Company Declaration Scheme Singapore

Senior Employment Credit SEC CPF Transition Offset CTO and Enabling Employment Credit EEC Jobs Support Scheme JSS Jobs Growth Incentive JGI Wage Credit Scheme WCS Productivity and Innovation Credit Scheme PIC Go to Top Schemes Section. Duty Free Shop Scheme.

Industrial Exemption Factory Scheme.

Company declaration scheme singapore. Corporation means any body corporate formed or incorporated or existing in Singapore or outside Singapore and includes any foreign company but does not include. This is also a requirement to qualify for the tax incentive schemes. Temporary scheme to allow companies to transfer foreign workers across sectors to manage manpower needs Work pass holders on SHN will receive SMS or calls from MOM All work pass holders with recent travel history to or transited in affected areas will be issued with a 7 or 14 days SHN and will be contacted by MOM via SMS video calls or inspections to ensure they are complying with the SHN.

1 Be registered and operate in Singapore. As a condition for ongoing exemption all restricted schemes must lodge an annual declaration every 12 months. The Company Declaration Scheme allows approved operators in the Airport Logistics Park of Singapore ALPS to remove local goods or goods with its Goods and Services Tax GST paid or accounted for from ALPS into customs territory using a Company Declaration form in lieu of TradeNet permits.

Definition of company The word company is defined differently in sections 21011 and 2126 of the Companies Act leading to different scope for each. Those who wish to store local or GST-paid goods in the Airport Logistics Park of Singapore ALPS may apply for the Company Declaration Scheme. More information on restricted schemes can be found in section 305 of the SFA and the Sixth Schedule to the Securities and Futures Offers of Investments Collective Investment Schemes.

Can I import protein powder and health supplements into Singapore for my personal or own consumption. The Consolidated Declaration is a facilitation designed for qualified Air Express Companies to consolidate multiple time-sensitive imports or exports of air express shipments. Perform a Post ACAP Review PAR and submit the PAR Declaration form GST F28 for business with a valid ACAP status.

AND 3 Companys Group annual sales turnover should be. Tax incentive schemes in Singapore for funds All fund management companies are required to be registered with the MAS therefore holding the title of being a Registered Fund Management Company RFMC or holding a Capital Market Services License CMSL. Regulatory framework Fund management activities in Singapore are regulated by the Monetary Authority of Singapore MAS under the Securities and Futures Act Cap.

GST will not be payable on these goods again. The court ordered the company to pay a fine of S24000 US19240 on 12 charges of failure to comply with the MES conditions imposed by the. For businesses with valid ACAP status the ASK declaration form is also not required if you perform a PAR and submit the PAR Declaration form GST F28.

Approved Import GST Suspension Scheme. There are three main criterias to be considered an SME in Singapore. What qualifies as an SME in Singapore.

Companies can zero-rate their supplies to overseas customers for goods hand-carried out of Singapore via Changi International Airport only. Under this scheme approved operators are allowed to remove local goods or goods previously covered by permits that are GST-paid or GST accounted for from ALPS into customs territory using a Company. Management companies in Singapore along with details on the specific tax incentives schemes for funds managed by Singapore-based fund managers.

2 Have a minimum of 30 per cent local shareholding. Kian Min Express Transport Pte Ltd a freight forwarding company in Singapore is the first company to be charged for misusing its Major Exporter Scheme MES status to import goods without paying the Goods Services Tax GST. The inconsistency should be resolved since section 212 is an extension of section 210 in that a scheme approved under section 210 may have to be carried into effect through section 212.

76C Authority for off-market acquisition on equal access scheme. Import GST Deferment Scheme Approved GST-registered businesses can defer their import GST payments until their monthly GST returns are due as long as they file their GST returns on a monthly basis. Shall be in the form of a declaration in writing signed by every director or shall be accompanied by a.

Employment Support Allowance Employment War Ep 4 Part Time Employment 60463 Image Of Employment Folder Che Employment Application Employment Good Grades

Employment Support Allowance Employment War Ep 4 Part Time Employment 60463 Image Of Employment Folder Che Employment Application Employment Good Grades

Https Higherground Mt Wp Content Uploads 2018 08 Apex Group Source Of Funds And Source Of Wealth Declaration Form Pdf

Approach Towards Saving Amount While Paying Tds Tax Deducted At Source Tax Deductions Paying

Approach Towards Saving Amount While Paying Tds Tax Deducted At Source Tax Deductions Paying

Fajr Quran Halaqa Surah Baqarah Ayah 1 20 Mind Maps Summary Master Data Management Mind Map Inbound Marketing Strategy

Fajr Quran Halaqa Surah Baqarah Ayah 1 20 Mind Maps Summary Master Data Management Mind Map Inbound Marketing Strategy

Genting Malaysia Berhad Initiates Empire Resorts Incorporated Purchase Doubledown Casino Top Online Casinos Resort

Genting Malaysia Berhad Initiates Empire Resorts Incorporated Purchase Doubledown Casino Top Online Casinos Resort

International Monetary Fund Imf Hq 2 Greenroofs Com Roofing Systems Green Roof Patio Area

