Where Do I Mail My 1099 Misc To Pa

When you paper file Form 1099-MISC you are on your own when it comes to catching mistakes. Employers use Form 1099-NEC to report payments of over 600 to independent contractors or other nonemployees.

Eviction Notice Late Rent Notice Rent

Eviction Notice Late Rent Notice Rent

If the entity issuing the 1099-MISC does not have a PA employer withholding account or the entity is issuing 9 or fewer paper Forms 1099-R1099-MISC showing zero PA withholding the forms can be mailed to.

Where do i mail my 1099 misc to pa. Were do I send copy of my 1099-r in pennsylvania If you are submitting your Pennsylvania state return by the efile process then there will be nothing you would need to mail in to the state. PO BOX 280509. IRS approved Tax1099 allows you to eFile Pennsylvania forms online with an easy and secure filing process.

Pennsylvania only requires that the Federal copy of the 1099-MISC be submitted to Pennsylvania if the contractor performed work in Pennsylvania. Some states require separate notification from the employer that they are filing 1099 forms through the CFSF Program. The IRS address you should mail Form 1099-NEC to depends on your state.

Do not include amounts properly reported on a Form 1099-MISC corrected Form 1099-MISC Form W-2 or Form W-2c for a prior year. ExpressEfiles system has your back checking all. E-File Pennsylvania 1099-MISC and 1099-NEC directly to the Pennsylvania State agency with Tax1099.

Also do not include amounts that are considered to be subject to a substantial risk of forfeiture for purposes of section 409A. Let us manage your state filing process. However if you are mailing in your return you need to attach to the first page of return the tax documents that have state tax withholdings.

For Pennsylvania personal income tax purposes the 1099-R forms are required to be filed with the department by January 31. Payees who have tax withheld and receive a copy of the Federal 1099-MISC are required to file a copy with their Pennsylvania tax return. Employer Withholding Tax Inquiries Only Notices and Assessments.

Even though the Pennsylvania Department of Revenue would prefer that Copy 1 For State Tax Department of the 1099-MISC be provided to them they will accept a copy of the Federal 1099-MISC. PO BOX 280904. You can file your W-2 wage records 1099-R distributions 1099-MISC1099-NEC income and REV-1667 Annual Withholding Reconciliation Statement Transmittal in e-TIDES using the File ReturnPayment link.

When your return gets accepted youll know immediately. You will need to file Form CT-1096 with Forms 1099-MISC. Required to apply for a 1099-MISC withholding account by completing a PA-100 Pennsylvania Enterprise Registration Form electronically.

If the entity is issuing 9 or fewer paper 1099R with a premature distribution of a pension or profit-sharing plan or a 1099 MISCNEC that has zero PA withholdings the forms should be mailed to. More FAQ on 1099 State Filings. Mail Pennsylvania 1099s to.

PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES PO BOX 280509 HARRISBURG PA 17128-0509 Get started with TaxBandits today and stay compliant with the State of Pennsylvania. HARRISBURG PA 17128-0509. Whether or not you would need to attach the 1099-R to the state return will depend on whether or not PA tax was withheld.

When filing federal copies of forms 1099 with the IRS from the state of Pennsylvania the mailing address is. PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES. Department of Revenue Services.

Department of Revenue Services State of Connecticut PO. You will need to file Form CT-W3 with Forms W-2. PA DEPARTMENT OF REVENUE.

HARRISBURG PA 17128-0904. Here is your. If you chose to mail in your return then please see this link.

PA Department of Revenue. Mail 1099-MISC forms to. Box 280412Harrisburg PA 17128-0412.

HARRISBURG PA 17128-0904 Mailing Address For Form 1099-R or 1099-MISC Showing Zero Withholding. Paper 1099-Rs or 1099-MISC Showing Zero Withholding. DOR recommends that 1099-MISC withholding returns and monies be remitted and filed electronically via the e-TIDES system.

If the IRS ever rejects your Form 1099-MISC you will be notified get an exact diagnosis of the issue and be able to take action right away. Mail W-2 forms to. We file to all states that require a state filing.

The IRS acts as a forwarding agent only so it is your responsibility to contact your state to verify that they have received the form and to find if they need additional information. Box 2930 Hartford CT 06104-2930. Previously nonemployee compensation was reported on Box 7 of Form 1099-MISC but the IRS has recently released Form 1099-NEC to replace that option.

1099-MISC PA Filing Requirements and Schedules. The DOR stated in its February 5 announcement that it expects payors and lessors to file the related 1099-MISC forms with boxes 16 and 17 completed timely in January 2019. For services in the course of your trade or business.

PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES. You must e-file forms if submitting 25 or more Forms W-2 or 1099-MISC. The Employer W-21099 Menu allows you to enter or edit information that was filed manually or uploaded in e-TIDES.

Department of the Treasury Internal Revenue Service Center Austin TX 73330.

Digital Mail Scanning Service For Us Mail Online Invoicing Invoicing Software Tax Forms

Digital Mail Scanning Service For Us Mail Online Invoicing Invoicing Software Tax Forms

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Coronavirus Stimulus Check When Will Irs Send 1 200 Checks Money

Coronavirus Stimulus Check When Will Irs Send 1 200 Checks Money

I Forgot To Send My Contractors A 1099 Misc Now What

I Forgot To Send My Contractors A 1099 Misc Now What

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

Form 1099 Misc Mailing Address Sednkww

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

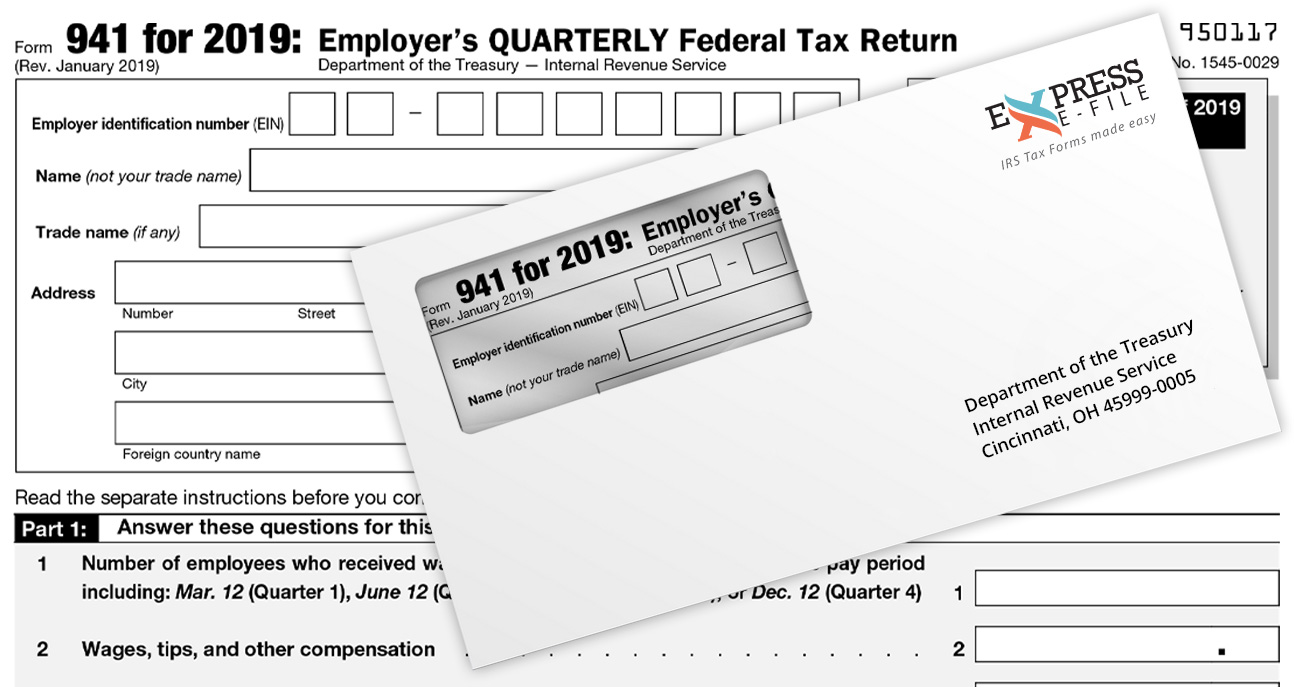

Where To Mail Form 941 Blog Expressefile Create Fillable Form W2 1099 Misc 941 2290

Where To Mail Form 941 Blog Expressefile Create Fillable Form W2 1099 Misc 941 2290

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

1099 S Form 4 Part Carbonless Zbp Forms

1099 S Form 4 Part Carbonless Zbp Forms

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Pennsylvania Form 1099 Misc Filing Requirements Gyf

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Misc Form 4 Part Carbonless Self Mailer Discount Tax Forms

1099 Misc Form 4 Part Carbonless Self Mailer Discount Tax Forms

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition