Business Bounce Back Loan Bank Of Ireland

You must request the top-up by 31 March 2021. British Business Bank plc is a development bank wholly owned by HM Government.

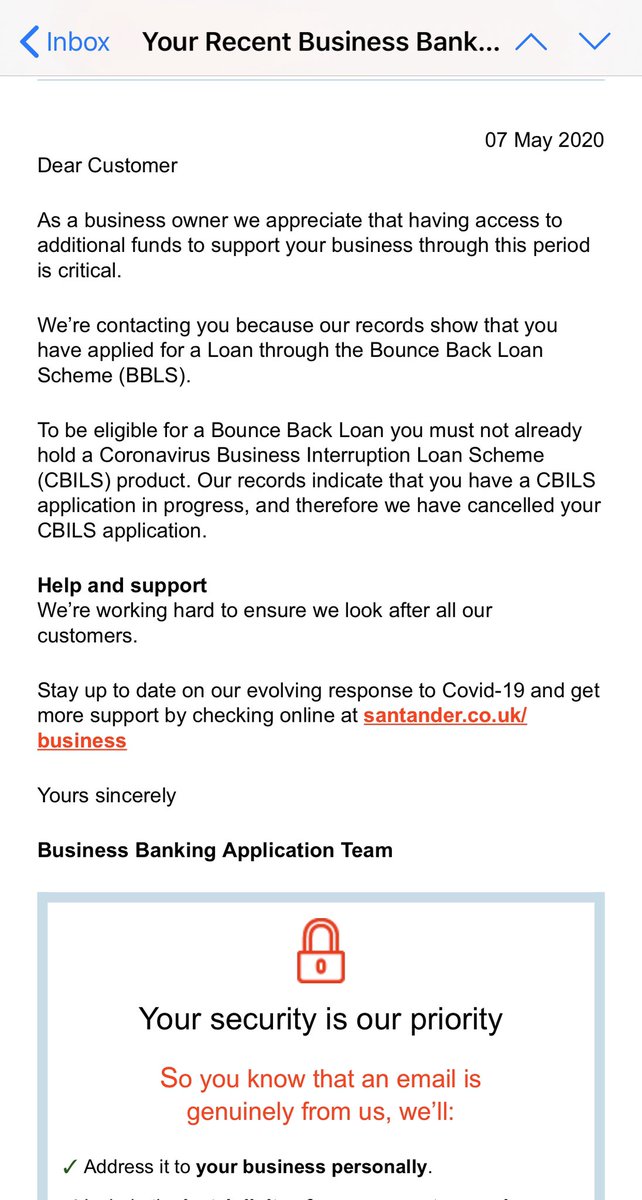

Santander Uk Help On Twitter Hello Chris Thanks For Getting In Touch The Email Has Notified You That We Have Picked Up That You Had Applied For Both Loans We Have Cancelled

Santander Uk Help On Twitter Hello Chris Thanks For Getting In Touch The Email Has Notified You That We Have Picked Up That You Had Applied For Both Loans We Have Cancelled

A lender could provide a six-year term loan from 2000 up to 25 of a business turnover.

Business bounce back loan bank of ireland. For loan proposals greater than 500000 the Bank will assess each transaction on its own merits such assessment to include the availability of existing and or additional security which may result in. Coronavirus Business Interruption Loan Scheme CBILS. The scheme is part of a series of government measures for UK businesses.

Business loans up to 120000 are. Managed by the British Business Bank on behalf of and with the financial backing of the Secretary of State for Business Energy Industrial Strategy. This scheme enables smaller businesses to access finance more quickly during the coronavirus outbreak.

How to apply for a SBCI Covid-19 Working Capital Loan with Bank of Ireland. If you already have a Bounce Back Loan but borrowed less than you were entitled to you can top up your existing loan to your maximum amount. The Bounce Back Loan scheme helps small and medium-sized businesses to borrow from 2000 up to 25 per cent of their turnover.

The government will cover interest payable in the first year. You can use our online application form which only takes a couple of minutes to complete. The borrower always remained fully liable for the debt.

The Bounce Back Loan Scheme enables businesses to obtain a six-year term loan at a government set interest rate of 25 a year. Prioritisation of funding requests as an accredited lender for the British Business Bank managed Bounce Back Loan Coronavirus Business Interruption Loan and Coronavirus Large Business Interruption Loan Scheme. Managed by the British Business Bank on behalf of and with the financial backing of the Secretary of State for Business Energy Industrial Strategy.

Before you apply to Bank of Ireland for a loan under the SBCI Covid-19 Working Capital Loan Scheme you will need to confirm your scheme eligibility with the SBCI. The Bounce Back Loan Scheme provides small and medium businesses SMEs micro businesses and other businesses with financial assistance in the form of smaller loans. The Bounce Back Loan Scheme BBLS offers loans of up to 50000 to businesses 100 per cent backed by the UK Government interest and payment free.

One of the accredited lenders that I did not receive much feedback on during the timeline of the Bounce Back Loan scheme was Bank of Ireland. The Bounce Back Loans Scheme enables businesses to obtain a six-year term loan at a government set interest rate of 25 a year. The repayments on a Graduate loan of 5000 over 5 years with 60 monthly instalments are 9420 per month at 495 variable Annual Percentage Rate.

The maximum loan available is 50000. The interest rate that the Bank will apply to all loans up to 500000 is 4. Bounce Back Loan Scheme is delivered by the British Business Bank through Bank of Ireland UK as an accredited lender.

Well get back to you within 24 hours. CBILS is delivered by the British Business Bank through Bank of Ireland UK as an accredited lender. Bounce Back Loan Scheme is delivered by the British Business Bank through Bank of Ireland UK as an accredited lender.

The government will cover interest payable in the first year. Information on eligibility criteria and how to apply can be found on the British Business Bank website. The Bounce Back Loan scheme closed for applications on 31 March 2021.

Managed by the British Business Bank on behalf of and with the financial backing of the Secretary of State for Business Energy Industrial Strategy. You may however have had a good or bad experience with that lender when you went about applying for a Bounce Back Loan with them and if so feel free to let everyone know how it went when you applied below. These impacts are leading to a number of financial needs for our business and agri customers including the provision of emergency working capital prioritising loan decisions for impacted customers payment flexibility on loan facilities and the provision of.

The scheme gave the lender a full 100 government-backed guarantee against the outstanding balance of the facility both capital and interest. British Business Bank plc is a development bank wholly owned by HM Government. Supports for businesses affected by COVID-19 The impact of COVID-19 is being felt across different business sectors.

The maximum loan amount was 50000. British Business Bank plc is a development bank wholly owned by HM Government. Customers are required to submit a standard business loan application to the Bank and a business plan.

APR stands for Annual Percentage Rate. Its never been easier to apply for a Bank of Ireland small business loan.

Bounce Back Loan Rejected Heres What To Do Next Updated

Bounce Back Loan Rejected Heres What To Do Next Updated

Bounce Back Loan Support Bouncebackloan Twitter

Bounce Back Loan Support Bouncebackloan Twitter

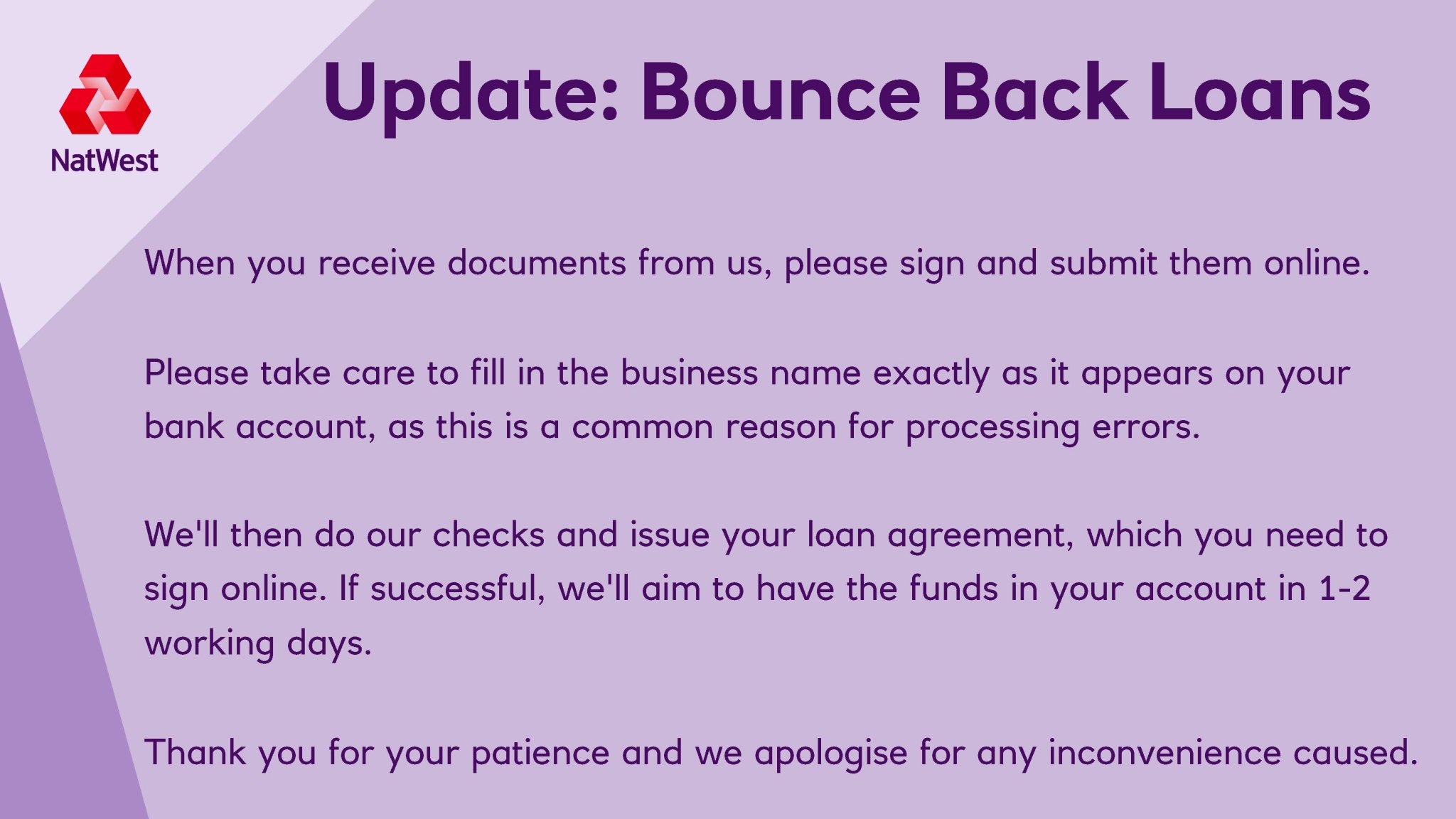

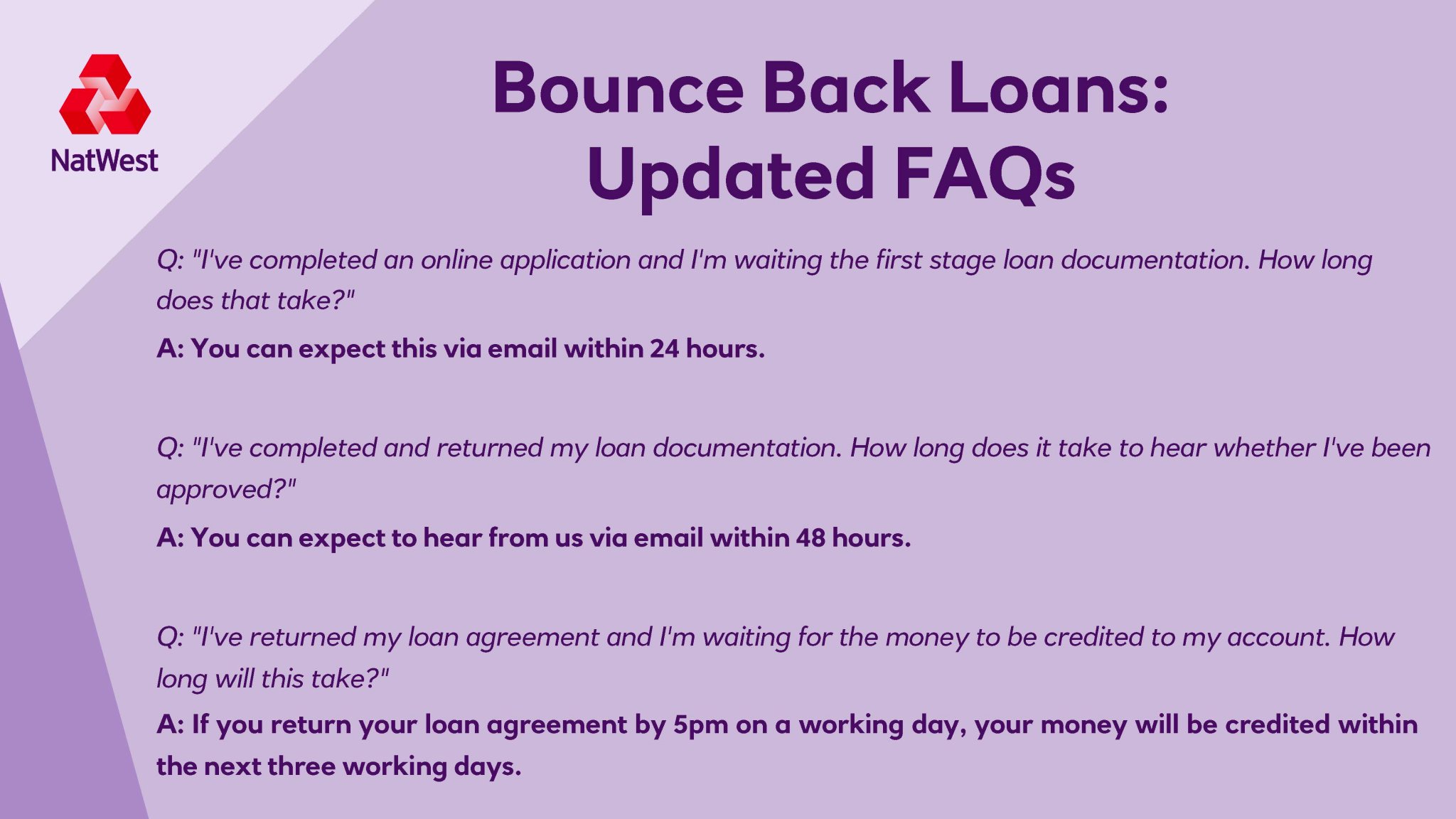

August 15th Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

August 15th Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

Bounce Back Loan All You Need To Know Abundance Aware

Bounce Back Loan All You Need To Know Abundance Aware

Barclays Uk Help On Twitter If You Re Thinking Of Applying For A Bounce Back Loan We Need Your Help Please Make Sure Your Account Information Is Up To Date Before You

Barclays Uk Help On Twitter If You Re Thinking Of Applying For A Bounce Back Loan We Need Your Help Please Make Sure Your Account Information Is Up To Date Before You

Hsbc Uk Business On Twitter Bounce Back Loan Update As At 18 May We Have Approved Over 80 000 Bb Loans Worth Over 2 7bn We Are Working Hard To Process Bbl Applications As

Hsbc Uk Business On Twitter Bounce Back Loan Update As At 18 May We Have Approved Over 80 000 Bb Loans Worth Over 2 7bn We Are Working Hard To Process Bbl Applications As

Uk Government Bounce Back Loans Apply Today Youtube

Uk Government Bounce Back Loans Apply Today Youtube

Police Told Not To Focus On Covid 19 Bounce Back Loans Fraud Business The Sunday Times

Police Told Not To Focus On Covid 19 Bounce Back Loans Fraud Business The Sunday Times

How To Apply For A Coronavirus Business Bounce Back Loan Scheme Loan Update Which Banks Process Youtube

How To Apply For A Coronavirus Business Bounce Back Loan Scheme Loan Update Which Banks Process Youtube

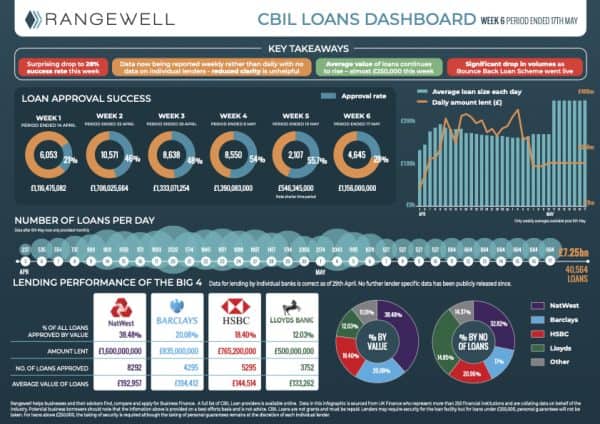

Cbils And Bounce Back Loan Data Dashboard Launched By Rangewell

Cbils And Bounce Back Loan Data Dashboard Launched By Rangewell

Bounce Back Loan All You Need To Know Abundance Aware

Bounce Back Loan All You Need To Know Abundance Aware

Bounce Back Loan Extended How To Apply For The Business Pay As You Grow Scheme After Government Announces Extension

Bounce Back Loan Extended How To Apply For The Business Pay As You Grow Scheme After Government Announces Extension

Bounce Back Loan Scheme Bbls What You Need To Know Coastal Tax

Bounce Back Loan Scheme Bbls What You Need To Know Coastal Tax

Bounce Back Loans Helped Companies Not Just Survive But Expand

Derry City Strabane Bounce Back Loans

Derry City Strabane Bounce Back Loans

Bounce Back Loan Fraud Fraud And Identity In Focus

Bounce Back Loan Fraud Fraud And Identity In Focus

Lenders And Mps Call For Clarity As Bounce Back Loans Deadline Approaches Again Altfi

Lenders And Mps Call For Clarity As Bounce Back Loans Deadline Approaches Again Altfi