How To Check Covid Relief Grant Balance

The grant is not both Income and expense. May 29 2020 Please follow this link to check the status of your COVID-19 SRD grant application.

Pin On Ehsaas Emergency Cash Grant Tracking

Pin On Ehsaas Emergency Cash Grant Tracking

The IRS is now sending out millions more stimulus.

How to check covid relief grant balance. As such regardless of insurance status providers cannot charge patients for the COVID-19 vaccine or administration of the COVID-19 vaccine. The special Covid-19 Social Relief of Distress Grant The President declared a National State of Disaster as a result of the Covid-19 global pandemic. Click the Apply red button in the upper right.

The University is thankful for this funding for students and we look forward to getting it into our. Apr 14 2020 The easiest method is to record the Grant as Other Income - Economic StimulusDisaster Relief or something similar. It will need to be reviewed come tax time to determine if it is declared as taxable income see below.

IRS payment timeline what to know about plus-up money. 1 day ago Stimulus check status update. Didnt Get the First and Second Payments.

Get information on coronavirus COVID-19 tax relief for businesses and tax-exempt entities. Browse the HHS coronavirus-related opportunities listed. Grant submission andor award can be entered as the Plan using Estimate.

Grant Funds provided to you are income unless you need to return it. Mar 29 2021 Regularly check your schools financial aid portal or its specific Covid-19 relief page for more information about the availability of new funds. COVID-19 relief options.

Click the button below to visit Grantsgov. The COVID-19 Social relief of distress SRD grant is a fund that was recently introduced to assist members of South African society who do not have any income nor receive any assistance from the. More about the COVID Relief Grant II Student Financial Aid Grant RCCs COVID Relief Grant II allocation is 126 million.

Contact your PPP lender and complete the correct form. Coronavirus Response and Relief Supplemental Appropriations Act CRRSAA On January 17 2021 Ashland University was awarded 1993958 from the Federal Coronavirus Response and Relief Supplemental Appropriations Act CRRSAA to help relieve the financial impacts from the COVID-19 pandemic on our students. Our online status check is live.

You may need to verify the adjusted gross income AGI from your most recent tax return. Dec 17 2018 And since the grant goes to Bank you also avoid JE for Banking. Mar 17 2021 HRSA COVID-19 Uninsured Program for non-insured vaccine recipients.

To check your status you need an ID number and cellphone number. Your lender can provide you with either the SBA Form 3508 SBA Form 3508EZ SBA Form 3508S or a lender equivalent. Click on or copy and paste this URL on your browser httpstcokvuCPU6xoY to check progress on your COVID-19 SRD grant.

Review the Eligibility criteria. May not seek any reimbursement including through balance billing from the vaccine recipient. May 29 2020 The new function allows potential recipients to check the status of their applications for the unemployment grant.

That is the plan for the activities not the entry. 12 hours agoPenn State will award more than 23000 cash grants to students through funding provided by the Higher Education Emergency Relief Fund II. Latest Updates on Coronavirus Tax Relief Tax Deadlines Changed.

Httpssrdsassagovza Paying the right social grant. In a press release President Eric Baron said the relief funding will help Penn State aid and relieve students with financial needs. Claim the 2020 Recovery Rebate Credit.

In this regard he introduced a special Covid 19 Social Relief of Distress Grant SRD of R350 per month for 6 months to be paid to individuals who are currently unemployed do not receive any form of income social grant or UIF payment etc. The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021. One-hundred percent of this allocation goes directly to students who apply and are eligible.

Employee Retention Credit Available for Many Businesses Financially Impacted by COVID-19 The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees. Select an opportunity by clicking the Opportunity Number in the first column. Apr 15 2020 To check your payment status you must enter your Social Security number date of birth and mailing address.

Check when and how your payment was sent with the Get My Payment tool.

Coronavirus Stimulus Check When Will Irs Send 1 200 Checks Money

Coronavirus Stimulus Check When Will Irs Send 1 200 Checks Money

What To Know About The Second Round Of Economic Impact Payment Eip Checks And Cards Page 2 Ftc Consumer Information

What To Know About The Second Round Of Economic Impact Payment Eip Checks And Cards Page 2 Ftc Consumer Information

Check Nadra Cnic Verification Online Id Card Tracking Status Online Check And Balance How To Check Balance Online Checks

Check Nadra Cnic Verification Online Id Card Tracking Status Online Check And Balance How To Check Balance Online Checks

How To Get 1200 Stimulus Check Instantly With Cash App Youtube

How To Get 1200 Stimulus Check Instantly With Cash App Youtube

Pin On Bookkeeping Accounting Taxes Qbo

Pin On Bookkeeping Accounting Taxes Qbo

Check The Status Of Your Covid 19 Srd Grant Application

Check The Status Of Your Covid 19 Srd Grant Application

Here S How To Check Sassa Balance On Your Phone Current Affairs Za

Here S How To Check Sassa Balance On Your Phone Current Affairs Za

The Fresh Guide To Ebt In Alabama Fresh Ebt

The Fresh Guide To Ebt In Alabama Fresh Ebt

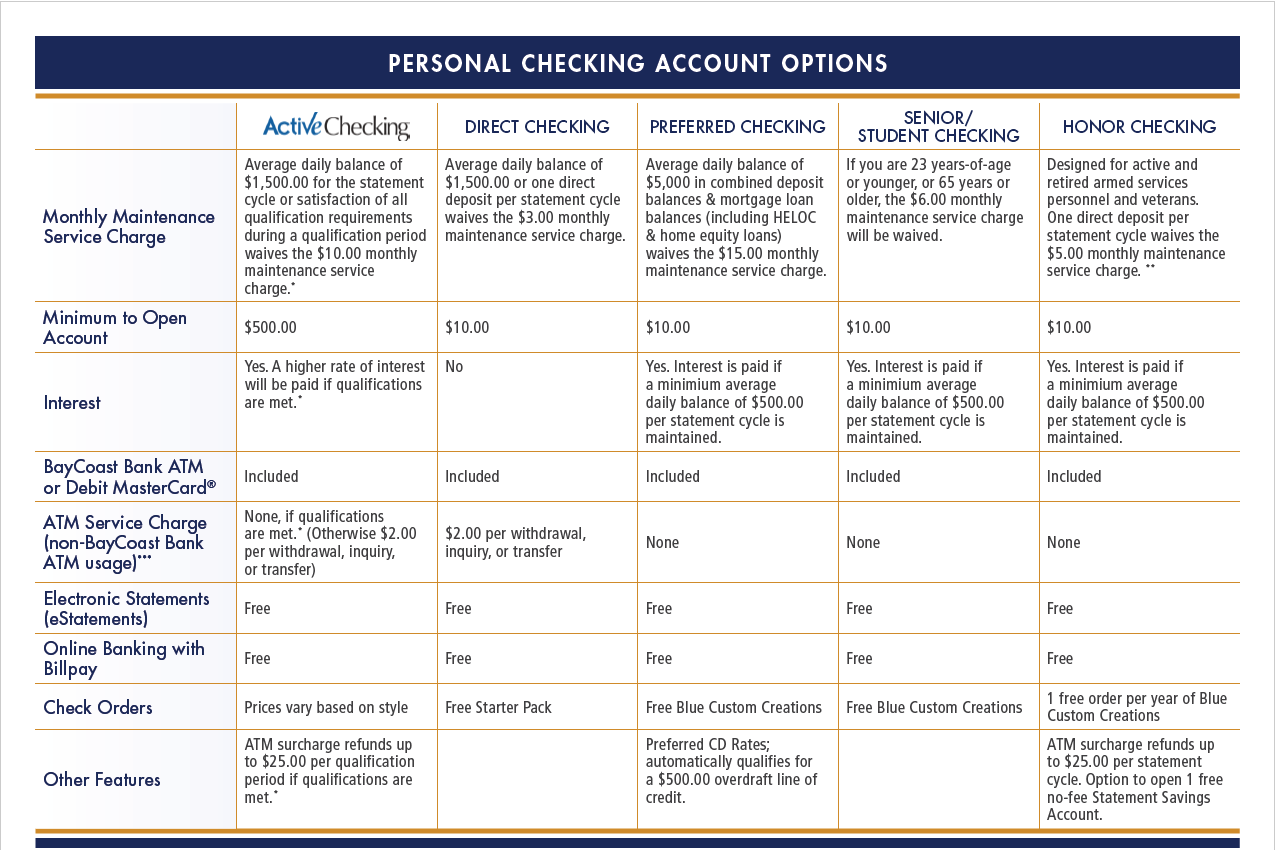

Pin On Https Businessbank Infostot Com

Pin On Https Businessbank Infostot Com

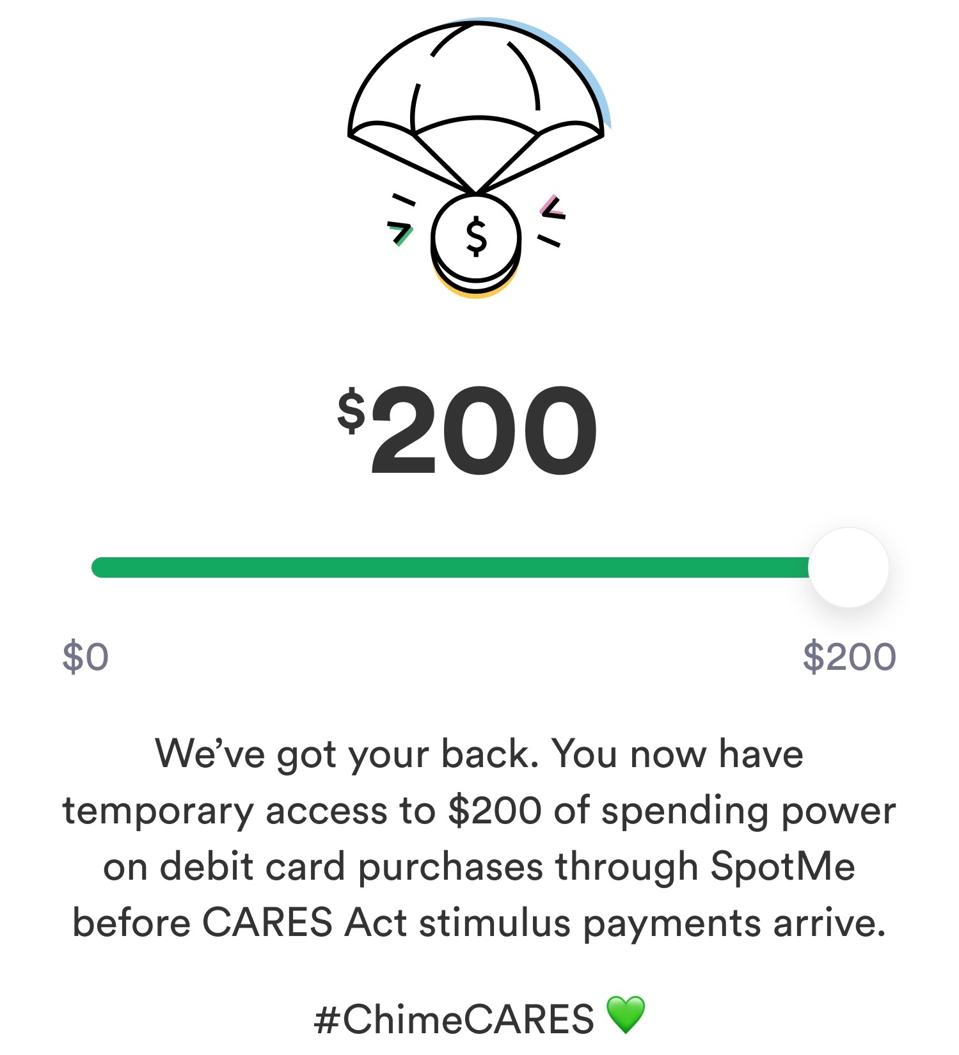

Digital Bank Chime Now Offering Stimulus Check Advance To 100 000 Users

Digital Bank Chime Now Offering Stimulus Check Advance To 100 000 Users

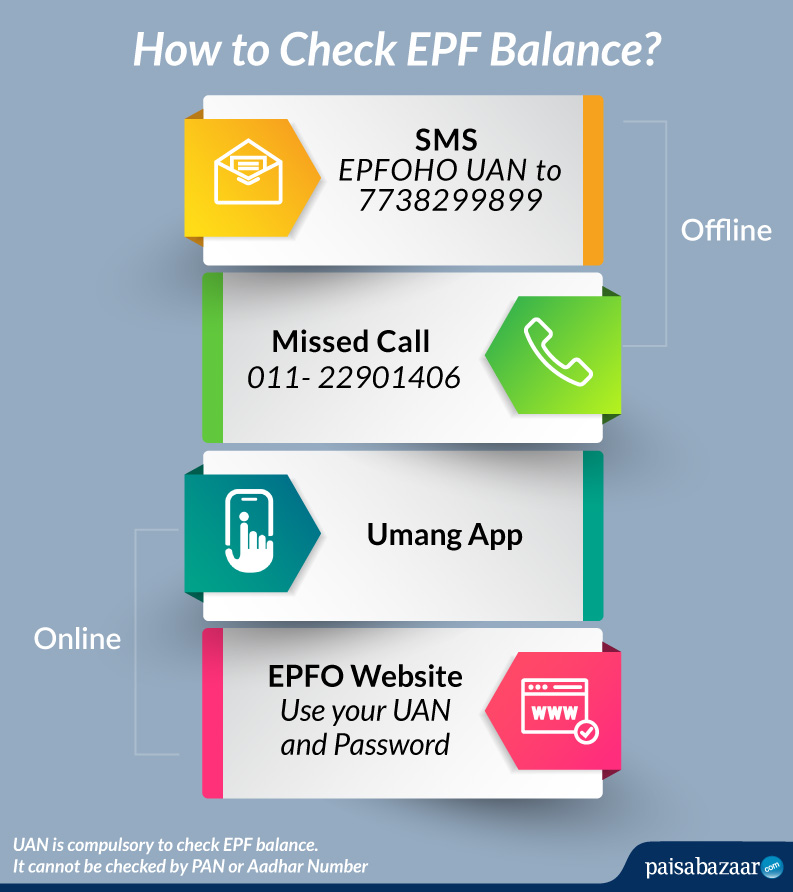

Check Epf Balance Online Via Umang App Sms Missed Call

Check Epf Balance Online Via Umang App Sms Missed Call

Check Your R350 Grant Relief Status Now Ussd Whatsapp Email And Online Applications

Check Your R350 Grant Relief Status Now Ussd Whatsapp Email And Online Applications

How To Check Saudi Iqama Visa Validity 2019 Very Simple Royal Palm Visa Online Visa Air Arabia

How To Check Saudi Iqama Visa Validity 2019 Very Simple Royal Palm Visa Online Visa Air Arabia

.png)