Business Tax Registration Florida

If you have not yet registered with the Department to collect andor report tax or are not sure if you need to register visit the Departments Account Management and Registration webpage. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

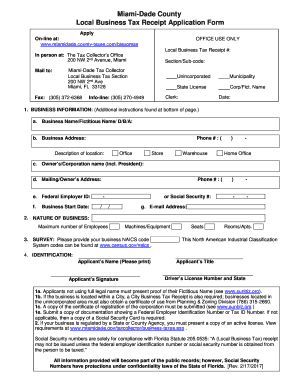

Miami Dade Local Business Tax Financeviewer

The username and password you choose will be required to begin resume and submit your application.

Business tax registration florida. You may be required to register to collect accrue and remit taxes or fees if you are engaged in activities associated with a tax or fee. You must register with the Florida Department of Revenue before you begin your business activities. The email address you provide will be used for account recovery if you forget your username andor password.

A new business must report its initial employment in the month following the calendar quarter in which employment begins. For example many businesses are responsible for sales and. 1 Florida Tax Registration Small businesses in the state of Florida must register for identification numbers permits or licenses for the taxes that correspond with their specific services.

Suite 130 Jacksonville FL 32202. If your business will sell taxable goods or services you must register as a sales and use tax dealer to collect report and remit sales and use tax before you begin conducting business in Florida. Before we issue a Local Business Tax Receipt a business must meet all required conditions.

The local business tax grants the privilege of engaging in or managing a business profession or occupation. You must apply for new Local Business Tax Receipts in person at our downtown office 231 E Forsyth St. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

3 Oversee property tax administration involving 109. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. The Florida Department of State is committed to our customers and we are implementing critical investments to our systems and processes which will improve efficiency and security for Florida.

Check with your local tax collectors office to see what they require. A business licenseoccupational license or business tax receipt is required by most counties in Florida to have the legal ability to do have a business in that county. The Department recommends that employers register to pay reemployment tax using the online Florida Business Tax Application or complete and submit a paper Florida Business Tax Application Form DR-1.

Local business tax receipts for each place of business and for each separate local business tax classification at the same location are required by Miami-Dade County and each municipality if applicable. In 2007 the name was changed from occupational license tax to local business tax. The Department of Revenue is in charge of state business taxes in Florida.

For returning users enter your user profile credentials to log in and begin or complete the Florida Business Tax Registration application. They collect sales and use tax reemployment tax and other business taxes. The County issues local business tax receipts for one year beginning Oct.

Florida Business Tax Application. New Business Start-up Kit. If you do not have a username and password select the Create User Profile button below.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. The following information is provided to assist newly registered businesses in working with the Florida Department of Revenue. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

New users must create a user profile with a username and password to begin or complete the registration application. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. During registration you may enroll to file and pay electronically.

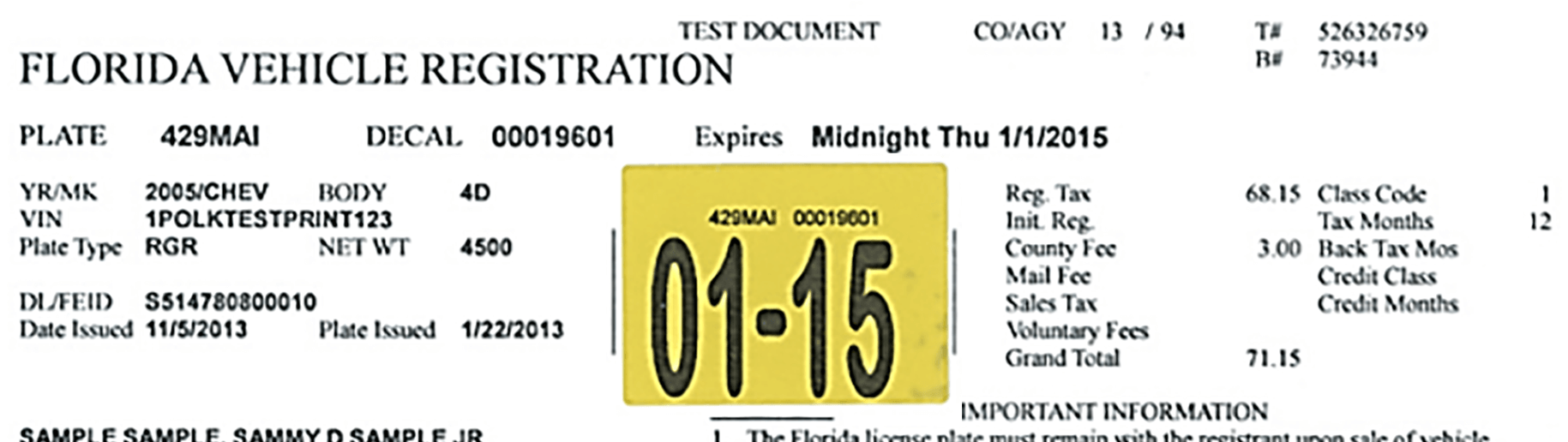

The 225 Initial Registration Fee must be paid when the owner does not have a license plate or record of a license plate registered in their name for a vehicle he or she previously owned in Florida to transfer to a newly acquired vehicle. 3 Oversee property tax administration involving 109 million parcels of. It is in addition to any other fees paid to operate a business.

Vehicle Sales Purchases Orange County Tax Collector

Vehicle Sales Purchases Orange County Tax Collector

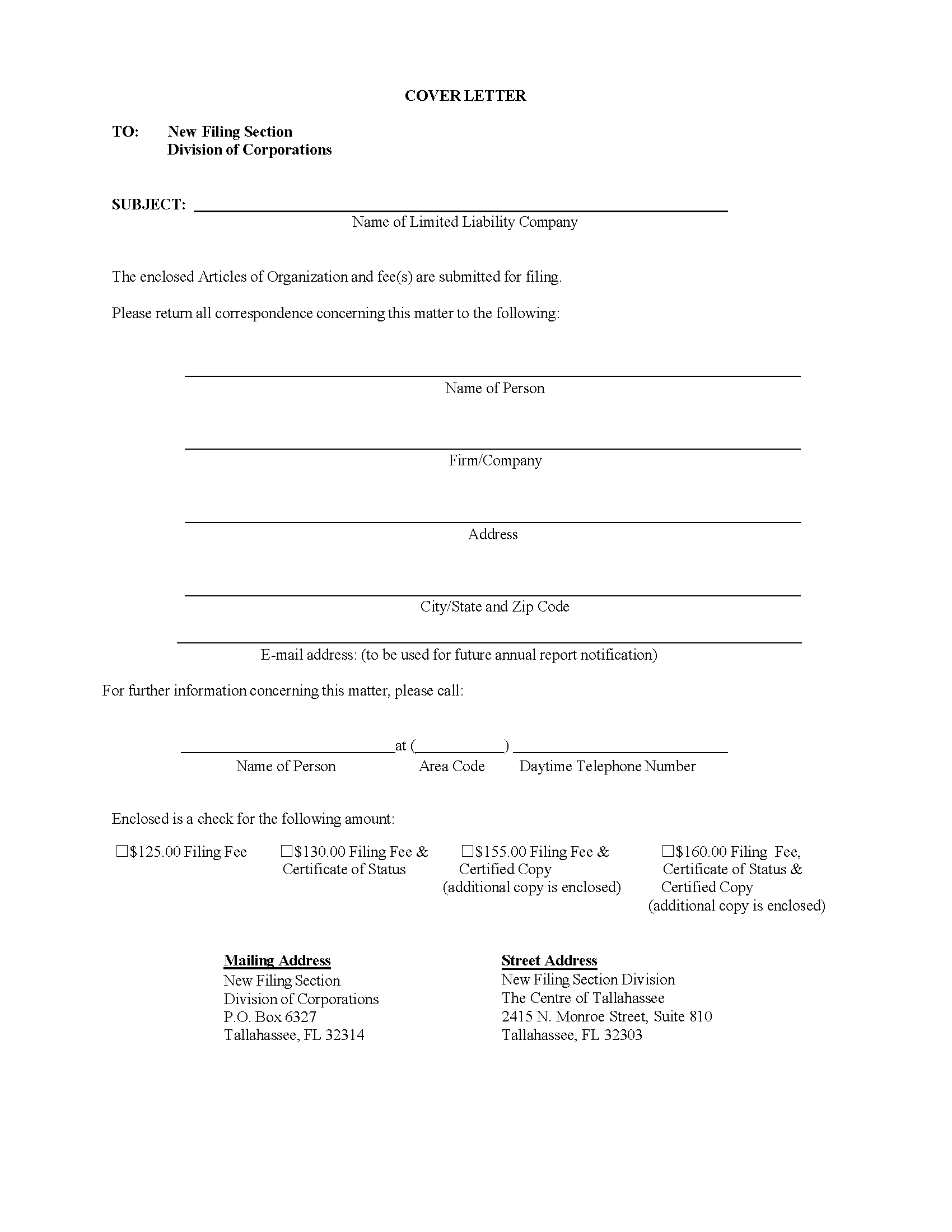

Florida Foreign Llc Registration Get A Florida Certificate Of Authority

Miami Dade Local Business Tax Financeviewer

Miami Dade Local Business Tax Financeviewer

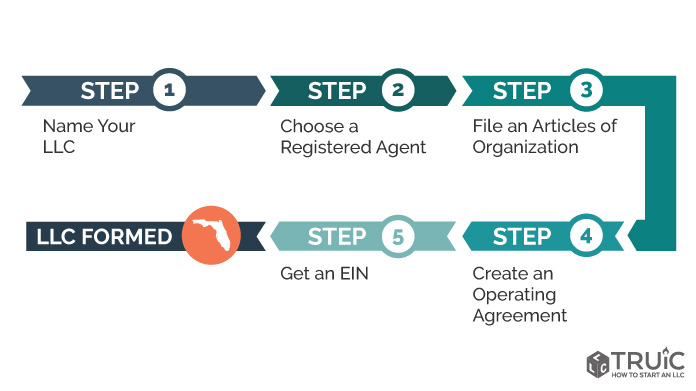

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida

Https Floridarevenue Com Rules Pdf Dr1n Pdf

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Florida Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Florida Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Know Before You Go Tag Renewals Tax Collector Of Escambia County

Know Before You Go Tag Renewals Tax Collector Of Escambia County

Miami Dade Local Business Tax Financeviewer

Miami Dade Local Business Tax Financeviewer

Florida How Do I Locate My Business Partner Number Taxjar Support

Florida How Do I Locate My Business Partner Number Taxjar Support

State Of Florida Com Incorporate In Florida

State Of Florida Com Incorporate In Florida

Https Www Jacksonvillebeach Org Sites Default Files Documents Local Bus Tax Form Pdf

Https Floridarevenue Com Taxes Documents Flprintsutresalecert Pdf

Https Floridarevenue Com Forms Library Current Gt800016 Pdf

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Business Tax Receipt How To Obtain One In 2021 The Blueprint

Florida Dept Of Revenue Submit Corporate Income Tax Information

Florida Dept Of Revenue Submit Corporate Income Tax Information

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida