1099-r Form Box 7 Codes

Governmental section 457b plans. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities.

Formulario 1099 R Instrucciones E Informacion Sobre El Formulario De Impuestos 1099 R

Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

1099-r form box 7 codes. If a 1099-R has than one distribution code in Box 7 you will need to determine which code should be applied to give the correct tax treatment and then only enter that code. 2 Early distribution exception applies under age 59½. Code 7 may be used in combination with codes A B D K L or M.

Find the explanation for box 7 codes here. You will not be able to enter both codes in the Distribution code field. Taxable amount not determined not mark and total distribution not marked.

In Drake17 and prior if the 1099-R reports a code of 8 in box 7 Distribution Code and is typed in that field on the 1099 screen the amount will flow to. Do not combine with any other codes. At the bottom of the 99R screen check the box Exclude here.

Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Box 7 is used to report income to you. If the client meets an exception to the early withdrawal penalty but code 1 early distribution no known exception is shown in Box 7 of Form 1099-R then add Form 5329 to the tax return.

What do all the codes in Box 7 of the 1099-R mean. If the two codes require different tax treatments you will need to add another 1099R screen to use the separate treatment. I have a 1099R with 1M in box 7.

Codes for Box 7 of the 1099-R tax form include number or a letter in the alphabet states the Prudential website. Do not combine with any other codes. The different codes within box 7 tell what the tax treatment of any distribution amounts should be.

1 Early distribution except Roth no known exception 2 Early distribution except Roth exception applies 3 Disability 4 Death 5 Prohibited transaction 6 Section 1035 tax-free exchange 7 Normal distribution 8 Excess contributions. The code D in box 7 is a new code this year for section 1411. On form 1099-R Box 7 is marked 7D.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. For more information on these distributions see the instructions for Form 1099-R. The following codes identify the distribution received.

These codes are designated by the IRS and are shown in the instructions for 1099-R. Report on Form 1099-R not Form W-2 income tax withholding and. How do I enter a distribution code that isnt in the drop-down list.

I have a 1099R with 1M in box 7. Also see instructions for Forms 5329 and 8606. Code 7 on Box 7 of the 1099-R tax form means Normal Distribution states TurboTax.

Line 7 of the 1040 to be included in wages line 15 of the 1040 to be included in IRA distributions if the IRASEPSIMPLE box is marked on the 1099 screen. Are you filing a Form 1099-R for your client. Next go to the ROTH screen.

1 Early distribution no known exception in most cases under age 59 ½. Governmental section 457b plans. 30 rows Within the program if your loan is treated as a deemed distribution please enter in box 7.

Code this screen as belonging to either the taxpayer or spouse by selecting either T. Clients 1099-R will show 2 3 or 4 in Box 7. 1 1 Early distribution no known exception in most cases under.

On screen 99R enter the 1099-R as it was received including the code J in box 7. What exactly do you have. How do I enter a.

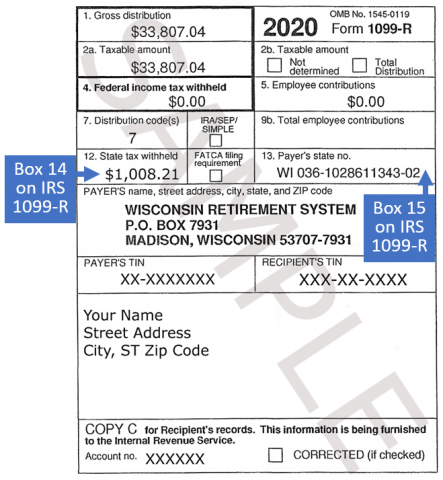

Her 1099R has box 1 gross distribution 27000 box 2 7000 box 5 34000 box 7 code 7D. 2020 1099-R Box 7 Distribution Codes. How does that translate.

Mark Topic as New. Code 8 According to the 2020 Instructions for Forms 1099-R and 5498 Code 8 Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020 signifies that excess contributions were deposited and returned in the same year regardless of the year for which the excess was attributed. 2020 Form 1099-R Codes Box 7.

30 rows See Corrective Distributions in the IRS instructions and IRA Revocation or Account. P Taxable in prior year of the 1099-R yearthe year the refunded contribution was made Code. The normal distribution is for individuals who are older than 59-12 and the distribution does not have a penalty.

A for a normal distribution from a plan including a. 7 is the code for Normal Distribution which means it was distributed to. Distribution is reported on.

Etf 1099 R Form Box Number Correction Etf

Pa 1099r To Paw2s Or Parecon1 1099r W2

1099 R 2020 Public Documents 1099 Pro Wiki

Understanding Your 2018 1099 R Kcpsrs

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

How To Calculate Taxable Amount On A 1099 R For Life Insurance

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Tax Form Focus Irs Form 1099 R Strata Trust Company

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

Irs Form 1099 R Box 7 Distribution Codes Ascensus

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Understanding Your 1099 R Form Kcpsrs

Form 1099 R Instructions 401k Fedforms