Ct Business Tax Registration Number Lookup

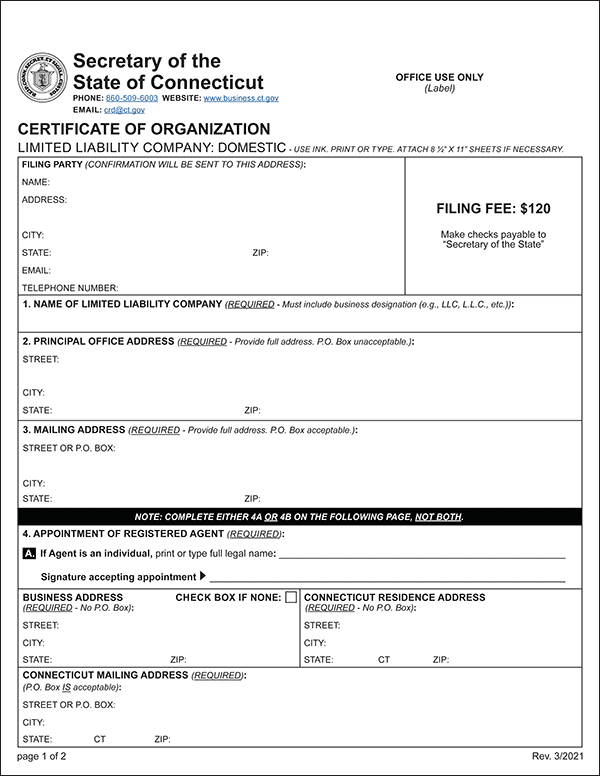

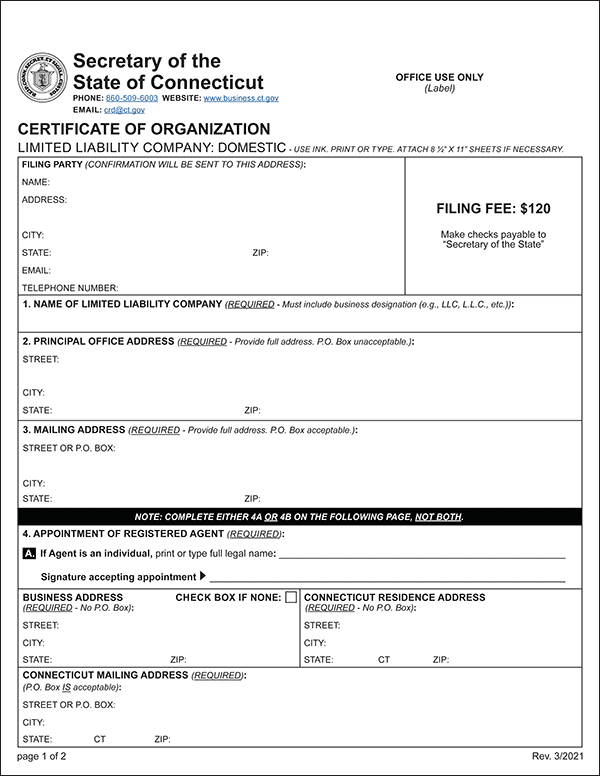

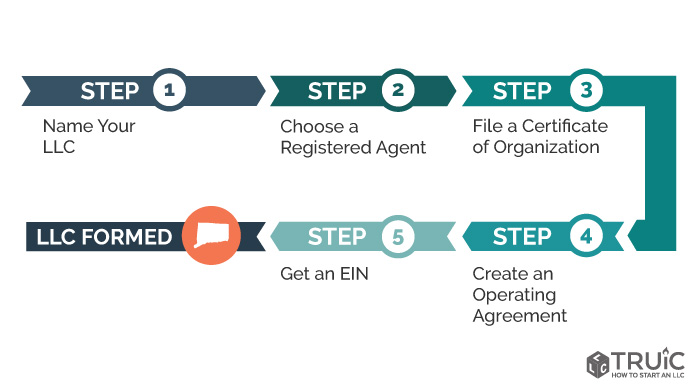

Include the business name s structure existing state tax ID number and nature of the new and existing business. Step 1 - Business Name.

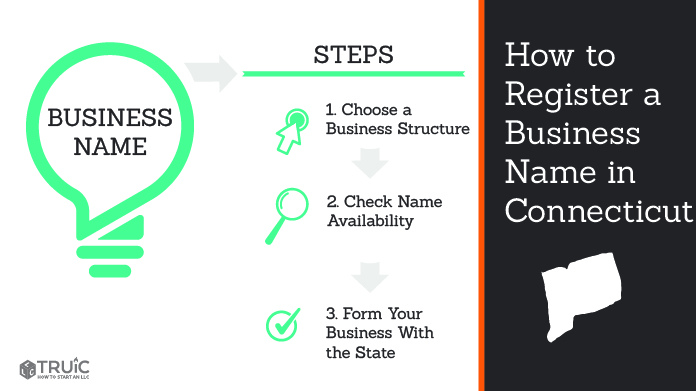

![]() Connecticut Llc How To Form An Llc In Connecticut Truic Guides

Connecticut Llc How To Form An Llc In Connecticut Truic Guides

Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business.

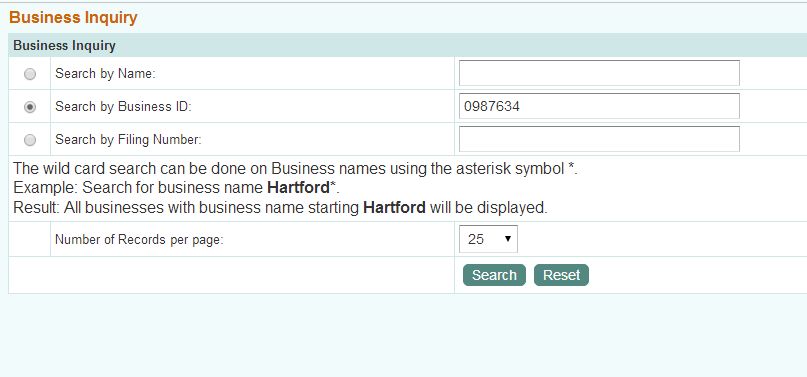

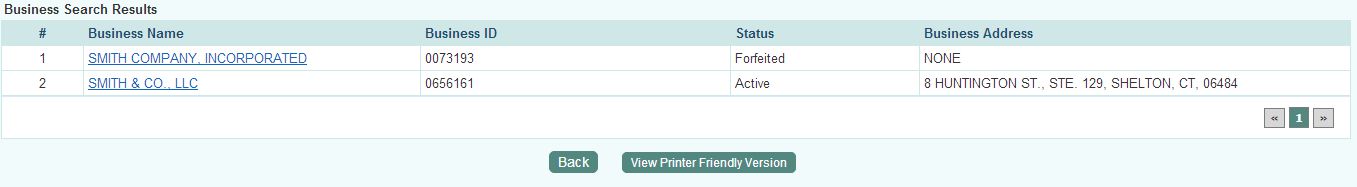

Ct business tax registration number lookup. Number of Records per page. Connecticut Business Registry Search. Federal Employer Identification Number FEIN if applicable this is issued by the Internal Revenue Service IRS - Find out if you need one.

Identify all your licensing and registration requirements to start your business. - CT filing payment deadlines for individual income tax returns extended to May 17th. Search Connecticut business licensing information available online by keyword below.

Not every business requires a license. When opening a new business in Connecticut its important you register your business with the State. Register your business today.

Update your business info Taxes and forms. Department of Revenue Services Guide to Connecticut Business Tax Credits Business tax credit information for a variety of industries. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

They let your small business pay state and federal taxes. To download recent business registration activity by month see this Google Drive folder. - Please check our 2021 CT Tax Filing Season FAQs - Learn more about myconneCT - Walk-in services at all DRS branch office locations remain suspended.

Search for business name Hartford. Stay up to date on all your business tax needs. Register a New Business Online.

Changed your business name. Your one stop for doing business in Connecticut. All businesses with business name starting Hartford will be displayed.

The wild card search can be done on Business names using the asterisk symbol. Enter the Connecticut Tax Registration Number of your closed business in the drop down box. Contact the Connecticut Business Hotline at the Connecticut Economic Resource Center by calling 800-392-2122.

FilePay Form CT-472 Attorney Occupational Tax Return FilePay Form OP-424 Business Entity Tax Return FilePay Form CT-1041 Income Tax Return for Trusts and Estates. Businesses that have a Connecticut Tax Registration Number CT REG can use the Taxpayer Service Center TSC-BUS to file pay view tax transactions and update the businesss account information. Fax to 860-297-4797 or mail to Attention.

You may not use the Sales and Use Tax Permit issued to the previous owner. Purchasing an Ongoing Business. Small Business Administration - Connecticut Index of State Agencies Advance CT Department of Administrative Services Connecticut Cities and Towns Listings.

Skip to Main Content Sign In. 2 rows Find Your Connecticut Tax ID Numbers and Rate Connecticut Tax Registration Number. Us up to date here.

Get employee registration help Update your business info. Search by Business ID. The owners and the Federal Employer Identification Number FEIN must be the same to reopen a closed business.

Welcome to the Connecticut Business Registration Data Search Portal Developed through a partnership between the Connecticut Secretary of the State and the Connecticut Data Collaborative this portal allows for full-text searching exploration and downloading of business registration records. Get tax info now Featured. The good news is you can complete the entire process online here at Business One Stop.

Search by Filing Number. This provides Connecticut with an accurate public record of your business. Step 2 - Find a Location Business registration is location specific.