International Monetary Fund Imf Hq 2 Greenroofs Com Roofing Systems Green Roof Patio Area

How To Register As A Self Employed Person In Singapore Lancerx

How To Register As A Self Employed Person In Singapore Lancerx

![]() Environmental Product Declaration Epd Overview Ecochain

Environmental Product Declaration Epd Overview Ecochain

What Are The Cn22 And Cn23 Customs Declarations And How To Use Them

What Are The Cn22 And Cn23 Customs Declarations And How To Use Them

Graphic Design Cover Letter Sample Free Download Resume Genius Cover Letter Example Templates Creative Cover Letter Resume Cover Letter Examples

Graphic Design Cover Letter Sample Free Download Resume Genius Cover Letter Example Templates Creative Cover Letter Resume Cover Letter Examples

The U S State Department Has Its Own Sprawling Air Force Here S What S In Its Inventory The Drive Air Force Small Drones Department

The U S State Department Has Its Own Sprawling Air Force Here S What S In Its Inventory The Drive Air Force Small Drones Department

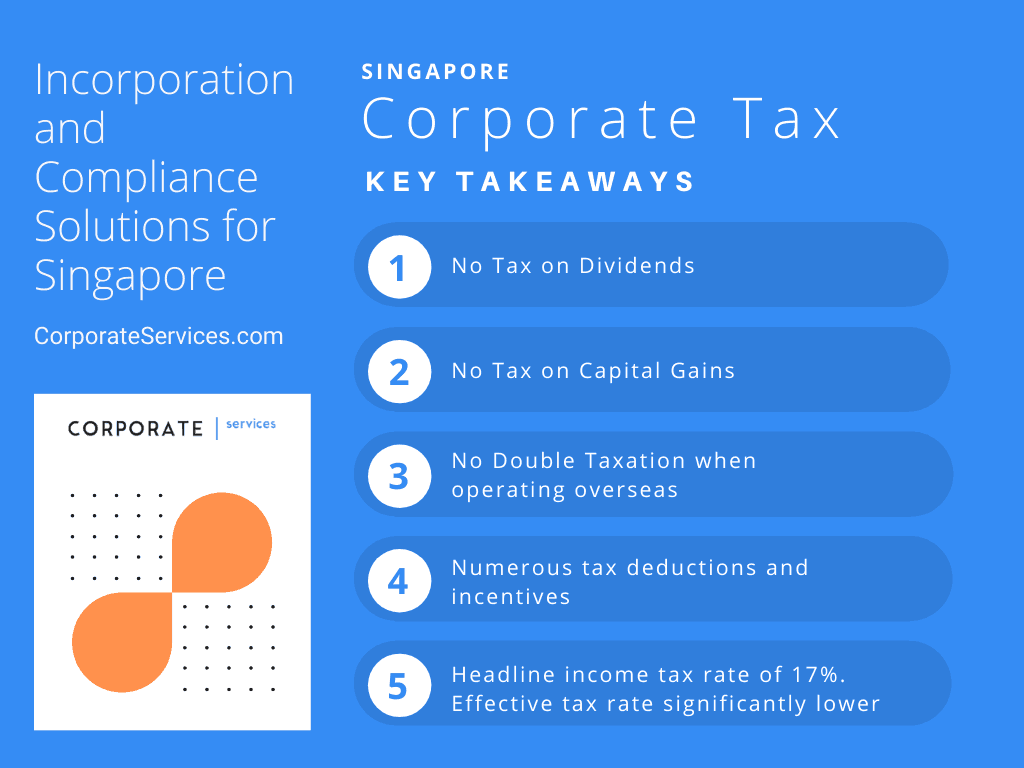

Singapore Corporate Tax 2021 Update Tax Rates Tax Incentives

Singapore Corporate Tax 2021 Update Tax Rates Tax Incentives

Fast Facts About The Philippines Philippines Fast Facts Real Estate Infographic

Fast Facts About The Philippines Philippines Fast Facts Real Estate Infographic

Pradhan Mantri Jeevan Jyoti Bima Yojana How To Fill Form Yoyomoneysingh Finance Guru Bima Give It To Me Finance

Pradhan Mantri Jeevan Jyoti Bima Yojana How To Fill Form Yoyomoneysingh Finance Guru Bima Give It To Me Finance

Dholera Sir Current Status Programme Manager Development Welfare Society

Dholera Sir Current Status Programme Manager Development Welfare Society

Interior Designers In Chennai Hospital Interior Design Hotel Interior Design Interior

Interior Designers In Chennai Hospital Interior Design Hotel Interior Design Interior

Declaration Person Not Longer Work In Company Do You Need A Letter Informing Replacement Of Employee To Customer Download T Work In Company Templates Person

Declaration Person Not Longer Work In Company Do You Need A Letter Informing Replacement Of Employee To Customer Download T Work In Company Templates Person

Business Letter Writing Sample Business Forms Business Letter Guide Letter Writing Samples Letter Template Word Business Letter Sample

Business Letter Writing Sample Business Forms Business Letter Guide Letter Writing Samples Letter Template Word Business Letter Sample