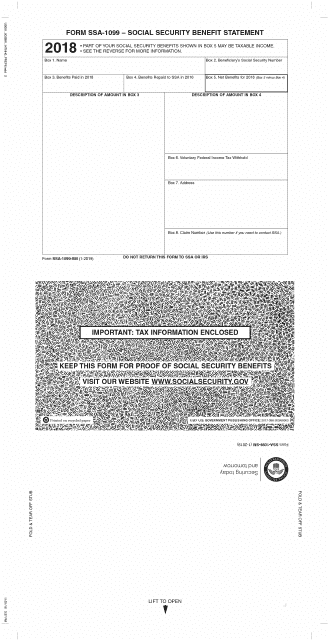

Ssa-1099 Blank Form

1099 SSA Form Fill Online By clicking the link above you can get to our page with fillable 1099 SSA Form with tips and instructions. Sign in to your account and click the link for Replacement Documents.

Sample 1099 Misc Form Filled Out Vincegray2014

Sample 1099 Misc Form Filled Out Vincegray2014

Benefits Repaid to SSA in 2016 201 6 2015_v01_Prep9_Layout 1 8315 1029 AM Page 1 LIFT TO OPEN SSA-1099-SM account FIRST-CLASS MAIL.

Ssa-1099 blank form. This form shows your total Social Security benefits for the year and any taxes withheld. Or contact your local Social Security office. A Social Security 1099 or 1042S Benefit Statement also called an SSA-1099 or SSA-1042S is a tax form that shows the total amount of benefits you received from Social Security in the previous year.

See the Appendix later for more information. What is a 1099 SSA Form Is a tax form we mail each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

To complete the filing process you will need to order blank copies of IRS Form 1099-S and IRS Form 1096. Form 1099 is a multipurpose form which is used for reporting different types of income. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

Net Benefits for 2016 SSA OR IRS Box 3 minus Box 4 Box 7. An SSA-1099 is a tax form we mail each year in January to people who receive Social Security benefits. These forms tax statements report the amounts paid and repaid and taxes withheld for a tax year.

The SSA issues Form SSA-1099 and Form SSA-1042S. An HSA or Archer MSA distribution isnt taxable if you used it. These forms need to be printed with a very specific type of paper and ink and while its possible to reproduce these documents from home its a lot easier to just order them from the IRS.

If more than one year has prior year payments use additional Lump-Sum worksheet. If you received Social Security benefits during the tax year you will receive a Form SSA-1099 from the Social Security Administration. Social security benefits include monthly retirement survivor and disability benefits.

Dont confuse the SSA-1099 with the 1099-R that reports retirement benefits from non-SSA sources like pensions 401 ks and IRAs. Many forms must be completed only by a Social Security Representative. To enter go to.

The RRB issues Form RRB-1099 and Form RRB-1042S. Tax form 1099 is issued by the IRS to the lender at the end of the year. Form SSA-1099 Lump-Sum Distributions Enter relevant year as shown on Form SSA-1099.

Form SSA-1099 is used to report any Social Security benefits that you may have collected during the year. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return. The payer isnt required to compute the taxable amount of any distribution.

Form 1099 is a form used for reporting different types of income including interest dividends pensions royalties and certain payments by a business to its employees. If you received benefits for more than one Social Security. They do not include supplemental security income SSI payments which are not taxable and do not need to be reported on your tax return.

You may receive more than one of these forms for the same tax year. Please call us at 1-800-772-1213 TTY 1-800-325-0778 Monday through Friday between 8 am. Address DO NOT RETURN THIS FORM TO Box 4.

Dropdown menu is available for prior year Filing Status. Luckily Social Security has you covered. They are used to report income and calculate taxes to be paid to the federal government of the United States.

A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits. The form you are looking for is not available online. Form SSA-1099-SM 1-2017 Box 3.

Benefits Paid in 2016 Box 5. Forms SSA-1099 SSA-1099-SM and SSA-1099-R-OP1 report retirement disability and survivor benefits from the Social Security Administration SSA. A form SSA-1099 Social Security Administration is used to report Social Security benefits issued to you during the year.

Form SSA-1099 or SSA-1099-SM shows the total amount of social security benefits you received during the tax year. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to IRS on your tax return. Ssa 1099 Form 1099 form IRS tax forms are used by taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service IRS of the United States.

The Social Security 1099 SSA-1099 or Benefit Statement is a tax form Social Security mails each year in January. If the prior year return was MFJ include social security payments received that year by BOTH taxpayer and spouse. The IRS will also receive a copy of your Form SSA-1099.

Youll be able to access your form and save a printable copy. 1099-Rs are entered elsewhere in TurboTax. File Form 8853 or Form 8889 with your Form 1040 or 1040-SR to report a distribution from these accounts even if the distribution isnt taxable.

If you did not receive your SSA-1099 or have misplaced it you can get a replacement online if you have a My Social Security account.

Ssa 1099 Form 2019 Pdf Fill Online Printable Fillable Blank Pdffiller

Ssa 1099 Form 2019 Pdf Fill Online Printable Fillable Blank Pdffiller

Sample 1099 Misc Form Filled Out Vincegray2014

Sample 1099 Misc Form Filled Out Vincegray2014

Non Ssa 1099 Form California Vincegray2014

Non Ssa 1099 Form California Vincegray2014

Get Form Ssa 1099 Online Vincegray2014

Get Form Ssa 1099 Online Vincegray2014

Get Form Ssa 1099 Online Vincegray2014

Get Form Ssa 1099 Online Vincegray2014

Understanding Your Tax Forms 2016 Ssa 1099 Social Security Benefits Taxgirl

Irs Form Ssa 1099 Sample Page 3 Line 17qq Com

Irs Form Ssa 1099 Sample Page 3 Line 17qq Com

Get Form Ssa 1099 Online Vincegray2014

Get Form Ssa 1099 Online Vincegray2014

1099 Int Blank Form Vincegray2014

1099 Int Blank Form Vincegray2014

Irs Form 1099 Misc Ssi Page 1 Line 17qq Com

Irs Form 1099 Misc Ssi Page 1 Line 17qq Com

Ssi 1099 Form 2017 Vincegray2014

Ssi 1099 Form 2017 Vincegray2014

Ssa 1099 Form 2019 Pdf Fill Online Printable Fillable Blank Pdffiller

Ssa 1099 Form 2019 Pdf Fill Online Printable Fillable Blank Pdffiller

Ssa 1099 Form Page 1 Line 17qq Com

Ssa 1099 Form Page 1 Line 17qq Com

Sample Ssa 1099 Page 1 Line 17qq Com

Sample Ssa 1099 Page 1 Line 17qq Com

Ssi 1099 Form 2017 Vincegray2014

Ssi 1099 Form 2017 Vincegray2014

Blank Ssa 1099 Page 5 Line 17qq Com

Blank Ssa 1099 Page 5 Line 17qq Com

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It