Does A Sole Proprietor Need A Business License In Ohio

If you are a freelance writer for example you are a sole proprietor. That means they dont register their businesses with a state.

Incorporate In Ohio Do Business The Right Way

But like all businesses you need to obtain the necessary licenses and permits.

Does a sole proprietor need a business license in ohio. However the process is more complicated if you want to hire employees or sell goods or services to the public. Ohio provides a comprehensive website of every profession and occupation that requires a license by any sole proprietorship. A sole proprietorship is the easiest business to form in Ohio.

To learn more about legal structure variations and registration see Start a Business. When transitioning your sole proprietorship to an LLC you will need to re-apply for any licenses and permits you used with your old business structure. Use the Licensing Permits tool to find a listing of federal state and local permits licenses and registrations youll need to run a business.

Contact your county and local government to determine if any special requirements exist for your type of business. See below for additional businessprofessional licensing and. Your business may need to obtain business licenses or professional licenses depending on its business activities.

For legal and tax purposes sole proprietorships are the only business type that isnt separate from the owner. You dont even need to register with the Secretary of State. However many cities require a business license to operate.

Where in the Ohio Revised Code ORC does it say I have to register as a sole proprietor. Ohio does not require a general business license by a sole proprietor but depending on the nature of the business activity you may need to acquire a business license to work in a compliant manner. A sole proprietorship is a separate type of business entity with separate legal characteristics.

A sole proprietor must withhold and pay employment taxes for his employees. In addition local regulations including licenses. For a sole proprietor the legal name of the business is your personal full legal name.

On the same form you may register your business name as a trade name which provides protection against other businesses using the name in Ohio. The documentation you will need depends on your industry and the rules in your county and state. Do Sole Proprietors Need A Business License In addition to getting licenses a sole owner must pay taxes on Income A sole owner needs to report all business income or losses on his or her individual income tax return -- IRS Form 1040 with Schedule C attached.

A business with a vendors license is required to file a final sales tax return. The vendors license can be closed while filing the final return through the Ohio Business Gateway by selecting cancel my account or through the Tele-File system. If you will be operating your sole proprietorship under a name that is different from your own name then you will need to file Form 534 with the Ohio Secretary of State.

While not a business license its common for Sole Proprietorships and Partnerships operating under a company name that is different from the full name of the owners to register for a Trade Name also known as a Doing Business As DBA. Instead you can just begin working under your name and use your Social Security Number as your tax ID. Sole proprietors are one-person owners of unregistered businesses.

The Ohio Business Gateway BusinessOhiogov Licenses and Permits page provides a list of professional licenses and business permits necessary to do business in Ohio. A sole proprietor is someone who owns an unincorporated business by himself or herself. However an individual may create and own an LLC or corporation.

Which state-level license your business will be needing depends upon the services or. This return would be filed for the period in which the final sale was made. Warning No content found for.

Ohio law does not require that a sole. Business Licenses The state of Ohio doesnt have a general business license. Ohio Vendors License Businesses selling products and certain services will need to register for an Ohio Vendors License and submit sales tax with the Ohio Department of Taxation.

However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. Any entity planning to transact business in Ohio using a name other than their personal name must register with the Secretary of State. A business can obtain this information by going to Ohios Business Gateway Licenses and Permits.

Businesses are required to register with the Ohio Secretary of State to legally conduct business in the state this is commonly called a business license. The owner is liable for all the debts of the business and can be sued in connection with its actions. Obtain the proper licenses and permits.

Regulations vary by industry state and locality. The filing fee is 50. A DBA doing business as name can also be used by a sole proprietor but it must be registered with the Secretary of State to ensure that the name is not currently in use by any other.

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file.

Register Your Business Name Department Of Taxation

Register Your Business Name Department Of Taxation

7 Steps To Starting A Small Business In Ohio Growth Capital

7 Steps To Starting A Small Business In Ohio Growth Capital

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

Register Your Business Name Department Of Taxation

Register Your Business Name Department Of Taxation

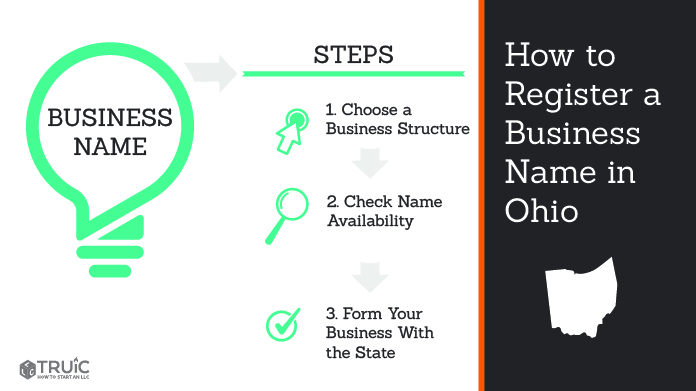

How To Register A Business Name In Ohio How To Start An Llc

How To Register A Business Name In Ohio How To Start An Llc

Nbfc Registration Process How To Apply Registration Financial Institutions

Nbfc Registration Process How To Apply Registration Financial Institutions

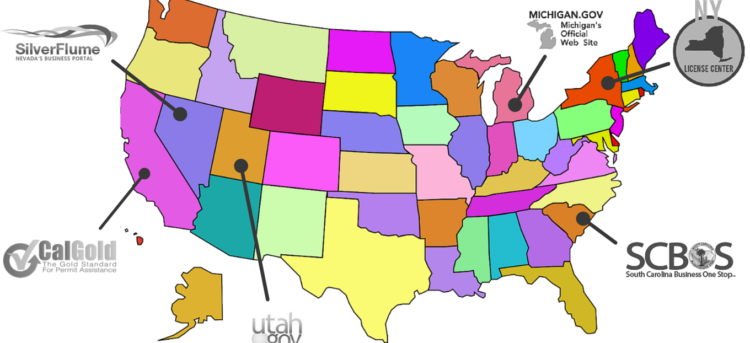

Business License Requirements By State Nav

Business License Requirements By State Nav

Fresh Purchase Agreement Real Estate Template Free Best Of Template With Regard To Home Purchase Agre Real Estate Contract Purchase Agreement Contract Template

Fresh Purchase Agreement Real Estate Template Free Best Of Template With Regard To Home Purchase Agre Real Estate Contract Purchase Agreement Contract Template

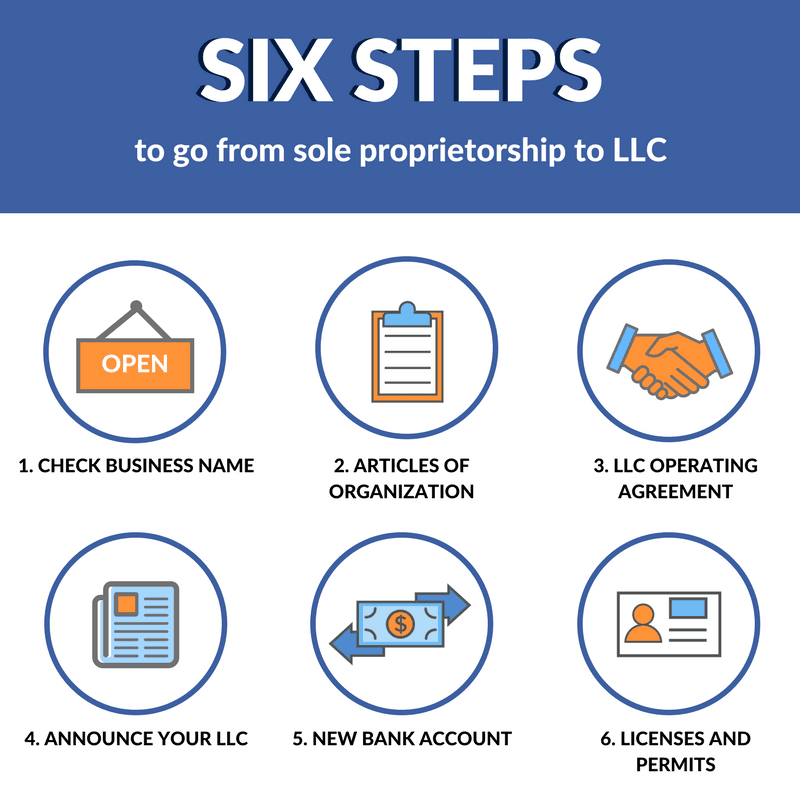

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

How To Become A Real Estate Agent Beginner S Guide Thestreet Real Estate Management Estate Management Real Estate Education

How To Become A Real Estate Agent Beginner S Guide Thestreet Real Estate Management Estate Management Real Estate Education

Business Licenses And Permits Obtain Licenses And Permits For Your Business Legalzoom

Business Licenses And Permits Obtain Licenses And Permits For Your Business Legalzoom

Step By Step Guide To Become A Real Estate Broker Real Estate Broker Real Estate Exam How To Become

Step By Step Guide To Become A Real Estate Broker Real Estate Broker Real Estate Exam How To Become

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Operating Agreement Template For Corporation Gallery

Operating Agreement Template For Corporation Gallery

How To Set Up A Sole Proprietorship In Ohio 14 Steps

How To Set Up A Sole Proprietorship In Ohio 14 Steps

New York Real Estate Broker Exam High Score Kit By Michael Lustig 39 99 Publisher Real Estate Licens Real Estate Exam Real Estate Sales Real Estate License

New York Real Estate Broker Exam High Score Kit By Michael Lustig 39 99 Publisher Real Estate Licens Real Estate Exam Real Estate Sales Real Estate License

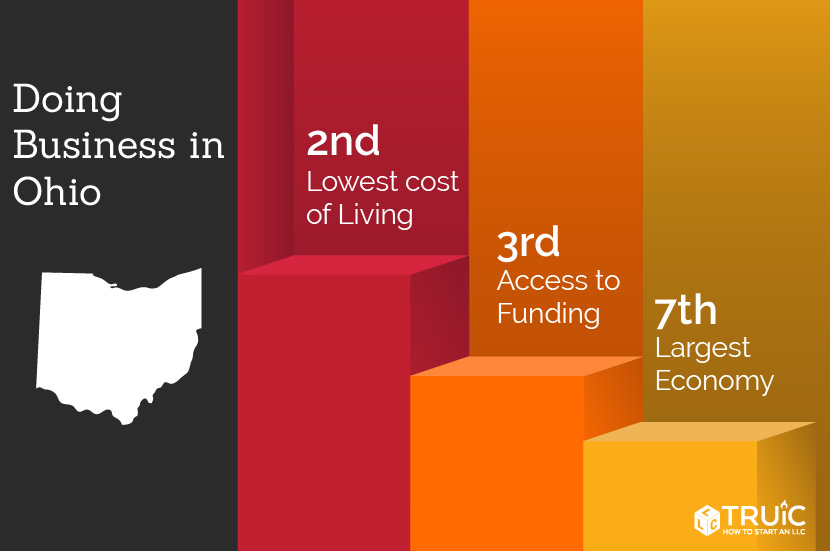

How To Start A Business In Ohio A Truic Small Business Guide

How To Start A Business In Ohio A Truic Small Business Guide

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Sole Proprietorship Business Names Radial Arm Saw

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Sole Proprietorship Business Names Radial Arm Saw