Pennsylvania 1099-r Reporting Requirements

1 We will no longer be filing via paper when using the 9 digit FEIN to the state of PA. You must submit all the 1099 forms you file with the IRS to.

1099 Deadlines Penalties State Filing Requirements 2020 2021

1099 Deadlines Penalties State Filing Requirements 2020 2021

Report Pennsylvania-taxable compensation and any Pennsylvania tax withheld from that income.

Pennsylvania 1099-r reporting requirements. The fields below are required for employers outside of Pennsylvania that do not have a PA Employer Account ID. If you are a payer operating a business in Pennsylvania or have paid Pennsylvania residents for their services you must file 1099 with the State. You can still use the 9 digit FEIN and we will e-file to the state of PA.

Pennsylvania does tax early distributions in certain situations. Report such payments on Form W-2 Wage and Tax Statement. Public School Employees Retirement System.

Detailed Explanation To assist you PSERS will include an explanation of the information appearing in. Employer Login ESS. The screen says Pennsylvania needs us to get really specific about the kind of retirement income youre receiving from name where name is the name you gave your 1099-R on the federal return.

Answered by COKALA Tax Information Reporting Solutions LLC a 3rd party independent advisory services firm offering experienced and practical help for tax regulatory compliance for Forms W-9 W-8 W-2 1099 1098 5498 945 1042 1042-S and state reporting. As part of the 2017-2018 budget process Pennsylvania expanded the 1099 reporting requirement to include withholding on payments made to non-resident individuals and disregarded entities that have non-resident members. Actually youll get one of these for each 1099-R you enter on the federal.

There is no special reporting for qualified charitable. If the code was a 1 or 2 this would indicate an early distribution. Generally do not report payments subject to withholding of social security and Medicare taxes on this form.

You may be required to submit Pennsylvania state reconciliation form REV-1667 R. The entity issuing the 1099 forms must have a PA employer withholding account to be able to file the forms electronically through e-TIDES. Are required to file Form 1099-R for Pennsylvania personal income tax purposes.

Beginning January 1 2018 anyone that makes the following payments is required to withhold from such payments an amount equal to the tax rate specified per 72 PS. You must report on Form 1099-R corrective distributions of excess deferrals excess contributions and excess aggregate contributions under section 401a plans section 401k cash or deferred arrangements section 403a annuity plans section 403b salary reduction agreements and salary reduction simplified employee pensions SARSEPs under section 408k6. 7302 currently 307.

Not required for employers who have a PA Employer Account ID. Payers of distributions from profit sharing retirement arrangements insurance contracts etc. Reportable disability payments made from a retirement plan must be reported on Form 1099-R.

The new policy will replace the old requirement of reporting a separate form for each distribution code. Box 2a Taxable Amount is for the value of the portion of the distributions Box 1 that is subject to income tax. Tax1099 offers this form for 499 through the platform.

If it coded 1 or 2 it may be taxable to the extent that the distributions exceed your basis in your retirement plan. How is 1099R Income to be reported on PA State Returns. You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan.

In 2012 Pennsylvania adopted 1099 reporting requirements for payers of certain non-employee compensation. Box 1 Gross Distribution is for the gross value of the distributions the taxpayer received during the previous tax year. Waste and Abuse Reporting.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. The federal tax filing deadline for individuals has been extended to. The code entered in box 7 of the 1099-R will determine the taxability on the PA return.

It also expanded the requirements with respect to when a copy of Federal Form 1099-MISC is required to be filed with the Pennsylvania Department of Revenue. If coded 1D or 7D it is a commercial annuity and is taxable same as federal. Do not report negative figures minimum value 000 maximum value 99999999999.

The second line identifies which 1099-R this screen is referring to. Include Pennsylvania-taxable amounts from federal Form 1099 that show pensions retirement plan distributions executor fees jury duty pay and other miscellaneous compensa. Reported on Form 1099-R.

Generally if box 7 of your 1099R is coded 7 or 4 it is not taxable for PA income tax purposes. Institutions must file a form 1099-R for each person or entity who received a distribution of 10 or more from programs such as profit-sharing or retirement plans IRAs annuities pensions insurance contracts and survivor income benefit plans. 1099-R Box 14 Numeric only including 2 decimal places.

An Official Pennsylvania Government Website. Would you be able to tell us if 1099-INT and 1099-R are reportable to the state of Pennsylvania. For tax years beginning on or after January 1 2005 any amounts reported in gross income for Federal Income Tax purposes for a retirement annuity that is not an employer sponsored retirement annuity reported as Codes 1D 2D 3D 4D or 7D in Box 7 beginning with 2013 Forms 1099-R are reported as interest income on PA Schedule A regardless of whether the annuity payments.

You will want to verify the code in box 7 of your paper 1099-R matches that which was entered into the program.

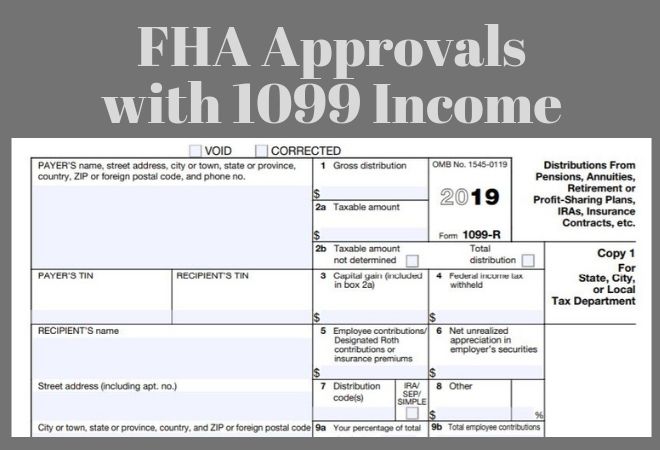

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

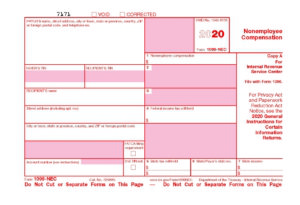

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To Read Your 1099 R Colorado Pera

How To Read Your 1099 R Colorado Pera

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Https Www Irs Gov Pub Irs Prior I1099gi 2011 Pdf

Https Www Irs Gov Pub Irs Prior P1220 2000 Pdf

Will The Irs Know If I Don T File A 1099

Will The Irs Know If I Don T File A 1099

Https Www Revenue Pa Gov Generaltaxinformation Tax 20types 20and 20information Employerwithholding Documents W2 1099 Csv Reporting Inst And Specs Pdf

New Form 1099 Reporting Requirements For 2020 Atkg Llp

New Form 1099 Reporting Requirements For 2020 Atkg Llp

Determining Taxation Of Disability Benefits

Determining Taxation Of Disability Benefits

Will The Irs Know If I Don T File A 1099

Will The Irs Know If I Don T File A 1099

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png) Form 1099 A Acquisition Or Abandonment Of Secured Property Definition

Form 1099 A Acquisition Or Abandonment Of Secured Property Definition