How To Get A 1099 Form From Unemployment Va

On the Did you receive unemployment or paid family leave benefits in 2020. If you change addresses you must give the VEC the new address to receive your 1099G.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

If you choose this option it could take several days to receive your form in the mail.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

How to get a 1099 form from unemployment va. If 760PY return add both columns of line 1. Line 1 Adjusted Gross Income from your last filed 760 760PY or 763 Virginia return. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. The amount you paid back will need to go in this line. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020.

It will be deducted from the. This is the fastest option to get your form. The 1099-G tax form is commonly used to report unemployment compensation.

Look for the 1099-G form youll be getting online or in the mail. The IRS does not require you to submit a paper copy of your 1099-G form with your taxes. Your local office will be able to send a replacement copy in the mail.

The Virginia Employment Commission will send you and the IRS Form 1099G at the years end detailing the benefits you received plus any federal tax withholdings elected. Search for unemployment compensation and select the Jump to link. If you havent received your 1099-G copy in the mail by Jan.

That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax. This means if you cant print the information out youll simply need to note the pertinent number to plug into the unemployment compensation block as well as any refunds or credits that apply. Unemployment is taxable income.

Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1. Therefore VA does not send out 1099 forms. To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link.

Your Social Security number If you filed jointly youll also need your spouses SSN. Heres how you enter the unemployment. Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333.

Claimants may also request their 1099-G form via Tele-Serve. Look up your 1099G1099INT To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return. These forms are available online from the NC DES or in the mail.

If joint return filed for tax. Go to the IRS website. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G.

Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund. Drivers license or state ID number. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

If you need a statement of benefits paid please contact your VA. Follow the prompts to schedule a callback. How do I obtain a 1099 form from VA.

If you received regular UC including PEUC EB TRA you will receive UC-1099G. Social Security or Alien. This 1099-G does not include any information on unemployment benefits received last year.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits. The tax year of your return. Call your local unemployment office to request a copy of your 1099-G by mail or fax.

Open or continue your tax return in TurboTax online. Press 2 Other questions about your 1099-G. If you received both UC and PUA you can expect to receive both forms.

If received PUA you will receive PUA-1099G. If you received Arizona Unemployment Insurance UI or Pandemic Unemployment Assistance PUA and you do not receive a 1099-G form by February 27 2021 please submit a report to the DepartmentIf you believe you didnt receive your 1099-G because your address on file was incorrect please enter the correct address in the form click the update box under the address field and submit. In most states self-employed or 1099 workers will need to provide the following information when applying for unemployment benefits.

Press 2 Individual. Instructions for the form can be found on the IRS website. The 1099 reflects all payments processed out to you for the current tax year 2020.

Name full mailing address and phone number. If you received unemployment compensation during the year you should receive Form 1099-G from the Office of Unemployment Compensation. Then you will be able to file a complete and accurate tax return.

31 there is a chance your copy was lost in transit. There will be a question on your tax form that will ask if you paid any unemployment back in the tax year 2020. VA benefits are not taxable.

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

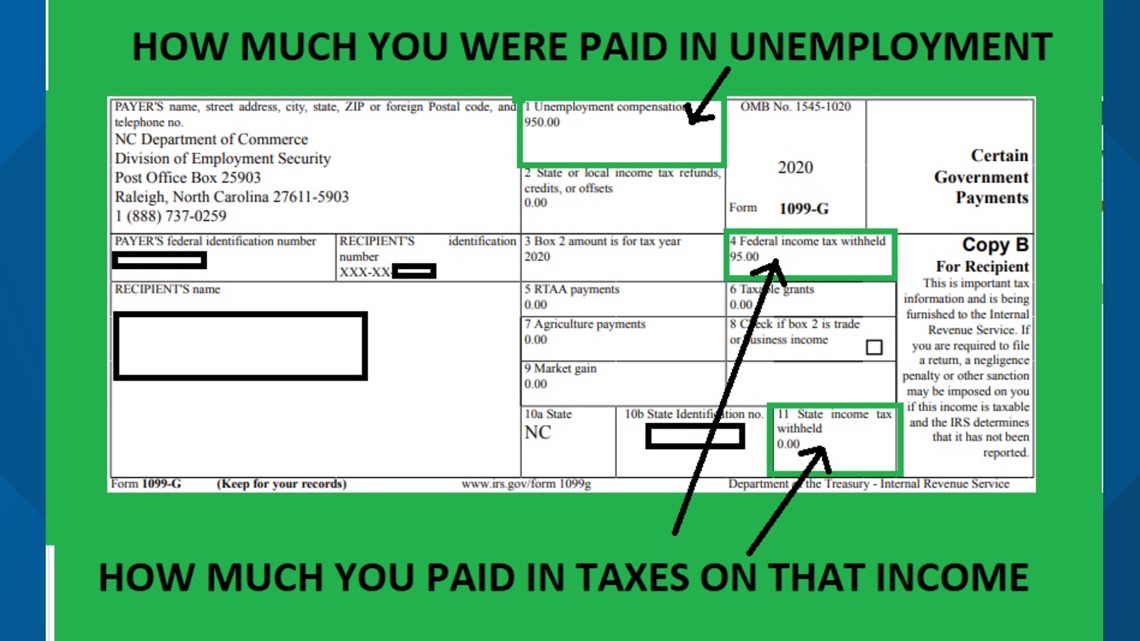

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Form Colorado 2018 Vincegray2014

1099 Form Colorado 2018 Vincegray2014

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

How To Print A 1099 Tax Form Off The Computer Vincegray2014

How To Print A 1099 Tax Form Off The Computer Vincegray2014

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

1099 Form Page 1 Line 17qq Com

1099 Form Page 1 Line 17qq Com

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block