Qualified Business Income Deduction Summary Form

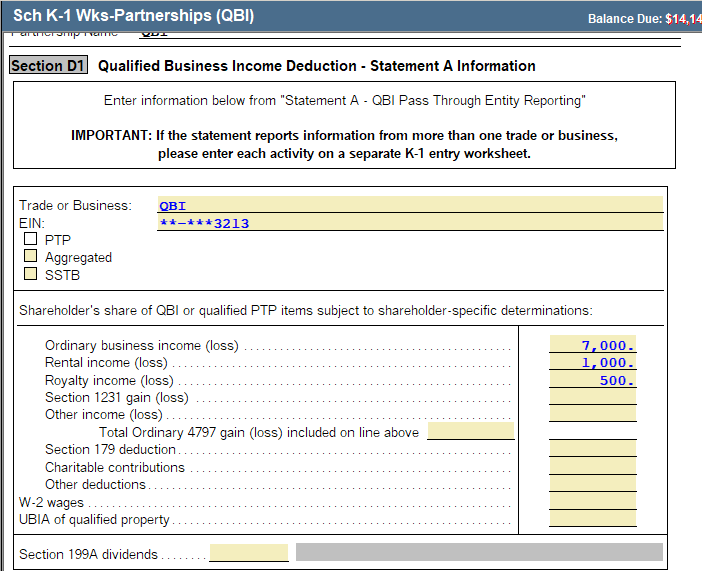

And Your 2020 taxable income before your QBI deduction is more than 163300 if. If you are reporting income from a partnership K-1 schedule form 1065 then you would need an entry in box 20 with code A AA AB AC or AD of the K-1 schedule to qualify for a QBI deduction.

TurboTax will calculate the deduction for you based upon the self-employment business income and expenses you enter.

Qualified business income deduction summary form. There are two forms being released Form 8995 and Form 8995-A. The QBI component can result from a sole proprietorship partnership S corporation trust or estate. 160700 single 321400 married filing jointly Form 8995 Qualified Business Income Deduction Simplified Computation can be.

A qualified business incomeQBI deduction allows domestic small business owners and self-employed individuals to deduct up to 20 of their QBI plus 20 of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income on their taxes or 20 of a taxpayers taxable income minus net capital gains. This tax summary will have a breakdown of your annual earnings and business-related expenses that may be deductible. An official IRS tax document that includes all on-trip gross earnings.

2018 taxable income before QBI deduction isnt more than 157500 315000 if married filing jointly. The Qualified Business Income Deduction can be generated from one of two components. The taxpayer has QBI qualified REIT dividends or qualified PTP income.

The qualified business income deduction QBI is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20. Business owners can deduct up to 20 of their qualified business income or if lower 20 of their taxable income net of any capital gain. B 20 of QBI.

Roughly 97 of your clients have taxable income under the threshold. Complete Form 8995 or Form 8995-A to claim the tax deduction The qualified business income deduction QBI deduction allows some individuals to deduct up to 20 of their business income REIT dividends or PTP income on their individual income tax returns. The taxpayer isnt a patron in a specified agricultural or horticultural cooperative.

Who Can Take the Deduction Individuals and eligible estates and trusts use Form 8995-A to figure the QBI deduction if. 2 then select Tools 3 then select View Tax Summary from the pop-up. The first component would likely be reported on Schedule C Schedule E Schedule F or a K-1.

This deduction will be reflected on line 9 of the 1040 form. For taxpayers whose taxable income before the QBI deduction is less than certain thresholds ie. The Form 1040 Instructions and Publication 535 provide worksheets to compute the deduction.

This deduction is claimed on the business owners individual return. If you want to get a better understanding of this important deduction you can review IRS FAQs as well as instructions to the tax forms Form 8995 and Form 8995-A. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom.

You have QBI qualified REIT dividends or qualified PTP income or loss. Use separate Schedules A B C andor D as appropriate to help calculate the deduction. So their deduction is equal to 20 of domestic qualified business income from a pass-through entitysubject to the overall limit based on taxable income.

This component is not limited by W-2 wages or the UBIA of qualified property. Unlike many tax items this is a deduction against taxable income not adjusted gross incomeAGI. Thus there is not a separate screen or place to enter the deduction as it is based upon the business owners total taxable income see more detail in link below.

Qualified property held by the business. Use the Form 1040 instructions if. Depending on the taxpayers taxable income the amount of PTP income that qualifies may be limited depending on the PTPs trade or business.

This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. You can peek at only the Federal form 1040 and the summary of the state info by going here. Roughly 3 of your clients are impacted by the threshold.

Available for individuals trusts or estates is 20 percent of qualified business income QBI. Generally qualified business income refers to the businesss profits. For non-SSTBs the deduction is either A or B whichever is less.

1 lower- Left side of the screenclick to the left side of the Tax Tools text selection. A 50 of the businesss W-2 wages paid or 25 of the W-2 wages paid plus 25 of the businesss unadjusted basis in all qualified property whichever one is the greater amount. The 199A deduction is available beginning with 2018 returns but will unless Congress extends it terminate Jan.

Only drivers who made more than 20000 in passengerdelivery payments and provided at least 200 ridesdeliveries will receive a 1099-K. Heres how the new qualified business income deduction works. Once incorporated TurboTax Deluxe will calculate the qualified business income deduction QBI from your K-1 entries.

About Form 8995-A Qualified Business Income Deduction About Form 8995-A Qualified Business Income Deduction Use this form to figure your qualified business income deduction.

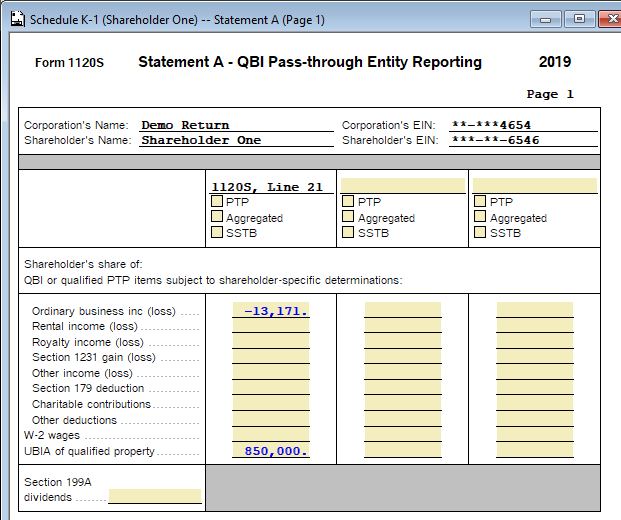

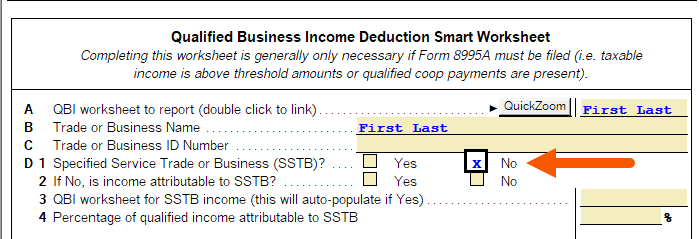

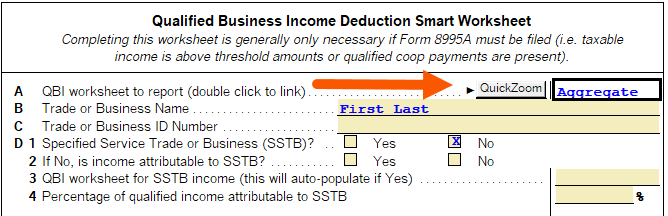

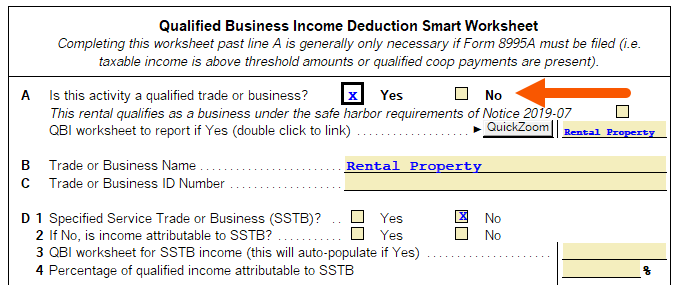

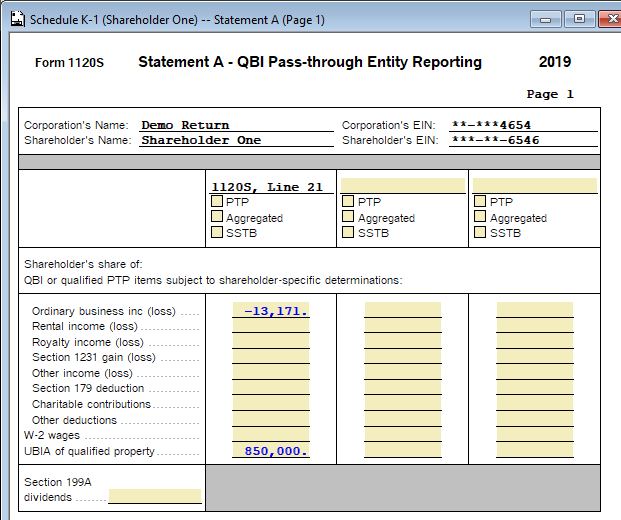

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

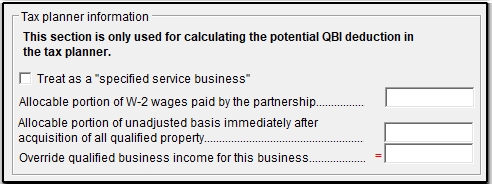

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

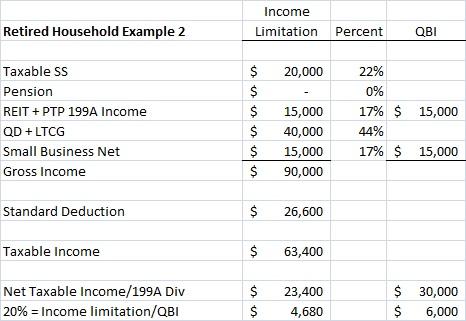

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

1040 Tax Planner Qualified Business Income Deduction Drake17 Can I Evaluate How The New Qualified Business Income Deduction Detailed In The Tax Cuts And Jobs Act Will Affect My Taxpayer S 2018 Return The Drake Tax Planner Can Be Used To

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor