How To Read 1099-sa Form

Select the appropriate box es and Continue. 1 which indicates normal tax-free distributions.

Form 1099 Int Rev 10 2013 Vincegray2014

Form 1099 Int Rev 10 2013 Vincegray2014

Form 1099-SA is used to show distributions from.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

How to read 1099-sa form. If you see code 1 you wont owe anything extra. A Social Security 1099 or 1042S Benefit Statement also called an SSA-1099 or SSA-1042S is a tax form that shows the total amount of benefits you received from Social Security in the previous year. You will receive a separate 1099-SA for each type of distribution made during the tax year.

A form SSA-1099 Social Security Administration is used to report Social Security benefits issued to you during the year. If the person isnt your employee howeverif theyre an independent contractor for exampleyou fill out a 1099 form instead. Receiving Form 1099-SA means that depending on which distributions you received from which accounts there are certain tax forms you will have to file.

2 excess contribution removal. If you are not sure who the account administrator is contact your employer or insurance provider. File Form 8889 or Form 8853 with your Form 1040 or 1040-SR to report a distribution from these accounts even if the distribution isnt taxable.

Health Savings Account HSA Archer Medical Savings Account MSA Medicare Advantage MA MSA. Health savings account HSA. Recordkeeping for Your HSA You must keep all receipts and records of medical.

Specific Instructions for Form 1099-SA File Form 1099-SA Distributions From an HSA Archer MSA or Medicare Advantage MSA to report distributions made from a health savings account HSA Archer medical savings account. IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year. How to Read Form 1099-C.

It is uncommon to have withholdings from social security benefits. When youre a small business owner issuing tax forms to an individual there are two different forms you can use. Box 5 shows the net amount of benefits paid for the year.

For Forms 1099-SA and 5498-SA only if due to a low volume of recipients you are filing the forms on paper you can send in the black-and-white Copyies A with a Form 1096 that you also printed from the IRS website. Shows the total amount of withdrawals from your HSA in 2020 including HSA rollovers but not HSA transfers. If you made an excess HSA contribution in 2019 and withdrew that excess contribution by the 2020 tax return filing deadline earnings from that excess HSA contribution are shown here they will also be in Box 1.

Inside your program search for 1099-SA. Provided you only use the funds to pay qualified medical expenses box 3 should show the distribution code No. If you have online access to your HSA account you may be able to access the Form 1099-SA through that account.

Heres how to understand your Form 1099-SA for the 2020 tax year. Box 4 the FMV of the account on the date of death. Required to file electronically.

Open continue your return in TurboTax if you dont already have it open. This will take you to the Tell us about the health-related accounts you had in 2020 screen. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

Box 3 code 4 see Box 3. The five distribution types are 1 normal. First your total HSA withdrawal goes on line 14a.

Shows the type of account that is reported on this Form 1099-SA. Box 1 the gross distribution. If you learn of the account holders death and make a distribution to the beneficiary in the year of death issue a Form 1099-SA and enter in.

A separate return must be filed for each plan type. Money you used reported in box 1. Then you can refer to Box 3 on IRS Form 1099-SA to see if your withdrawal was allowed.

Specific Instructions for Form 1099-SA File Form 1099-SA Distributions From an HSA Archer. Box 6 shows the amount of your federal tax withholdings. Forms on paper you can send in the black-and-white Copyies A with a Form 1096 that you also printed from the IRS website.

If you received benefits. The distribution may have been paid directly to a medical service provider or to the account holder. Box 3 shows the amount paid for Medicare.

Archer Medical Savings Account Archer MSA. Reverse side of your Form 1099-SA for official Internal Revenue Service IRS distribution code definitions. Below youll find a quick rundown of the 1099-C form.

If you did not take any money out of the account then you wouldnt be receiving a form for 2017. And 5 prohibited transaction. File Form 1099-SA to report distributions made from a.

Noncitizens who live outside of the United States receive the SSA. Cancellation of Debt All versions of Form 1099-C are available on the IRS website. You will receive a Form 1099-SA that shows the total amount of your annual distributions ie.

How to use Form 1099-SA for your taxes. When you distribute money from your HSA your tax return has one extra hoop to jump through Form 8889. If the person in question is your employee you fill out a W-2 form.

To view a sample Form. Select Jump To 1099-SA. Medicare Advantage Medical Savings Account MA MSA.

