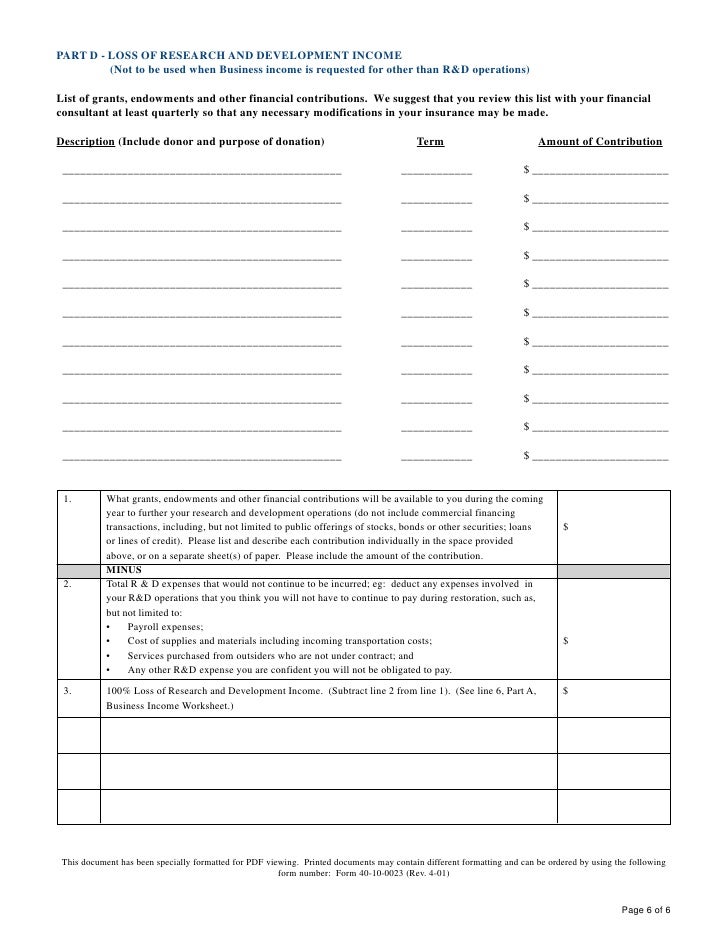

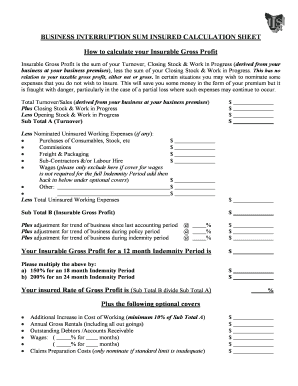

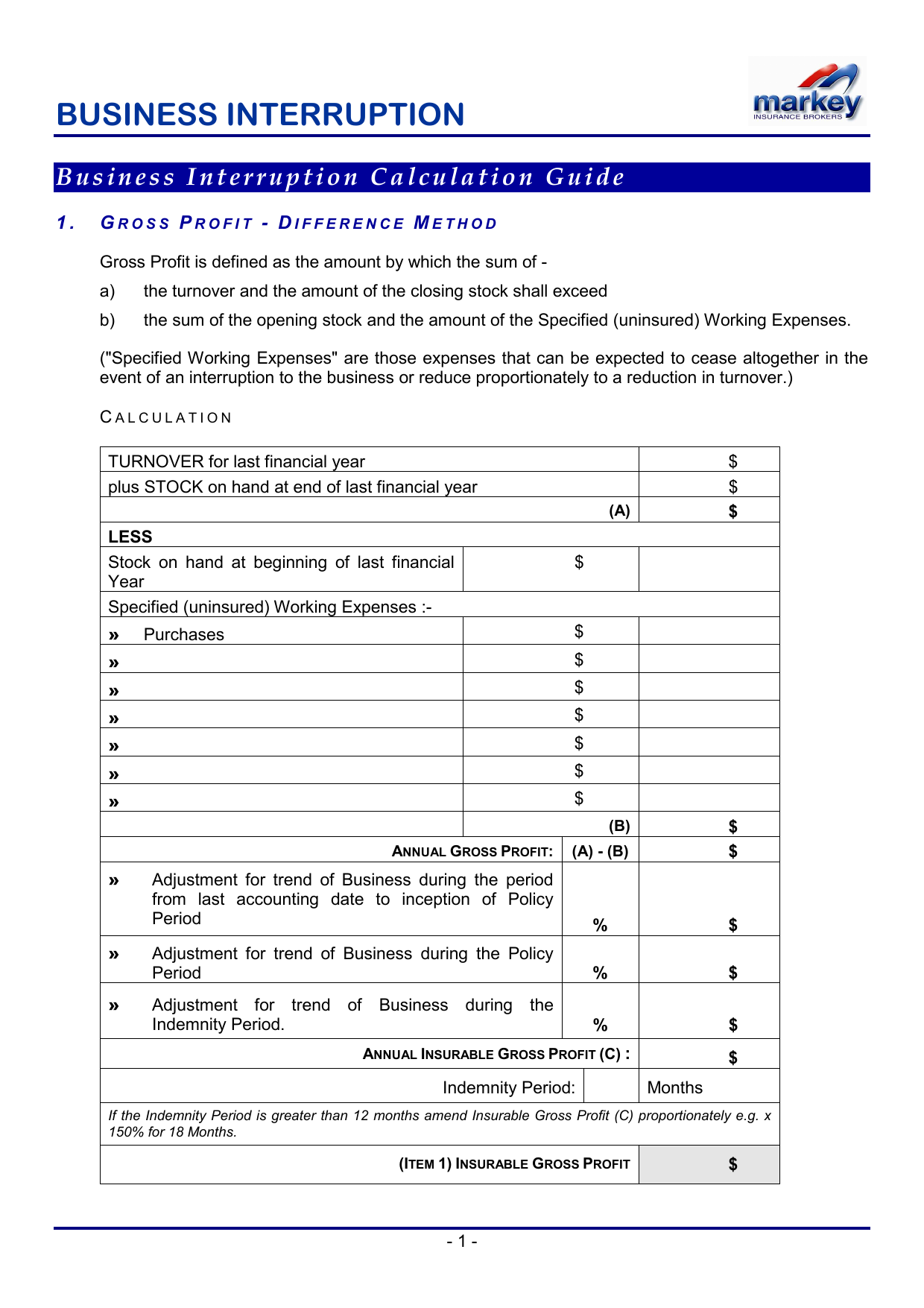

Business Interruption Calculation Sheet Fill Online Printable Fillable Blank Pdffiller

Business Interruption Calculation Sheet Fill Online Printable Fillable Blank Pdffiller

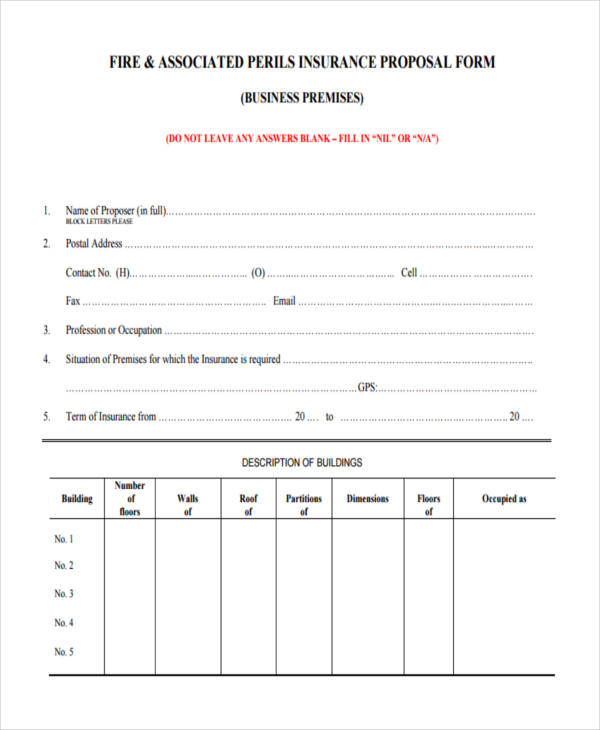

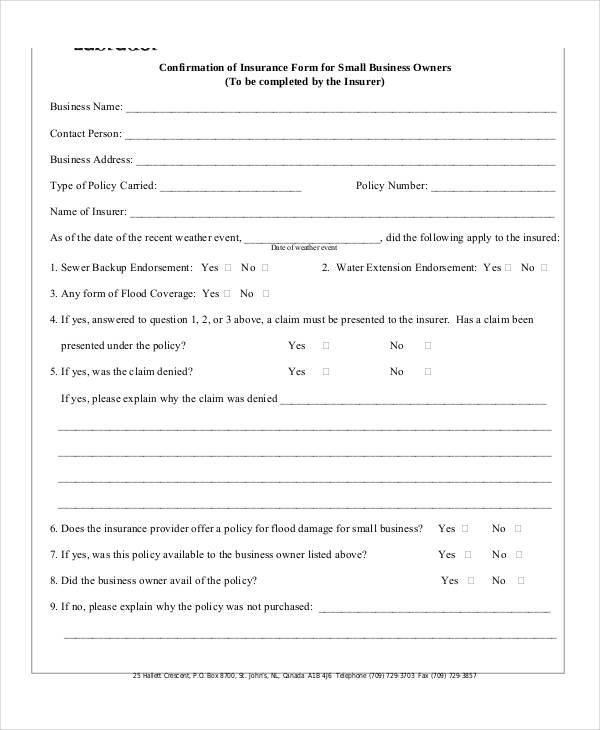

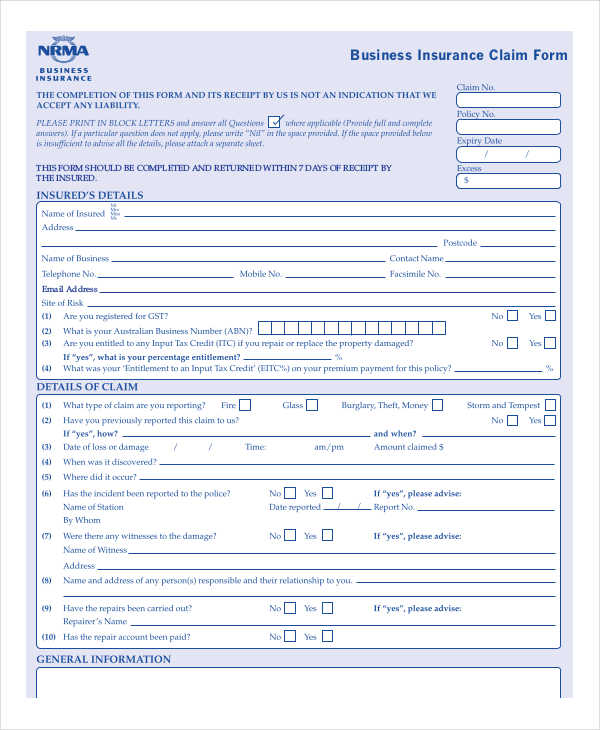

Free 11 Business Insurance Forms In Pdf Ms Word

Free 11 Business Insurance Forms In Pdf Ms Word

Free 11 Business Insurance Forms In Pdf Ms Word

Free 11 Business Insurance Forms In Pdf Ms Word

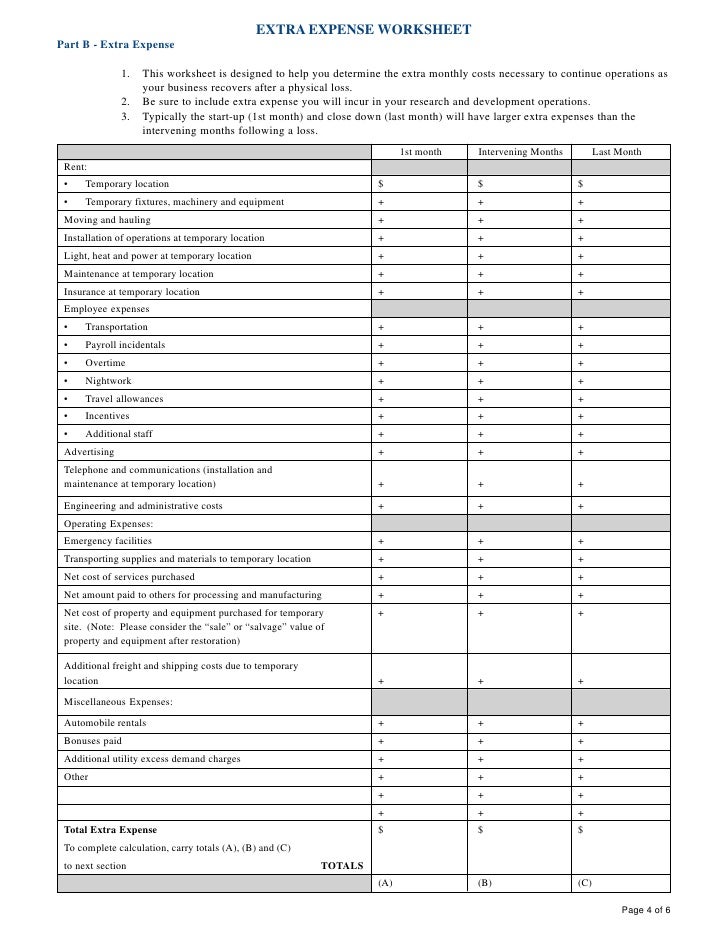

Business Interruption Worksheet Fill Online Printable Fillable Blank Pdffiller

Business Interruption Worksheet Fill Online Printable Fillable Blank Pdffiller

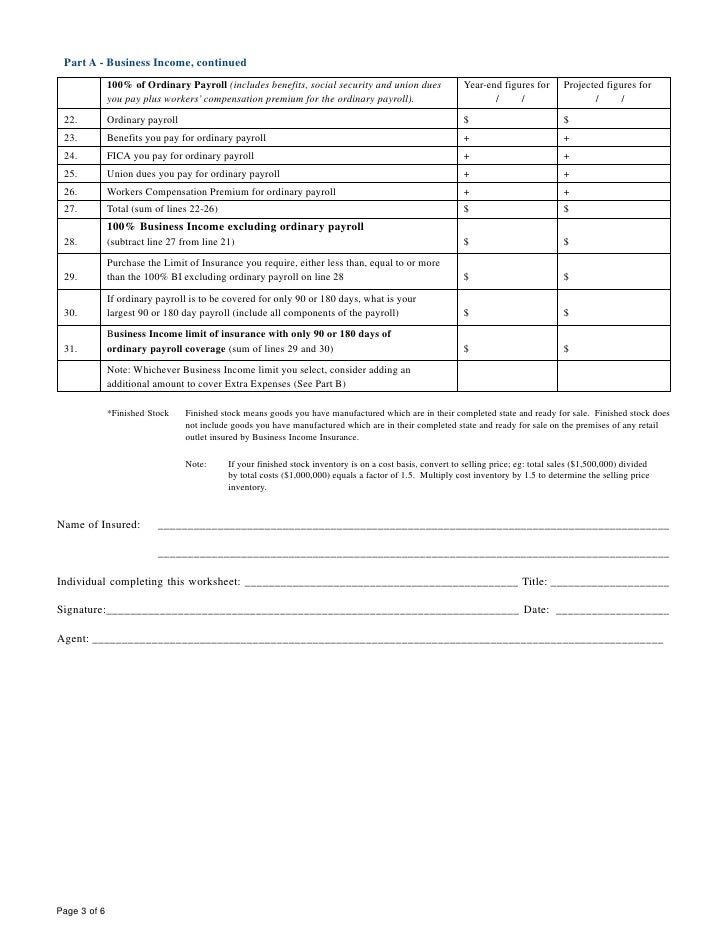

Business Interruption Calculation Sheet

Business Interruption Calculation Sheet

Free 11 Business Insurance Forms In Pdf Ms Word

Free 11 Business Insurance Forms In Pdf Ms Word

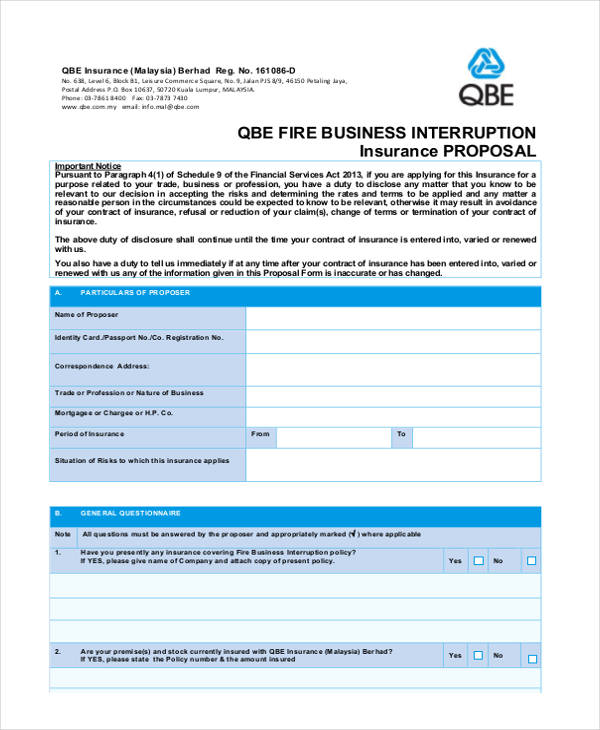

Free 44 Insurance Proposal Forms In Pdf Ms Word Excel

Free 44 Insurance Proposal Forms In Pdf Ms Word Excel

Free 49 Insurance Proposal Forms In Pdf Ms Word Excel

Free 49 Insurance Proposal Forms In Pdf Ms Word Excel

Free 42 Insurance Proposal Form Formats In Pdf Ms Word Excel

Free 42 Insurance Proposal Form Formats In Pdf Ms Word Excel

Commentary Does Business Income Insurance Cover Coronavirus Shutdowns

Commentary Does Business Income Insurance Cover Coronavirus Shutdowns

Free 11 Business Insurance Forms In Pdf Ms Word

Free 11 Business Insurance Forms In Pdf Ms Word

Pdf Measuring Losses For Small Business Interruption Claims Depreciation Expenses

Pdf Measuring Losses For Small Business Interruption Claims Depreciation Expenses