Business Valuation Formulas

This is also called book value. A rule of thumb valuation basically consists of using a simple formula that estimates the value of a business through a set of established and very general business pricing guidelines.

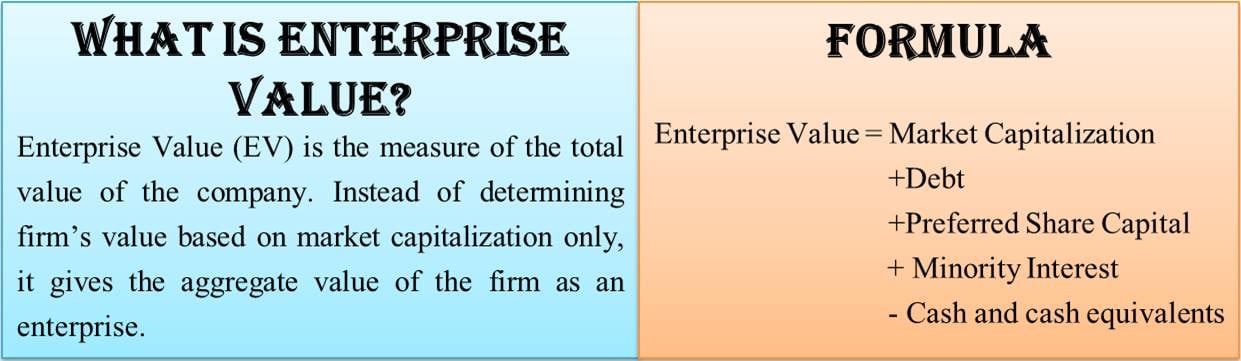

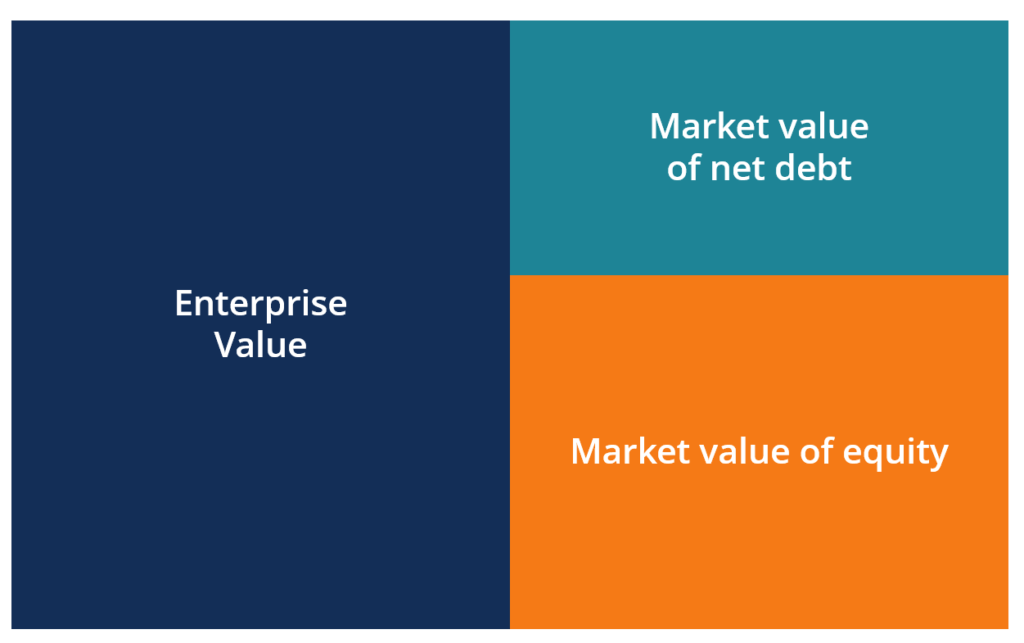

How To Calculate Enterprise Value Enterprise Value Calculation

How To Calculate Enterprise Value Enterprise Value Calculation

Online and offline sales network.

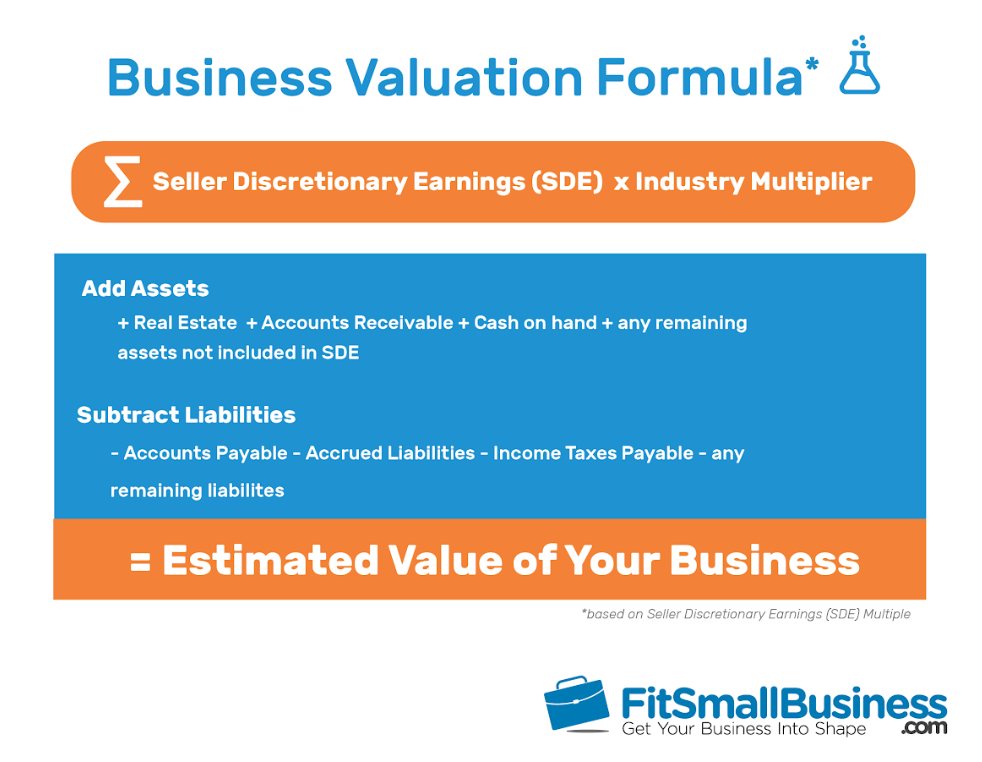

Business valuation formulas. Annual earnings before interest taxes depreciation and amortization Anticipated rate of earningscompensation growth 0 if level 0 to 100 Number of years earnings are expected to continue. Auto Repair Shop35 of annual revenues. In fact many professionals can be similarly confused by the various multiple formulas currently in use.

This method takes your current income before income taxes depreciation and amortization and projected income for a defined number of years and determines the present value of that income. While there are no hard and fast rules to determine the weights many business valuation experts use a number of guidelines when selecting the weights for their business value conclusion. The buyer will try to lower the valuation in order to generate some value from an acquisition while the seller has an incentive to be overly optimistic in making projections and valuing assets.

2 to 3 times Sellers Adjusted net. Each approach offers you a different view of what a business is worth. Business Valuation Divestitures and Spin.

Maximum 10 which assumes perpetuity 0 to 10 Level of businessindustryfinancial risk. However the structure size industry and complexity of the business will matter in the outcome. Determined bythe value of the business as identified in the business appraisal minus the sum of the working capital assets and the fixed assets being purchased.

Each one has issues so the buyer and seller can be expected to argue over the real value of the entity. Essentially an asset-based business valuation will total up all the investments in the company. The business value is just the sum of the weighted values which in this case equals 1145000.

Full Service Gas Station. The value of any business can be determined three ways formally known as the business valuation approaches. Business valuation formula the DCF-equation As can be seen from the previous equation in case the company witnesses same cash flows over its whole lifecycle the worth of business can be calculated as the cash-flow divided by discount rate.

Use this method to determine your companys value. While there are potentially many ways to value a business one popular method is using the discounted or present value of your estimated cash flow. The business valuation formulas used to compute the value of a business for sale are numerous and can be confusing to many small business owners.

The factors most brokers will take into account when assessing your business include. Add to this the. This is best suited for valuations of small businesses.

A computational procedure used to determine the value of a business. Business Valuation Formula Definition. A going concern asset-based approach takes a look at the companys balance sheet lists the businesss total assets and subtracts its total liabilities.

Website traffic if significant to your business model Age of business. The simplest among them is the Sellers Discretionary Earnings or SDE. There are various forms of business valuation formula.

There is no perfect valuation formula. Once you have the SDE for your business you can use it to calculate a ballpark value by multiplying SDE by a business sale price multiplier. Rate of 20 percent the value of your excess earnings is 626000.

12 rows Using a cap. Asset-based business valuations can be done in one of two ways. Intangible assets business value working capital fixed assets Working.

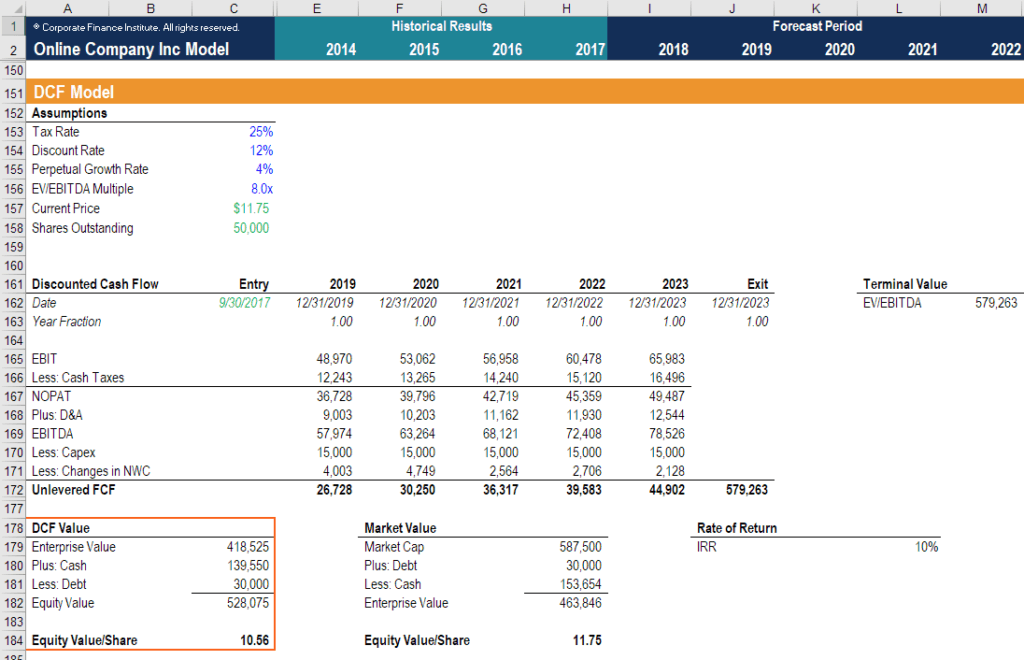

How To Calculate Enterprise Value Enterprise Value Calculation

How To Calculate Enterprise Value Enterprise Value Calculation

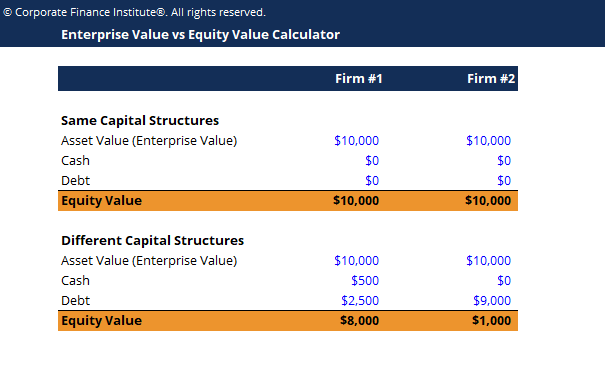

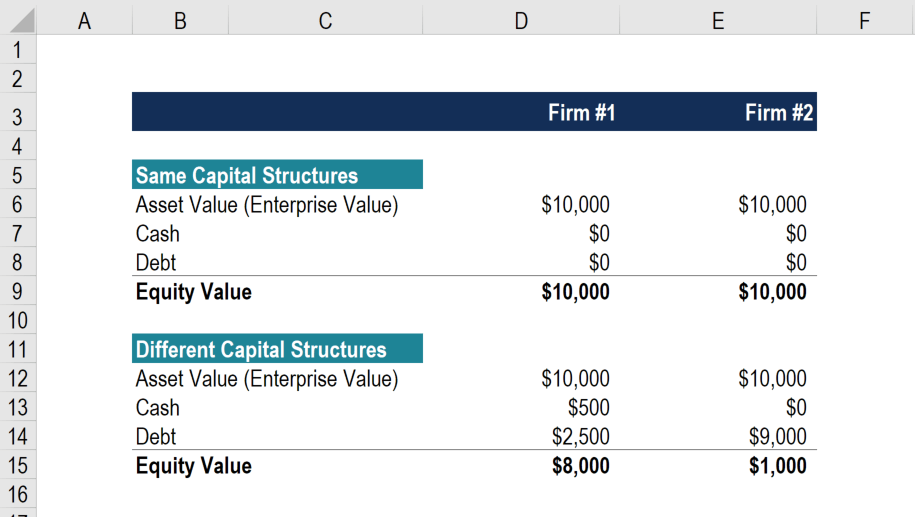

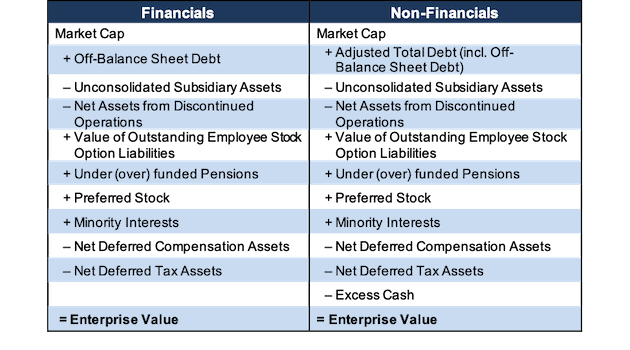

Enterprise Value Vs Equity Value Calculator Download Free Template

Enterprise Value Vs Equity Value Calculator Download Free Template

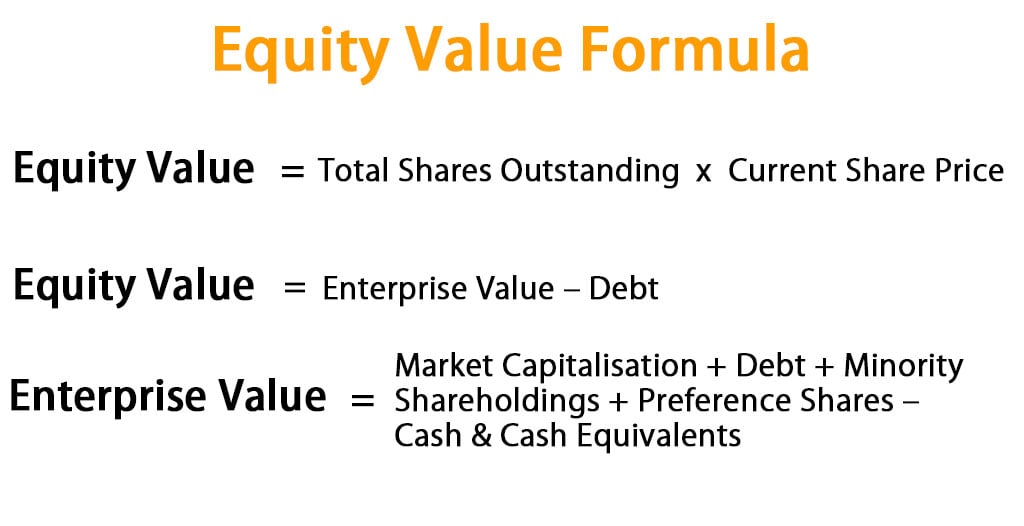

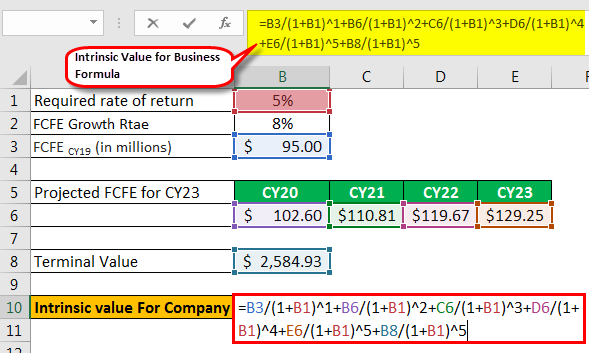

Absolute Valuation Formula Example How To Calculate Absolute Value

Absolute Valuation Formula Example How To Calculate Absolute Value

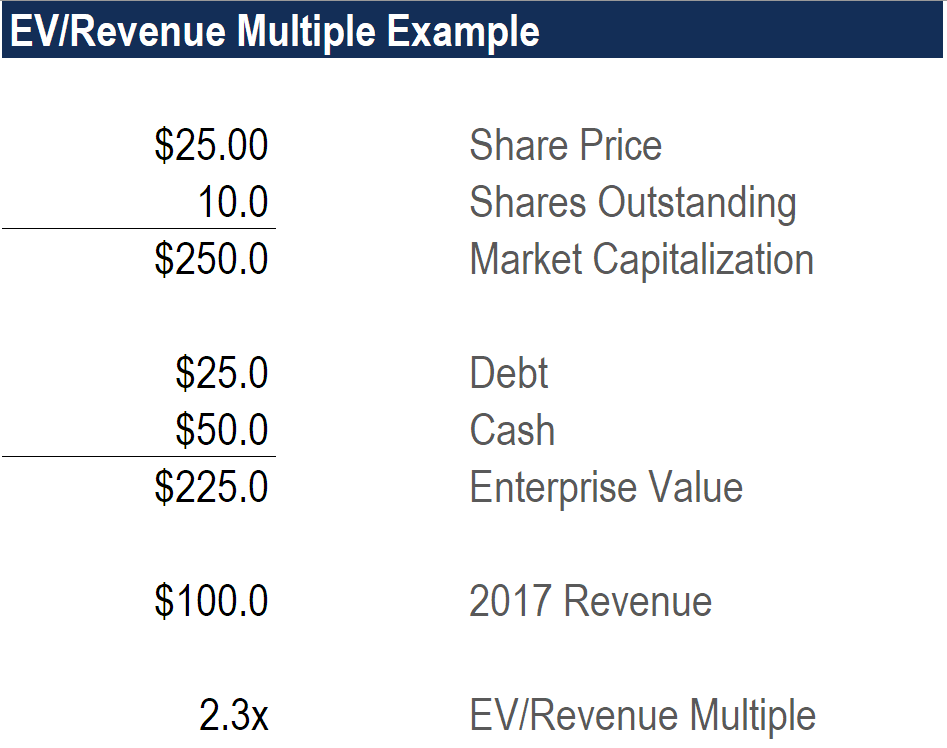

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

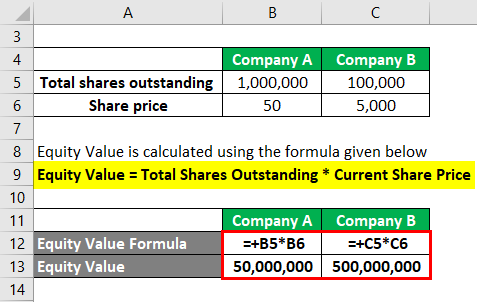

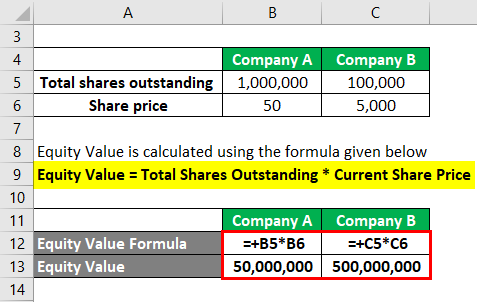

Equity Value Formula Calculator Excel Template

Equity Value Formula Calculator Excel Template

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Ev Formula Definition And Examples Of Ev

Business Valuation Equation Tessshebaylo

Business Valuation Equation Tessshebaylo

How Much Is My Business Worth San Diego Business Broker

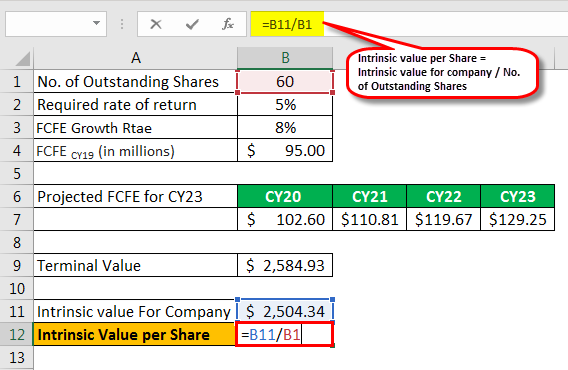

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Enterprise Value Vs Equity Value Complete Guide And Examples

Enterprise Value Vs Equity Value Complete Guide And Examples

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Ev Formula Definition And Examples Of Ev

Rate Of Return Formula Calculator Excel Template

Rate Of Return Formula Calculator Excel Template

Enterprise Value Definition And Formulas Investingpr Com

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Ev Formula Definition And Examples Of Ev

Enterprise Value Definition And Calculation New Constructs

Enterprise Value Definition And Calculation New Constructs

Equity Value Formula Calculator Excel Template

Equity Value Formula Calculator Excel Template