If you are not certain please contact usAnd be sure to review business registration information. Be certain that the address used on the registration applications is an active address to receive mail. Choose and verify that the business name you choose is available to use.

The Confirmation Number will serve as an official acknowledgement that your application has been received by DRS and act as your temporary tax identification number. Registration Unit Department of Revenue Services 25 Sigourney Street Hartford CT 06106. You will receive your registration package with your permanent Connecticut tax registration number in approximately 10-15 business days.

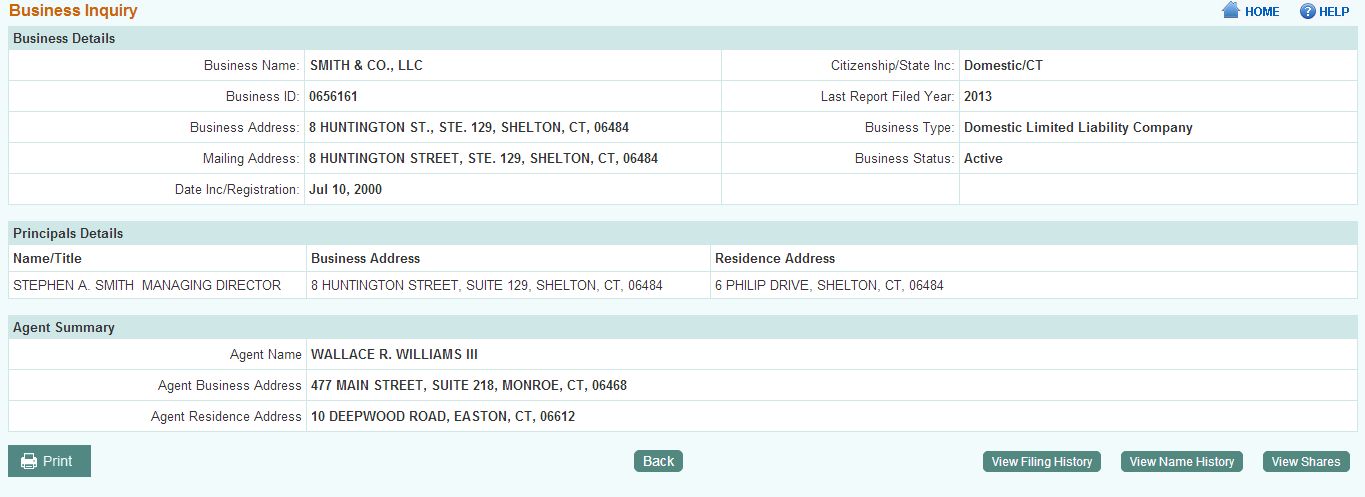

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Step 2 Requirements For Delaware Businesses Division Of Revenue State Of Delaware

Step 2 Requirements For Delaware Businesses Division Of Revenue State Of Delaware

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

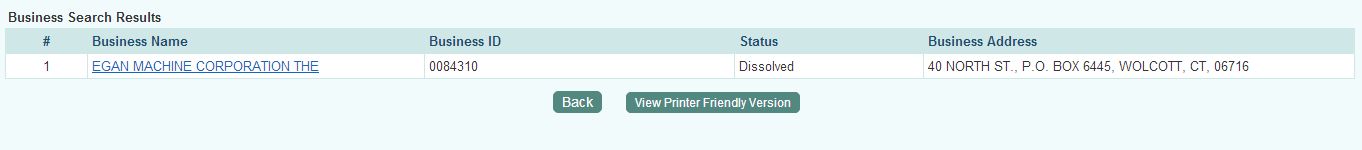

How To Search Available Business Names In Connecticut Startingyourbusiness Com

How To Search Available Business Names In Connecticut Startingyourbusiness Com

How To Register A Business Name In Connecticut How To Start An Llc

How To Register A Business Name In Connecticut How To Start An Llc

Site Domain Registration Domain Site Logos

Site Domain Registration Domain Site Logos

Connecticut Llc How To Form An Llc In Connecticut Truic Guides

Connecticut Llc How To Form An Llc In Connecticut Truic Guides

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

Connecticut Llc How To Form An Llc In Connecticut Truic Guides

Connecticut Llc How To Form An Llc In Connecticut Truic Guides

How To Get A Resale Certificate In New York Startingyourbusiness Com

How To Get A Resale Certificate In New York Startingyourbusiness Com

Employer S State Id Number Lookup Applications In United States Application Gov

Employer S State Id Number Lookup Applications In United States Application Gov

What Is A Registered Agent Hire A Service Or Be Your Own

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Connecticut Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Start Your Own Professional Tax Practice Intuit Proconnect

Start Your Own Professional Tax Practice Intuit Proconnect

Understanding Your 5071c Letter Internal Revenue Service Internal Revenue Service Understanding Yourself Understanding

Understanding Your 5071c Letter Internal Revenue Service Internal Revenue Service Understanding Yourself Understanding