Shows the fair market value FMV on date of death for deceased participants.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

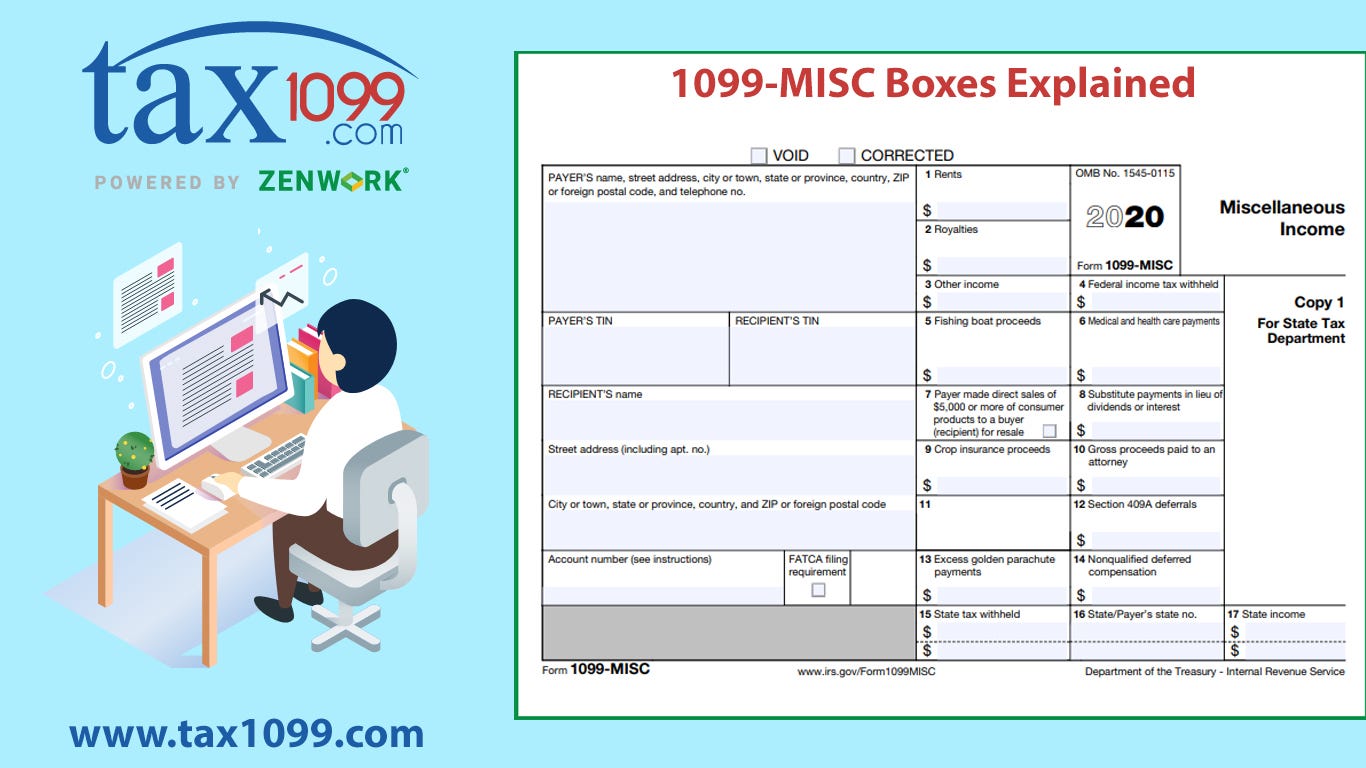

How To Read 2020 Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

How To Read 2020 Form 1099 Misc Boxes And Descriptions By Tax1099 Com Irs Approved Efile Service Provider Medium

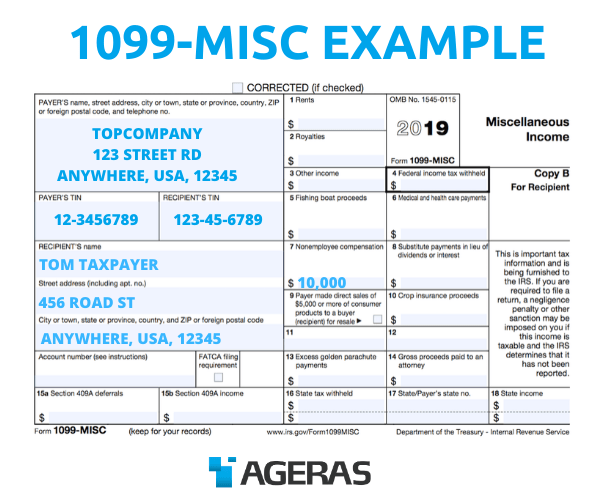

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Correcting Your Hsa Reporting Two Steps Two Forms Ascensus

Correcting Your Hsa Reporting Two Steps Two Forms Ascensus

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

1099 Nec Form 2021 1099 Forms Zrivo

1099 Nec Form 2021 1099 Forms Zrivo

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Sa Form Copy C Payer State Discount Tax Forms

1099 Sa Form Copy C Payer State Discount Tax Forms

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition