How To Access 1099 Form Online

You can elect to be removed from the next years mailing by signing up for email notification. To download the user-guide click here.

Hours of operation are 7 am.

How to access 1099 form online. You may owe Uncle Sam if you didnt withhold taxes. Access your 1099-G by logging in to your account on your unemployment benefits portal. From there you will be able to download the 1099 Misc Reporting Form.

To access this form please follow these instructions. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document.

If you do not have an online account with NYSDOL you may call. 1099Gs are available to view and print online through our Individual Online Services. 1099-NEC Snap and Autofill.

For more information about disputing your 1099-G you can download the user-guide here. 1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. You can receive a copy of your 1099-G Form multiple ways.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. If you qualify to get a 1099 Income Reporting Form the easiest way to receive your document is to download it directly from your organization website. A replacement SSA-1099 or SSA-1042S is available for the previous tax year after February 1.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. I specifically need box 5. To view the video tutorial on how to access your 1099-G click here.

Download Form 4852 Substitute for Form W-2 Wage and tax Statement or Form 1099-R Distribution from Pensions Annuities Retirement or Profit-sharing Plans IRAs Obtain phone assistance through 800-829-1040. Available in mobile app only. To 7 pm Monday-Friday your local time - except Alaska and Hawaii which are Pacific time.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or. If you dont have access to a printer you can save the document on your computer or laptop or even email it.

The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. These forms are available online from the NC DES or in the mail. If you already have a my Social Security account you can log in to your online account to view and print your SSA-1099 or SSA-1042S.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. Hello my question is about my ssa 1099 form for my tax return im about to file and i need access to my 2020 statements for the person who does my taxes. To view and print your current or previous year 1099-G tax forms online logon to the online benefits services website.

Myunemploymentwisconsingov Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. To view and print your statement login below. Look for the 1099-G form youll be getting online or in the mail.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement. To download your Online 1099 Misc Form log into the organization site and click on the Tax Information.

Sign in to your online account Go to OPM Retirement Services Online Click 1099-R Tax Form in the menu to view your most recent tax form Select a year from the dropdown menu to. Get a copy of your Social Security 1099 SSA-1099 tax form online. You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

We do not mail these forms. How to Get Your 1099-G online.

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

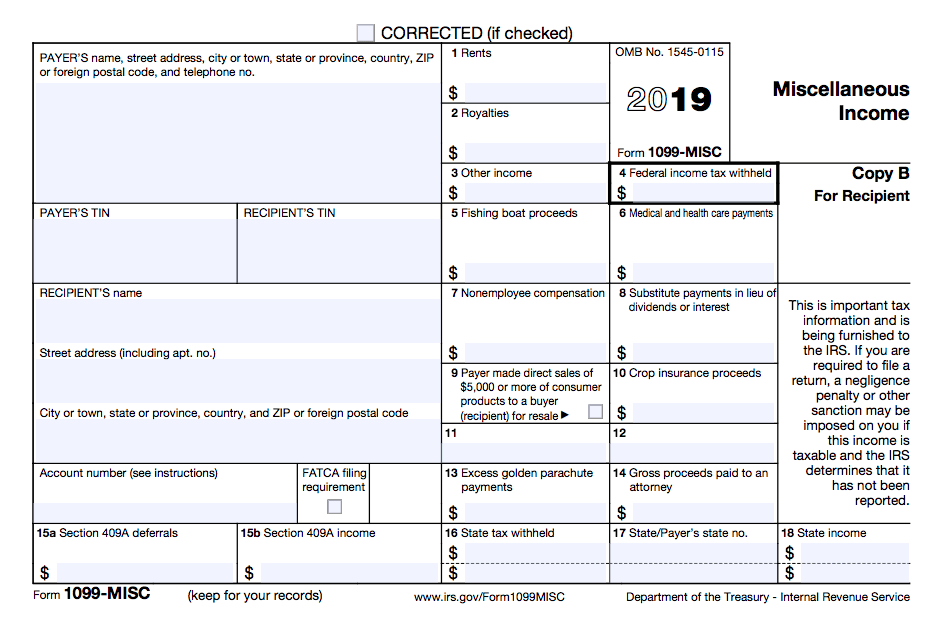

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Understanding Your Instacart 1099

Understanding Your Instacart 1099

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager