Do You Have To Send 1099 To Utility Companies

Water waste disposal phone internet etc. Form 1099-MISC is used to report payments made to vendors that provide services to a business.

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

Do you have to send 1099 to utility companies. If your business this includes self-employed individuals LLCsPartnerships and Corporations pays 600 or more a year for services rent or royalties to any individual Partnership or LLC not taxed as a corporation you are required to issue Form 1099-Misc reporting the total dollar amount paid to them during the year. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. On that form they are required to check whether they are taxed as a sole proprietor partnershipor corporation.

If this happens to you youll need to write back to the IRS and explain the payment was for a. The Substitute Form W-9 is available on the. While utility bills technically count as payment when theyre rolled into your rent they dont belong on a 1099-MISC if you pay utility companies directly.

Vendors who operate as C- or S-Corporations do not require a 1099. If the following four conditions are met you must generally report a payment as nonemployee compensation. Below that threshold you do not need to report the payment.

However the buyer has reported the sale to you and the IRS on Form 1099S. Follow this 1099 Decision Tree to help you decide who you need to supply a form to. If you paid your vendor directly through your bank account check debit card ACH you are responsible for sending them a 1099.

Regarding the issuance of 1099s the current rules are as follows. Equipment instruments and disposable supplies. Items that do NOT need to be reported on Form 1099-MISC.

You must send and file a 1099-MISC for certain types of payments if you paid 600 or more during the year. Anyone who checks any box other than corporation needs to be sent a 1099-MISCform if you paid them 600 or more during the year for services they performed. You do not have to send 1099s to corporations.

What about utility bills that you pay directly. Storage unit records storage etc. The same rule applies to farmers that make payments in connection with the trucking or.

Who are considered Vendors or Sub-Contractors. 16041-3 c exempts payments for freight services from the general requirement for payors to issue Form 1099 to independent contractors and others with which they do business. Is any foreign entity eg foreign individual foreign company etc.

The primary purpose of the 1099-MISC is to report income individuals independent contractors etc receive to. Corporations with the exception of attorneys medical and healthcare services and CPA firms. How to File 1099s.

You should obtain a completed Substitute Form W-9 when initiating any transaction with a new vendor that could be reportable on a 1099-MISC. Hello again Jan Anytime that you pay someone more than 600 during the year for services which they have performed you should have that person or company fill out a W-9 form for you. If you paid your vendor through PayPal or a Credit Card the merchant will issue them a 1099K and you wont have to.

In that statement alone there are some keys to what needs to be reported including. This also applies if your landlord is the one who passes along monthly utility bills to you that arrive from utility providers to allow you to pay directly. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

Thus trucking companies need not issue Form 1099s to owner-operators that are under lease for freight hauling services. You made the payment to someone who is not your employee. Additionally you dont need to send 1099s to sellers of merchandise freight storage or similar items.

If you are in business whether self-employed or running a company you must send a 1099 form with copies to the IRS to anyone that you pay money to unless the payments meet one or more of the. You dont need to send a 1099 to corporations or for payments of rent to real estate agents typically property managers -- yet they are required to send them to the property owners. The IRS will often send letters to the taxpayer in this situation and attempt to add the sales price to your taxable income.

1 To a Business First the payments need to be made in a business so you dont have to prepare a 1099-MISC for the guy who cuts your home lawn. Business structures besides corporations general partnerships limited partnerships limited liability companies and sole proprietorships require Form 1099. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent.

Utility Bill Generator Fill Out And Sign Printable Pdf Template Signnow

Utility Bill Generator Fill Out And Sign Printable Pdf Template Signnow

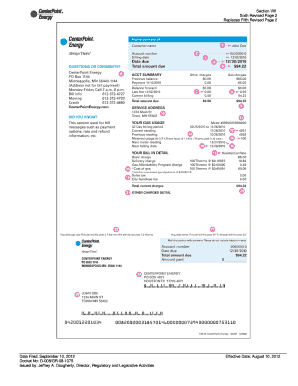

Fake Utility Bill Template Unique Centerpoint Provider Energy Electric Houston Texas Bill Template Energy Bill Gas Bill

Fake Utility Bill Template Unique Centerpoint Provider Energy Electric Houston Texas Bill Template Energy Bill Gas Bill

Usa California Socal Gas Utility Bill Template In Word Format Bill Template Utility Bill Rental Agreement Templates

Usa California Socal Gas Utility Bill Template In Word Format Bill Template Utility Bill Rental Agreement Templates

Utility Gas Natural Home Bill Statement Proof Of Address Connecticut New England Verification Applicat In 2021 Worksheet Template Energy Bill Credit Card App

Utility Gas Natural Home Bill Statement Proof Of Address Connecticut New England Verification Applicat In 2021 Worksheet Template Energy Bill Credit Card App

Utility Maryland Cooperative Bill Statement Electric Proof Of Address Fake Energy Gas Smeco Gas Company Doctors Note Gift Card Generator

Utility Maryland Cooperative Bill Statement Electric Proof Of Address Fake Energy Gas Smeco Gas Company Doctors Note Gift Card Generator

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

Utility Bill Template Fill Online Printable Fillable Blank Pdffiller

Utility Bill Template Fill Online Printable Fillable Blank Pdffiller

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

British Gas Customer Bills And Statements By Lucy Hamlet Via Behance Bill Template Gas Bill Bills

British Gas Customer Bills And Statements By Lucy Hamlet Via Behance Bill Template Gas Bill Bills

Pacific Power Bill Statement Power Bills Gas Bill

Pacific Power Bill Statement Power Bills Gas Bill

Ambit Energy Statement Ambit Energy Energy Bill Template

Ambit Energy Statement Ambit Energy Energy Bill Template

Canada Maritime Electric Utility Bill Template In Word Format Bill Template Utility Bill Templates

Canada Maritime Electric Utility Bill Template In Word Format Bill Template Utility Bill Templates

Fpl Florida Power Light Energy Electric Utility Statement Bill Gas Water Sanitation Credit Card App Bill Template Certificate Of Completion Template

Fpl Florida Power Light Energy Electric Utility Statement Bill Gas Water Sanitation Credit Card App Bill Template Certificate Of Completion Template

Paystubs Proof Of Income Employment Earnings Job Fake Work Verification Custom Printab Payroll Template Statement Template Resume Design Template Free

Paystubs Proof Of Income Employment Earnings Job Fake Work Verification Custom Printab Payroll Template Statement Template Resume Design Template Free

What Are Utilities Costs For The Ppp Bench Accounting

What Are Utilities Costs For The Ppp Bench Accounting

Exceptional Clean Tips Are Readily Available On Our Site Look At This And You Wi Filing Cabinet Organization Cabinet Organization Office Organization At Work

Exceptional Clean Tips Are Readily Available On Our Site Look At This And You Wi Filing Cabinet Organization Cabinet Organization Office Organization At Work

Usa California Pg E Electricity Utility Bill Template In Word Format Bill Template Utility Bill Electricity

Usa California Pg E Electricity Utility Bill Template In Word Format Bill Template Utility Bill Electricity