How To File A 1099s On Turbotax

Open or continue your return. A 1099-R form records distributions you received during the year from certain retirement accounts including 401 k 403 b and IRA accounts.

In Case You Missed It Today Is Tax Day For The Us That Means You Need To Get Your Taxes Submitted Stamped Or An Extension Filed By Midnight Tonight Not To Wor

In Case You Missed It Today Is Tax Day For The Us That Means You Need To Get Your Taxes Submitted Stamped Or An Extension Filed By Midnight Tonight Not To Wor

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022.

How to file a 1099s on turbotax. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. Follow the screens to enter the info from your 1099-S. I work for Turbo Tax.

Here is how you can import your tax document to your TurboTax. When you are completing your tax return and it is time to enter 1099 information you can use the TurboTax import feature. It is not necessary that all parties to the transaction or that more than one party enter into the agreement.

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. If you have questions upgrade to Live and you can talk to a CPA live for free. If you land on the Your 1099-R Entries screen instead select.

Under your W2s youll see the option to add 1099s. How do I enter a 1099-K in TurboTax Online. Select Tax Home from the left-side menu you might already be there Scroll down and select Your account.

Terms and conditions may vary and are subject to change without notice. Terms and conditions may vary and are subject to change without notice. After starting a new return from the File menu please select Import then choose From Financial Institution.

If youre entering info about your business for the first time youll be asked some general questions about. After signing in to TurboTax open or continue your return. Inside TurboTax search for 1099-R and select the Jump to link in the search results.

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. Terms and conditions may vary and are subject to change without notice. Answer Yes on the Did you get a 1099-R.

Open continue return if you dont already have it open. Select Create W-2s and 1099s. On Stocks Mutual Funds Bonds Other click the start or update button.

Harris 2021 February 11 How do I file a 1099 G on Turbotax. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. Be sure to enter all the information on your 1099-R into TurboTax.

Terms and conditions may vary and are subject to change without notice. 0000 - How do I file a 1099 G on Turbotax0037 - Can I file my 1099 G next yearLaura S. Select the Jump to link in the search results.

You can enter into a written agreement at or before closing to designate who must file Form 1099-S for the transaction. Heres how to enter your 1099-R in TurboTax. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022.

Enter that information under your Federal Wages and Income tab. Open or continue your return. Heres how to enter the form.

Click on Federal Taxes Personal using Home and Business Click on Wages and Income Personal Income using Home and Business Click on Ill choose what I work on if shown Under Investment Income. Income listed on a 1099-R form can be taxable or tax-free and if you have withdrawn money before retirement age may be subject to early distribution penalties. The agreement will identify the person responsible for filing if such designated person signs the agreement.

Terms and conditions may vary and are subject to change without notice. How to Put in a 1099-R on TurboTax. Terms and conditions may vary and are subject to change without notice.

Search for Schedule C and select the Jump to link in the search results. Type sale of home in the Search box.

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 R User Interface Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Data Is Irs Forms Irs Tax Forms

1099 R User Interface Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Data Is Irs Forms Irs Tax Forms

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

1099 Form 2016 File Form 1099 R 2015 Wikimedia Mons Tax Forms Templates Common Myths

1099 Form 2016 File Form 1099 R 2015 Wikimedia Mons Tax Forms Templates Common Myths

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

How To File A 1099 Misc Online 2021 Qasolved

How To File A 1099 Misc Online 2021 Qasolved

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

2015 W2 Fillable Form Fillable Form Ia W 4 Employee Withholding Allowance Fillable Forms 1099 Tax Form Power Of Attorney Form

2015 W2 Fillable Form Fillable Form Ia W 4 Employee Withholding Allowance Fillable Forms 1099 Tax Form Power Of Attorney Form

Da Form 3161 Fillable Da Form 3161 Example Hunt Hankk Cover Sheet Template Form Job Application Form

Da Form 3161 Fillable Da Form 3161 Example Hunt Hankk Cover Sheet Template Form Job Application Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 Irs W9 Form Top 22 W 9 Form Templates Free To In Pdf Format Fillable Forms Job Application Template Business Letter Template

2015 Irs W9 Form Top 22 W 9 Form Templates Free To In Pdf Format Fillable Forms Job Application Template Business Letter Template

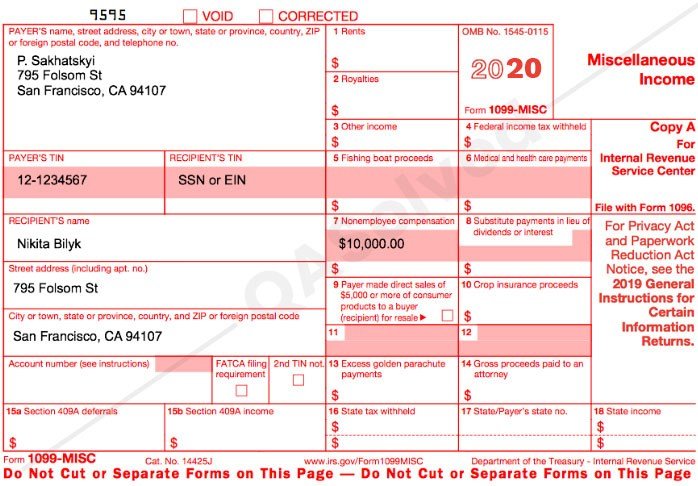

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Without Legal Justification Wh Says Irs Will Pay Tax Refunds Even If Shutdown Continues Tax Questions Filing Taxes Free Tax Filing

Without Legal Justification Wh Says Irs Will Pay Tax Refunds Even If Shutdown Continues Tax Questions Filing Taxes Free Tax Filing

W5 Form Look Up 5 Outrageous Ideas For Your W5 Form Look Up W2 Forms Tax Forms Power Of Attorney Form

W5 Form Look Up 5 Outrageous Ideas For Your W5 Form Look Up W2 Forms Tax Forms Power Of Attorney Form