Does An Ltd Company Get A 1099

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. The information in this article is intended to be a general overview and not to be used as detailed instructions for completing this form.

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

For contractors that operate and file taxes as corporations such as a C-corp.

Does an ltd company get a 1099. The IRS regulations for Form 1099-MISC are complex and every business situation is unique. Get help from a tax professional or use tax preparation software to prepare this form. See the Form 1099-MISC instructions for further information.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S. Internal Revenue Service IRS requires businesses to issue a Miscellaneous Income Form 1099-MISC return to the people and companiesincluding limited liability companies LLCsthey pay if the arrangement between the business and the service provider meets certain requirements Instructions for 1099-MISC.

An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC. Heres another way to remember. Sole proprietor Do send 1099.

If a sole proprietor has a dba name and the payments are made out to the dba company do we use the company EIN number or the name of the sole proprietor on line 1. Sole proprietor Do send 1099-MISC. Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient.

For tax purposes theyre treated as corporations so in general they dont get a 1099. Or Ltd are also exempt from 1099 requirements with the exception of those you pay for medical or health care or law firms that youve hired for legal services Those corporations that have filed a S-Corp election with the IRS. The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee.

The IRS mandates that all companies send 1099s to their independent contractors and. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. There are a few narrow exceptions to the rule including medical and health care payments made to a corporation attorneys fees and fish purchased for cash.

In general Form 1099-Misc must be issued to any business or person to whom your LLC made payments totaling 600 or more for rents services prizes or awards or other payments of income. An LLC will not receive a 1099 if taxed as an s-corporation. Payments for which a Form 1099-MISC is not required include all of the following.

But not an LLC thats treated as an S-Corporation or C-Corporation. In most circumstances 1099-MISC are filed only when a company pays an individual or a partnership. Heres another way to remember.

But not an LLC thats treated as an S-Corporation or C-Corporation. Business structures besides corporations general partnerships limited partnerships limited liability companies and sole proprietorships require Form 1099. The exception to this rule is with paying attorneys.

If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. The funny part about this is that if you are the one issuing a Form 1099-MISC you will have no way to tell if the vendor you are issuing to is an s-corporation since the business name will only include LLC in the title. You do need to send 1099s to single-member limited liability company or LLCs or a one-person Ltd.

If you did business with a corporation you typically do not need to send them a Form 1099 MISC even if you did do over 600 in business with them. Does a Limited Liability Disregarded Entity Get a 1099. Those whos names contain Corporation Company Incorporated Limited Corp Co Inc.

Companies usually arent required to issue 1099s to corporate entities such as PLLCs that provide professional services to them just as theyre not required to file 1099-MISC forms for corporations. In this case a manager or member of a company can file a 1099 for that person since for tax purposes the LLC is treated as a person. Corporations are exempt recipients but a 1099-MISC may be required under certain circumstances.

As a general rule a business must issue a Form 1099 As a general rule a business must issue a Form 1099-MISC to each individual partnership Limited Liability Company Limited Partnership or Estate to which you have paid at least 600 in rents or fees for services including parts and materials prizes and awards or other income payments. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. In addition the form must be issued to anyone to whom the LLC made royalty payments of 10 or more.

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Do I Need A 1099 For An Llc Llc Limited Liability Company Irs Forms

Do I Need A 1099 For An Llc Llc Limited Liability Company Irs Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

1099 Form 2016 Download Instructions For Form 1099 H 2016 Printable Pdf Form Irs Forms Tax Credits

1099 Form 2016 Download Instructions For Form 1099 H 2016 Printable Pdf Form Irs Forms Tax Credits

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Fill Ss4 Form Online Make Tax Return Process More Simpler Financial Information Online Application Limited Liability Company

Fill Ss4 Form Online Make Tax Return Process More Simpler Financial Information Online Application Limited Liability Company

Irs 1099 Form Download Filling Your Taxes Know More About Irs Form 1099 Irs Forms Irs Irs Tax Forms

Irs 1099 Form Download Filling Your Taxes Know More About Irs Form 1099 Irs Forms Irs Irs Tax Forms

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Your Most Common Home Security Questions Answered Accounting Accounting Services Filing Taxes

Your Most Common Home Security Questions Answered Accounting Accounting Services Filing Taxes

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

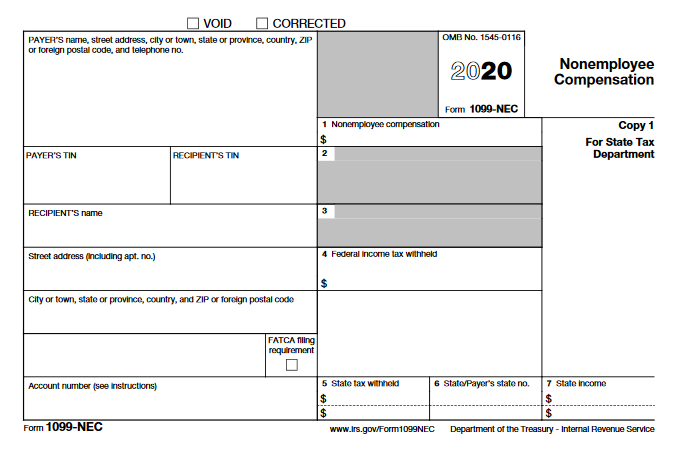

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Form 2016 Download Instructions For Form 1099 Ltc 2016 Printable Pdf Form Job Application Form Fillable Forms

1099 Form 2016 Download Instructions For Form 1099 Ltc 2016 Printable Pdf Form Job Application Form Fillable Forms

Irs Form 1099 R Box 7 Distribution Codes Ascensus