How To Report Form 1099 G

If you are a nominee that received subsidy payments for another person file Form 1099-G to report the actual owner of the payments and report the amount of the payments in box 7. Make sure you double-check your Form 1099-G even if you did claim and receive unemployment insurance benefits.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Look for the 1099-G form youll be getting online or in the mail.

How to report form 1099 g. File your return reporting the income you actually received. In Market Gain 9 enter the amount reported in Box 9 of Form 1099-G if applicable. Or you might need to go to your states unemployment website and use the password etc.

You may opt to have federal income tax withheld on those benefits. Unemployment compensation is generally taxable income to you so Form 1099-G gives you the amount of unemployment benefits you must report on your tax return. Depending on what box you have an entry in on your 1099-G depends on where you report it in the program.

If you do the amount withheld will be reported in Box 4. If you believe you didnt receive your 1099-G because your address on file was incorrect please enter the correct address in the form click the update box under the address field and submit the report. State or local income tax refunds.

The amount showing in Box 1 might be overstated if your identity was stolen and someone submitted. If you were a victim of unemployment identity theft and received Form 1099-G with an amount in Box 1 you should. To report unemployment compensation.

You may owe Uncle Sam if you didnt withhold taxes. Entries on Form 1099-G Certain Government Payments Box 6 this covers certain government payments are generally reported on IRS Schedule 1 Form 1040 Additional Income and Adjustments to Income Line 8. Box 2- State Refunds Box 3- indicates tax year This information is provided to you by your state.

Box 1- Unemployment Compensation. Amounts entered in this field carry to Schedule F lines 6a. If you suspect unemployment benefits fraud you should report it to DES at 984-465-9224 or through the online fraud reporting form.

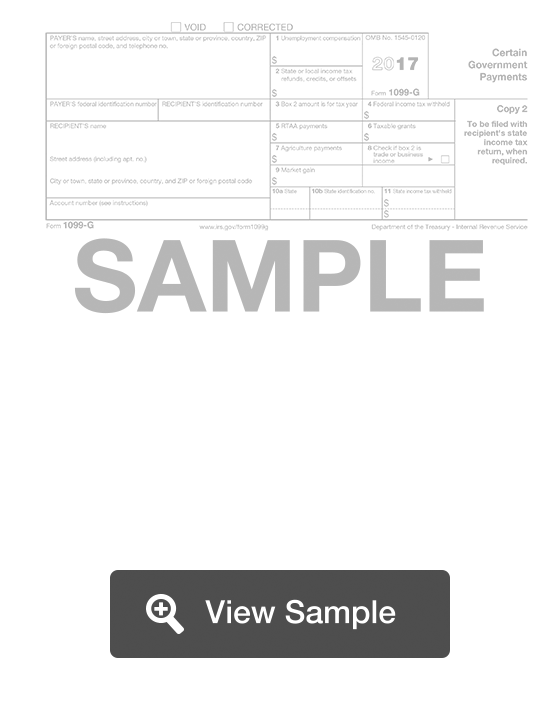

You must include the form with your tax return and include the benefits you were paid in your earnings for the applicable calendar year. Form 1099-G entitled Certain Government Payments is one of a series of 1099 forms used by the Internal Revenue Service IRS to report different payments from and financial transactions with a. The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

If you received Arizona Unemployment Insurance UI or Pandemic Unemployment Assistance PUA and you do not receive a 1099-G form by February 27 2021 please submit a report to the Department. Learn more about steps you can take to report and recover from identity theft on the DES Unemployment Insurance Fraud page. Department of the Treasury - Internal Revenue Service.

If you use a tax preparer or you e-file be sure to include the 1099-G form with your other tax information for the calendar year. Enter USDA agricultural subsidy payments made during the year including market facilitation program payments. 19 hours agoThe Colorado Department of Labor and Employment says the most important and first step to take if you receive an inaccurate 1099-G or Reliacard and never filed for unemployment is to report.

How does one report a CCC-1099-G payment with the breakouts for Price Loss Coverage Agricultural Risk Coverage and Market Facilitation - Crops. Contact the 1099-G issuer for a corrected form showing 0 benefits received. States are reporting an uptick in fraudulent claims.

Some states will mail out the 1099G. Form 1099-G - Taxable Grants. What do I do with the 1099-G tax form.

That you have been using to certify for weekly benefits to get your 1099G from the states site. For Internal Revenue Service Center. Unemployment benefits are taxable and must be reported on federal and state tax returns.

You will have to enter a 1099G that is issued by your state. I have not received my 1099-G form and have been trying to get it through my state unemployment department and the IRS website but keep hitting walls. DES must investigate and confirm fraud to correct the 1099-G for the individual and the IRS.

According to the IRS Recipient Instructions for Form 1099-G you should refer to IRS Publication 225 Farmers Tax Guide and the IRS Instructions for Schedule F Profit or Loss from Farming for information on reporting income from Form 1099-G. Ive heard that if I file myself online which I usually do and dont add my 1099 the IRS will basically fix it and send me a bill. These forms are available online from the NC DES or in the mail.

Your 1099-G Tax Form. Copies of the 1099-G forms are also sent to the IRS and the Michigan Department of Treasury. If the item relates to an activity for which you are required to file Schedule C Form 1040 Profit or Loss From Business Schedule E Form 1040.

You received a Form 1099-G reporting in Box 1 unemployment insurance benefits that you never received or an amount greater than what you actually received during the year.

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Software To Create Print E File Irs Form 1099 G

1099 G Software To Create Print E File Irs Form 1099 G

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

Form 1099 G Government Payments Fill Out Online Pdf Formswift

Form 1099 G Government Payments Fill Out Online Pdf Formswift

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training